Options Strategies Explained

Bull Call Spread

What is bull call spread?

These strategies can be broken down into three parts: bull, call, and spread.

"Bull" refers to the belief that the price of the underlying asset will increase in the future.

"Call" refers to the types of options used in these strategies.

Options spreads are a trading strategy where an investor buys and sells multiple options of the same type (call or put) on the same underlying asset. Typically, these options will have different strike prices or expiration dates.

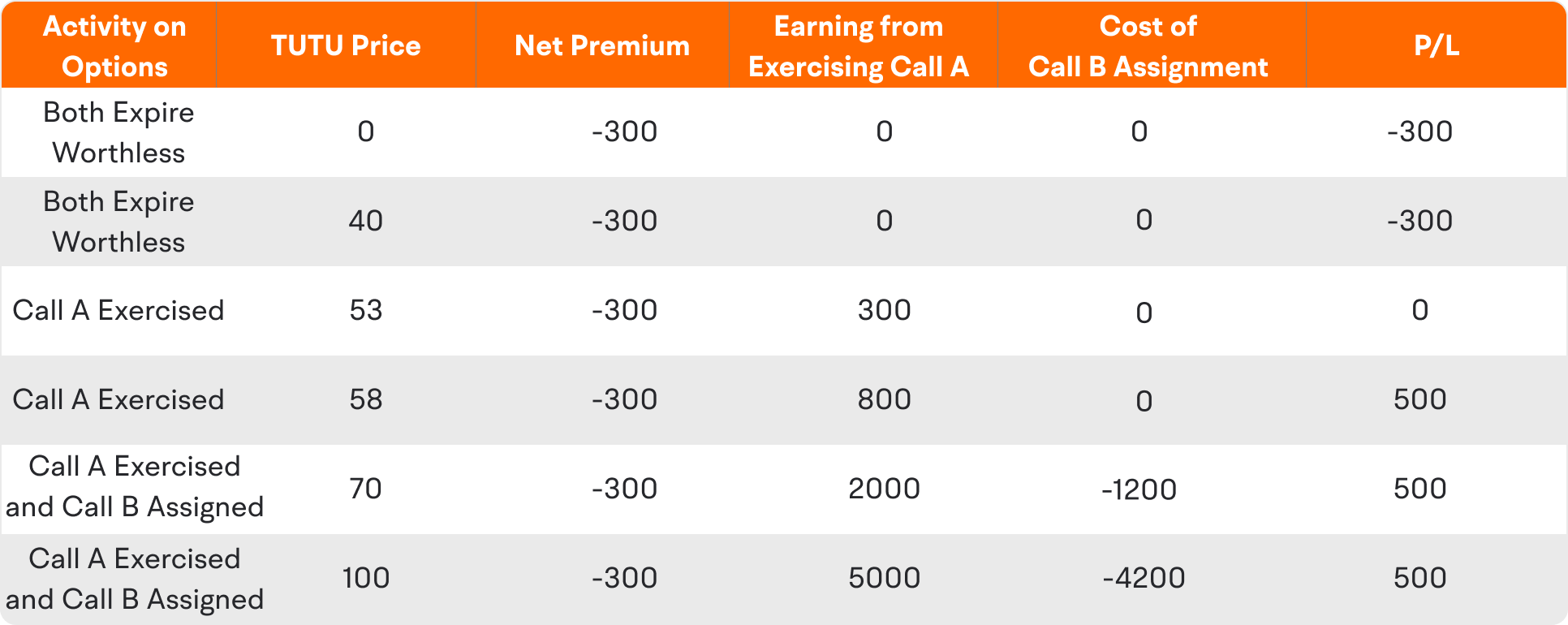

Practical Scenarios

● Expect the stock price to increase, but only to a certain extent.

● Already hold a call option and expect the stock price to increase, but want to reduce the cost and hedge against the risk of a drop in the stock price.

