What Is An Earnings Call?

An earnings call refers to a conference call between the management of a public company, investors, analysts, and the media to discuss a company's financial results for a year or a quarter. Typically, a press release summarizing the essential aspects of the financial status of a company is also released along with the earnings call.

The usual period for scheduling the earnings call is after the publication of earnings reports for the given period. Typical examples of earning reports in the United States are SEC 10-K and 10-Q.

How Does An Earnings Call Work?

The term "earnings call" combines the company's earnings report and conference call to discuss results.

Earnings calls allow companies to discuss their financial results. However, small companies could be an exception. Most companies upload their website's presentation and phone recordings of earning calls. But they do so a few weeks after the actual call. Thus, they made the call accessible to the investors who didn't attend the call.

Earnings Call and SEC Forms 10-K and 10-Q

Company management examines its SEC Form 10-Q (quarterly report) or 10-K (annual report) during an earning call. Federal securities rules and regulations require publicly traded companies to fill out these forms to provide certain information. For instance, they must provide information about qualitative discussion and financial results.

The MD&A section (Management Discussion and Analysis) provides in-depth information about the financial results and other performance-affecting factors. It will reveal the causes of the rise or fall on the balance sheet, income statement, and cash flows.

The MD&A will go through specific development factors. Moreover, it will also discuss the risk associated with loan extension, share purchasing, and pending lawsuits. The MD&A portion is also helpful in introducing the upcoming year by discussing future objectives and strategies for initiatives and brand-new projects, as well as any updates to the executive team and significant recruits.

Advantages and Disadvantages of Earnings Calls

Investors, analysts, and financial community members can gain valuable information from earnings calls. Information released during the earnings call can support analysts in efficiently doing business analysis.

Earnings calls also allow participants to ask questions from the company's executives and representatives. The questions might provide insightful data that would improve the company's reputation. Some might also raise issues that management would prefer to remain hidden, which would be detrimental to the business.

Investors may immediately get the information they need during earnings calls instead of analyzing dozens of report pages. Additionally, some investors may plan on trading before the earnings call. Moreover, it also details how information released affects the trade.

The earnings call preparation process can be time-consuming and expensive. This commitment might interfere with regular corporate activities. After holding an earnings call, a corporation must also keep the investment community interested. This means it must keep making these calls to keep investors from anticipating a problem.

Pros

● facilitates basic analysis

● helps investors make trading decisions

● enables participants to investigate

Cons

● challenges regular business operations

● Q&A could lead to undesirable outcomes

● must generate a steady pattern to stop the unfavorable perception

Why Is Earning Call Conducted?

A public firm can share its previous results and plans on an earnings call. Moreover, a company could also respond to analysts, investors, and media queries.

Where Can I Access the Earnings Calls of A Company?

The company's website typically posts earnings call recordings for a specific time. Often, the transcripts are accessible for a longer time. These transcripts and recordings are also available on investment websites. Reviewing the company's results report on its website or the Securities and Exchange Commission's (SEC) website is the next best option in the absence of an earnings call.

Final Thoughts…!!!

The term "earnings call" is a conference call between the financial community and company executives. Management discusses potential risks, future strategies, and the company's performance for a specified time during this call. Analysts and investors are typically encouraged to ask questions at the end of the call, which aids in their fundamental business analysis.

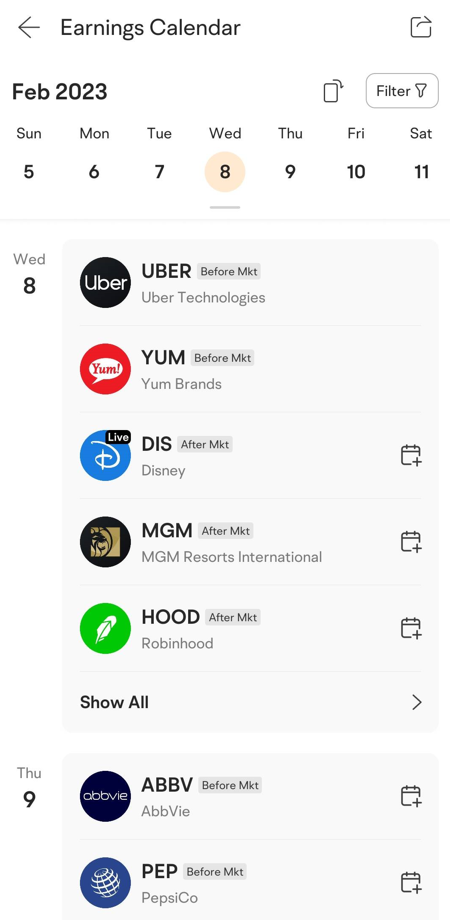

Moomoo stock trading app provides the earnings report calendar feature so that investors can track the earnings report schedule more quickly with convenience. Sign up and download the moomoo app today to access the clear earnings calendar!

Images provided are not current and any securities are shown for illustrative purposes only.