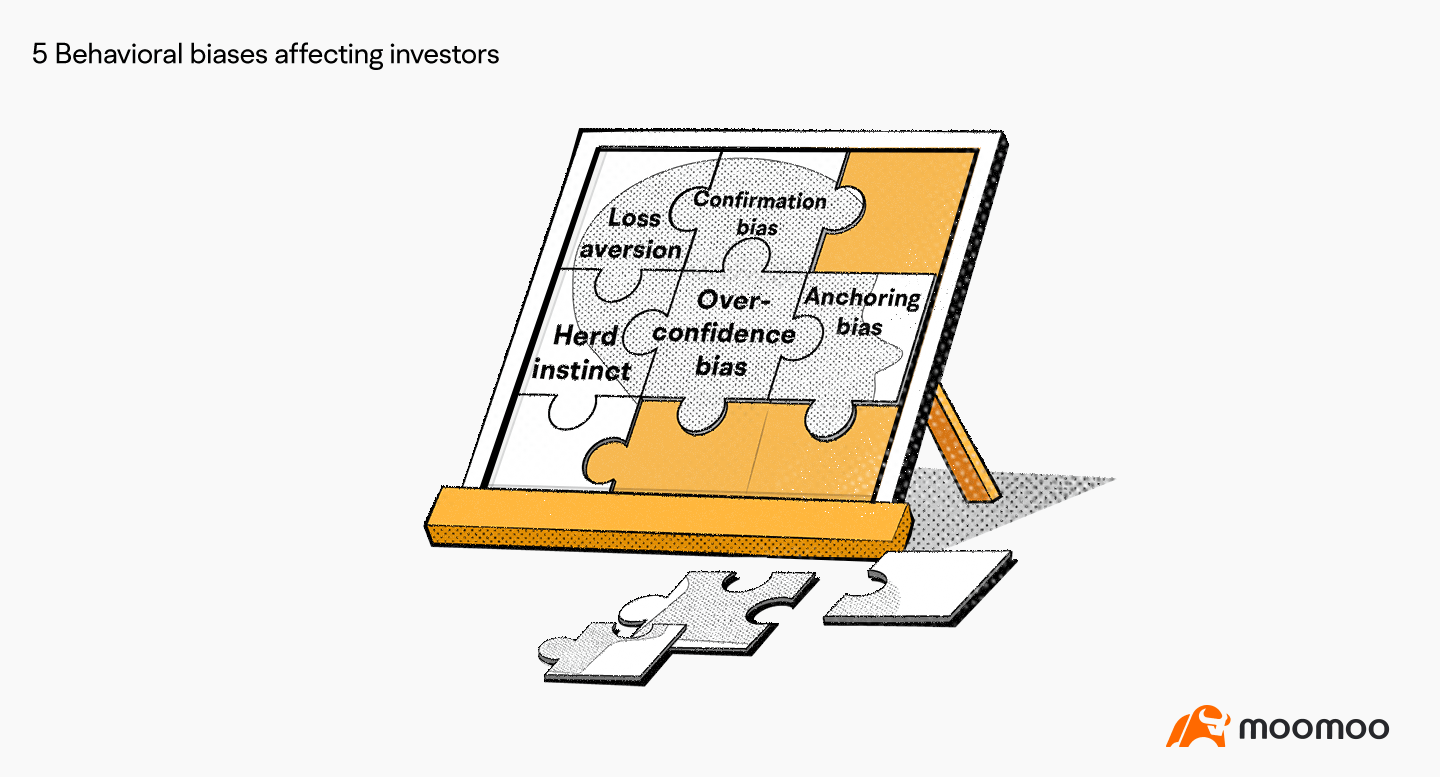

5 Behavioral biases affecting investors

Key Takeaways

Behavioral finance is the study of psychological impacts on investors' behaviors

Different from traditional finance theory, behavioral finance emphasizes the role played by psychology in individual behaviors

The five most common behavioral biases are loss aversion, anchoring bias, herd instinct, overconfidence bias, and confirmation bias

Understanding Behavioral Finance

Behavioral finance studies the psychological impacts on the behaviors of investors and the subsequent effects on the markets. It is based on some facts, such as investors are not always rational, their self-control is limited, and how they behave is subject to their own biases.

To understand behavioral finance, we first need to understand traditional finance theory. Traditional finance theory is comprised of three core assumptions:

Individuals have complete self-control.

Individuals understand all available data before making decisions.

Individuals are always consistent in their decision-making.

In a nutshell, traditional finance theory states that individuals always make rational decisions solely based on objective facts available.

However, irrationality is built into human nature. In reality:

We don't always have self-control.

We don't always have time to understand all the data before making a decision.

We are not always consistent in terms of decision-making.

Behavioral finance is different from traditional finance theory in that it emphasizes the role played by psychology in individual behaviors.

According to behavioral finance, investors are vulnerable to making sub-optimal decisions due to psychological influences that complicate our decision-making.

By understanding the different psychological responses to our emotions, we attempt to limit the effect of emotion on our investing decision-making.

Five Behavioral Biases Affecting Investors

Here, we highlight five prominent behavioral biases common among investors. In particular, we look at loss aversion, anchoring bias, herd instinct, overconfidence bias, and confirmation bias.

Loss aversion

Loss aversion occurs when investors care more about losses than gains.

As a result, some investors might want a higher payout to compensate for losses. If the high payout isn't likely, they might try to avoid losses altogether even if the investment's risk is acceptable from a rational investor's standpoint.

In investing, loss aversion can lead to the so-called disposition effect when investors sell their winners and hang onto their losers. Investors do this because they want quick gains. But when an investment is losing money, many of them would choose to hold onto it because they want to get back to their initial price.

Anchoring bias

It means some investors tend to be over-reliant on an arbitrary benchmark such as a purchase price or sticker price. Market participants with an anchoring bias tend to hold investments that have lost value because they have anchored their fair value estimate to the original purchasing price rather than to fundamentals.

Herd instinct

The term herd instinct refers to a phenomenon where people join groups and follow the actions of others because they assume that other individuals have already done their research.

Herd instincts are common in all aspects of society, including the financial sector, where investors follow what they see other investors are doing rather than relying on their own analysis. Asset bubbles or market crashes by panic buying and panic selling are believed to manifest herd instinct at scale.

Overconfidence bias

Overconfidence bias means being too confident in our abilities, making us take excessive risks. This bias is common in behavioral finance and can exert huge impact on capital markets.

Overconfidence has two components: being confident in the quality of your information and in your ability to act on said information at the right time for maximum gain.

Confirmation bias

Confirmation bias is a term in cognitive psychology that describes how people naturally favor information that confirms their existing beliefs.

Experts in behavioral finance have found that this fundamental principle applies notably to market participants. Investors search for information that confirms their existing opinions and ignore facts or data that contradict them. As a result, their own cognitive biases may reduce the value of their decisions.