I. Strategy Explained

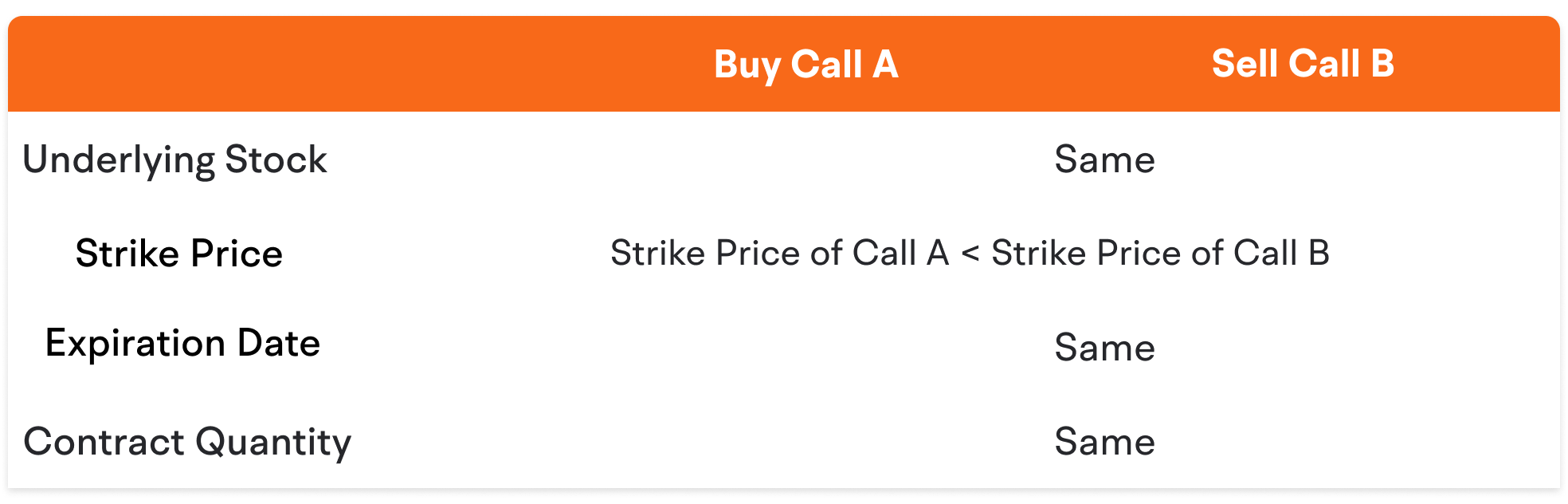

1) Setup

「![]() Buy Call A」 + 「

Buy Call A」 + 「![]() Sell Call B」

Sell Call B」

Strike Price of Call A < Strike Price of Call B

2) Breakdown

The potential profit:

Buy Call A: may profit when the underlying stock rises.

Sell Call B: reduce the cost of buying Call A.

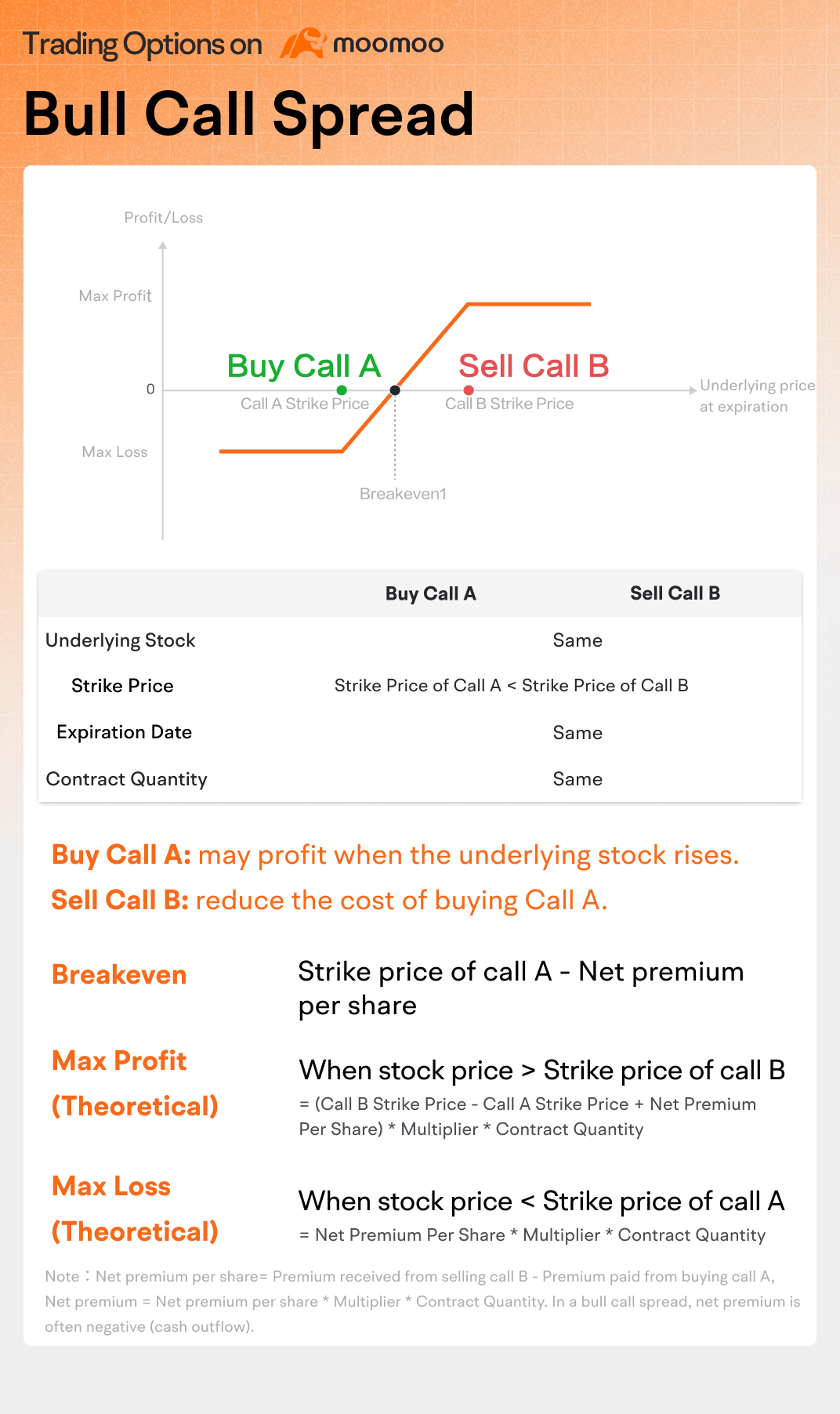

3) Features of Strategy

Ideal conditions: Bullish. The underlying stock price rises slightly.

Limited Profit: If the stock price rises as expected, selling call B with the higher strike price limits the maximum profit.

Theoretical Maximum Profit = (Call B strike price - Call A strike price + Net Premium Per Share) * Multiplier * Contract Quantity

Limited Loss: If the stock does not rise as expected, buying call A with the lower strike price limits the maximum loss.

Theoretical Maximum Loss = Net Premium Per Share * Multiplier * Contract Quantity

Option Buying Strategy: The primary trading position in this strategy is the long call A, which potentially generates profits if the stock rises as expected.

This is a low-cost bullish option strategy with a limited potential loss. Ideally, it should be considered when implied volatility is low and can benefit from significant price movements afterward.

Higher Initial Cost: The premium for call A, closer to the stock price, is higher than for call B. So, starting this strategy means you'll spend money upfront due to the net premium outflow.

II. Case Study

TUTU (a theoretical stock for demonstration purposes only) is a company listed on NASDAQ, focusing on the artificial intelligence. The company has collaborated with ChatGPT to launch an innovative AI language model aimed at optimizing user interaction experience.

The market is divided on TUTU's collaboration with ChatGPT. Some believe this move will solidify its leading position in the AI field, while others worry that growth slowdown, market competition, and supply chain issues may limit the stock price increase. After analyzing TUTU's potential, you estimate that its stock price will rise slightly, but the upside will be limited.

Based on this judgment, you construct a bull call spread. This involves buying a call option with a lower strike price (call A) to capture the potential stock price increase, while simultaneously selling a call option with a higher strike price (call B).

Through this strategy, you can benefit from the stock price increase to gain potential profits and reduce the cost of buying call A by selling call B, thereby capping the profit potential while better managing the downside risk compared with holding underlying stock.

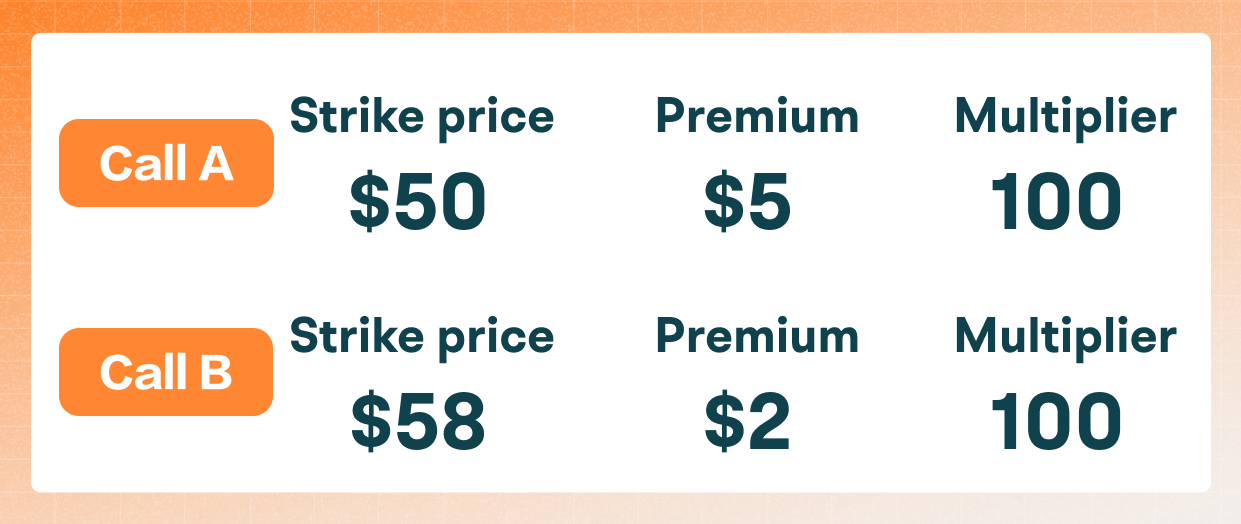

Cost of opening the position:

Premium paid for call A: -$500 (-$5 per share).

Premium received from call B: $200 ($2 per share).

Net premium in total: -$500 +$200=-$300 (-$3 per share).

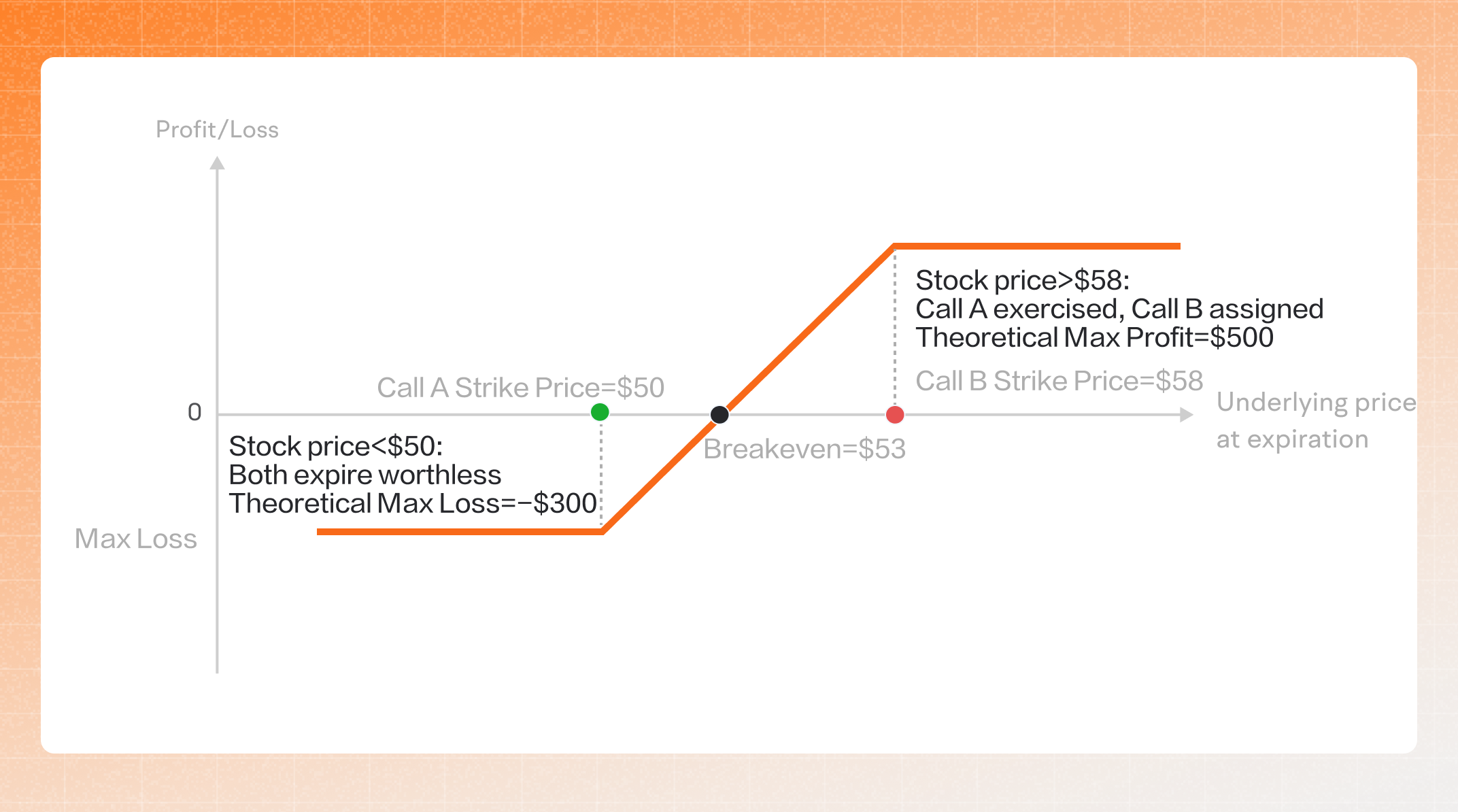

1) Scenario 1: stock price is below call A strike price at expiration

Both call A and call B are OTM and expire worthless.

The maximum loss is achieved, which is the net premium paid when opening the position.

Maximum Loss (Theoretical): Net Premium per Share * Multiplier * Contract quantity = (-$5+$2)*100*1=-$300

Note: The loss for this strategy is limited (assuming no shares are exercised or assigned). Even if TUTU's stock price drops to $0, the maximum loss is still -$300.

2) Scenario 2: stock price is between call A strike price and call B strike price at expiration

Breakeven = Call A Strike Price - Net Premium Per Share = $50-(-$3)=$53.

If the stock price is below $53, the strategy suffers loss and the loss is limited.

If the stock price is above $53, the strategy gets profit and the profit is limited.

3) Scenario 3: stock price is above call B strike price at expiration

Both call A and call B are ITM and maximum profit is achieved in this case.

Maximum Profit: (Call B strike price - Call A strike price + Net premium per share) * Multiplier * Contract quantity

Note: In bull call spread, net premium is often negative (cash outflow).

Call A exercised: you can buy 100 shares of TUTU for $50.

Call B assigned: you need to sell 100 shares of TUTU for $58.

During this process, you can get $8 difference per share.

But don't forget: there was a -$3 per share net premium outflow incurred when opening the position.

Since the multiplier is 100, the total profit is ($58-$50-$3)*100*1=$500.

Note: The profit for this strategy is limited. Even if TUTU's stock price rises to $100, the maximum profit is still $500.

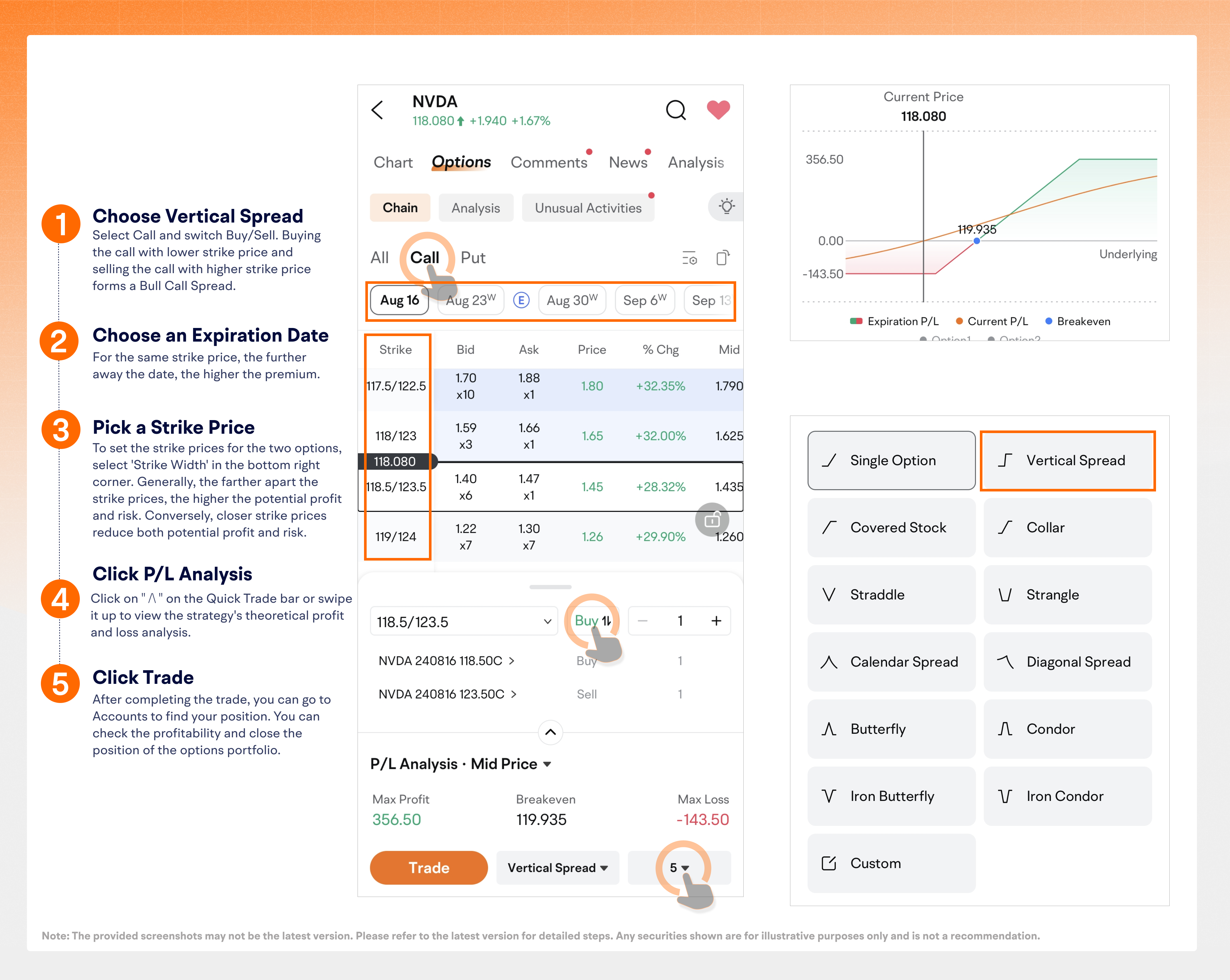

III. How to construct a bull call spread on moomoo

IV. Applying the bull call spread strategy

1) Expect the underlying stock price to rise, but with limited upside

Investors often base their strategies on short-term price trends. If these trends change or fade quickly, the original spread strategy may become ineffective. Therefore, a bull call spread is generally better suited for short-term speculation rather than long-term investment.

If an investor expects the stock price to move within a certain range by a certain time frame, they can buy call A (anticipating the stock price will rise above A) and sell call B (expecting it won't rise above B). This approach allows them to possibly benefit from a stock price increase while limiting the risk of a price decline compared with holding the underlying stock.

2) Expect the underlying stock price to rise, already bought a call, and want to reduce costs

Expecting the stock price to rise, an investor may buy an ATM call A. To help offset some of the high premium for call A, sell a call B with a higher strike price.

From this perspective: If an investor expects the underlying stock price to increase, they can create a bull call spread by buying an ATM call A and selling an OTM call B at the indicated resistance level. This strategy allows them to potentially profit from the stock's rise while reducing the initial cost.

V. FAQs

![]() Q: Choosing the strike price?

Q: Choosing the strike price?

Conservative: Conservative investors may buy and sell both in-the-money calls. In this way, there is a higher probability the options will expire in the money, but this also requires a higher initial premium outlay.

Moderate: Moderate investors may buy an in-the-money call and sell an out-of-the-money call, taking on additional level of risk in exchange for potentially moderate returns.

Aggressive: Aggressive investors may buy and sell both out-of-the-money calls. Such a combination can generate higher returns potentially, but there's a lower probability the options will be in the money by expiration.

![]() Q: Evaluating the bull call spread position in different scenarios?

Q: Evaluating the bull call spread position in different scenarios?

Scenario 1: When the stock price drops below call A strike price or rises above call B strike price

Both options are either in-the-money (ITM) or out-of-the-money (OTM) simultaneously. This indicates that the strategy has reached the boundary of theoretical maximum loss or maximum profit.

In this case, investors can choose to hold the position until expiration. Whether suffering the loss or gaining the profit, moomoo will automatically liquidate the options upon expiration.

Scenario 2: When call A strike price < stock price < call B strike price

Evaluate the risk of call B being assigned early. If the risk is high, and a short stock position is not wanted, then consider these two methods:

![]() Method 1: Sell to close the call A position and buy to close the call B position. Exit the bull call spread strategy by closing both options in the strategy.

Method 1: Sell to close the call A position and buy to close the call B position. Exit the bull call spread strategy by closing both options in the strategy.

![]() Method 2: Buy to close the Call B position. Although the closing cost may be high in this case, it avoids the risk of being assigned while retaining the profit potential of call A. Remember if you close the call A position only and leave the call B position, it effectively results in a very risky naked call selling position.

Method 2: Buy to close the Call B position. Although the closing cost may be high in this case, it avoids the risk of being assigned while retaining the profit potential of call A. Remember if you close the call A position only and leave the call B position, it effectively results in a very risky naked call selling position.

Scenario 3: Turn a bull call spread into a long call butterfly

Conversely, if investors have constructed a bull call spread but the price of the underlying asset has already risen to a resistance level, they may worry that the stock price will remain steady near this level by expiration, causing the options' time value to decline.

To help address this, investors may add a bear call spread, changing the strategy into a long call butterfly. This not only allows them to potentially capture the time value of the bear call spread but also helps protect the positive gains of the bull call spread. There are also potential cons to this strategy. The second short call (ATM) is exposed until the underlying reaches the strike price of the second long call.

Scenario 4: Turn a bull call spread into a long diagonal bull call spread

The difference between long diagonal bull call spread and bull call spread is the choice of expiration date. In the long diagonal bull call spread, investors often buy one long-term call option with a lower strike price and sell one short-term call option with a higher strike price, while the quantity of the bought and sold call options remains the same.

If the stock price remains relatively unchanged or falls before the short-term call option expires, this diagonal bull call spread helps to cushion some of the costs from the further dated long call because you have already earned the premium from the short-term short call positon. After the first short-term call option expires, the investor can engage in another spread trade, selling another call option with the same expiration as the long call which will convert it into a regular bull call spread.

![]() Q: What is the difference between a bull call spread and a bull put spread?

Q: What is the difference between a bull call spread and a bull put spread?

While both strategies are used to try to profit from a rising market, they differ in their approach and risk profile.

Investors may choose between a bull call spread and a bull put spread based on their expectations of price movements, implied volatility, and risk appetite:

Bull call spread: If investors are optimistic about the market, have a low risk tolerance, and the current implied volatility is low, they might opt for a bull call spread. This strategy generally involves buying a call at the current price and selling a higher strike call to potentially profit from a rise in the stock price while reducing the initial cost.

Bull put spread: If investors are moderately optimistic or neutral about the market, have a higher risk tolerance, and the current implied volatility is high, they might choose a bull put spread. This generally involves selling a put at the current price and buying a lower strike put. This strategy allows them to collect premium upfront while limiting potential losses if the stock price drops significantly.

Bull Call Spread | Bull Put Spread | |

Attitude | Bullish | |

Construction | Buy Call A +Sell Call B | Buy Put A + Sell Put B |

Open Position | A net debit | A net credit |

Construction Decoding | This is essentially a low-cost bullish option strategy with a stop-loss element. Buy Call A: gain from the price increase of the stock Sell Call B: reduce the cost of Call A | The main trading and profit-generating position in this strategy is Sell Put B. Selling Put B: collect a premium. Buying Put A: hedge against the risk brought by Selling Put B. |

Breakeven Point | Stock Price = Strike Price of Call A + Net Premium paid | Stock Price = Strike Price of Put B - Net Premium received |

Maximum Gain (theoretical) | Maximum gain is achieved when the stock price is at or above the strike price of Call B. Maximum Gain = [(Strike Price of Call B - Strike Price of Call A) - Net Premium] * Multiplier * Contract Size | Maximum Gain is achieved when the stock price is at or above strike price of Put B. Maximum Gain = Net Premium * Multiplier * Contract Size |

Maximum Loss (theoretical) | Maximum Loss happens when the stock price is at or below the strike price of Call A. Maximum Loss = Net Premium Paid * Multiplier * Contract Size | Maximum Loss happens when the stock price is at or below the strike price of Put A. Maximum Loss = [(Strike Price of Put B - Strike Price of Put A) - Net Premium ] * Multiplier * Contract Size |

Practical Scenarios |

|

|