An Easy-to-understand Macro Course

Discussing the driving forces behind rises in gold prices

This article contains 2300 words and takes about 6 minutes to read.

Gold has always had a significant role in the international monetary system. Throughout different historical periods, various countries have minted gold coins, with the world's first gold coin being created around 560 BC. In fact, the discovery of gold mines in California during the 19th century led to the largest wave of immigration in US history.

In this context, we will discuss the place of gold in the economic landscape and explore the reasons why it continues to be a popular investment choice.

Gold's Development History

Supply and Demand Analysis of Gold

Why People Invest in Gold?

How is Gold Priced?

Investment Options for Gold

Summary

For a significant period in history, gold was commonly used as a currency in many countries. It was tied to fixed prices and exchange rates with other currencies, known as the gold standard. This model was initially adopted by Britain and later replicated around the world.

However, due to World War I, the gold standard lost its relevance, and the Great Depression led to widespread hoarding of gold. In 1944, the Bretton Woods system emerged as a new international system of exchange rates. Under this system, the US dollar was fixed to gold at $35 per ounce, while other currencies' exchange rates were adjustable.

In 1971, President Nixon reduced the dollar's value against gold to curb inflation, causing an increase in gold hoarding. Eventually, the Bretton Woods system ended when Nixon announced that the dollar would be completely independent of gold.

Although gold lost its official status in the international monetary system, it remains an attractive investment due to its scarcity and safe-haven properties.

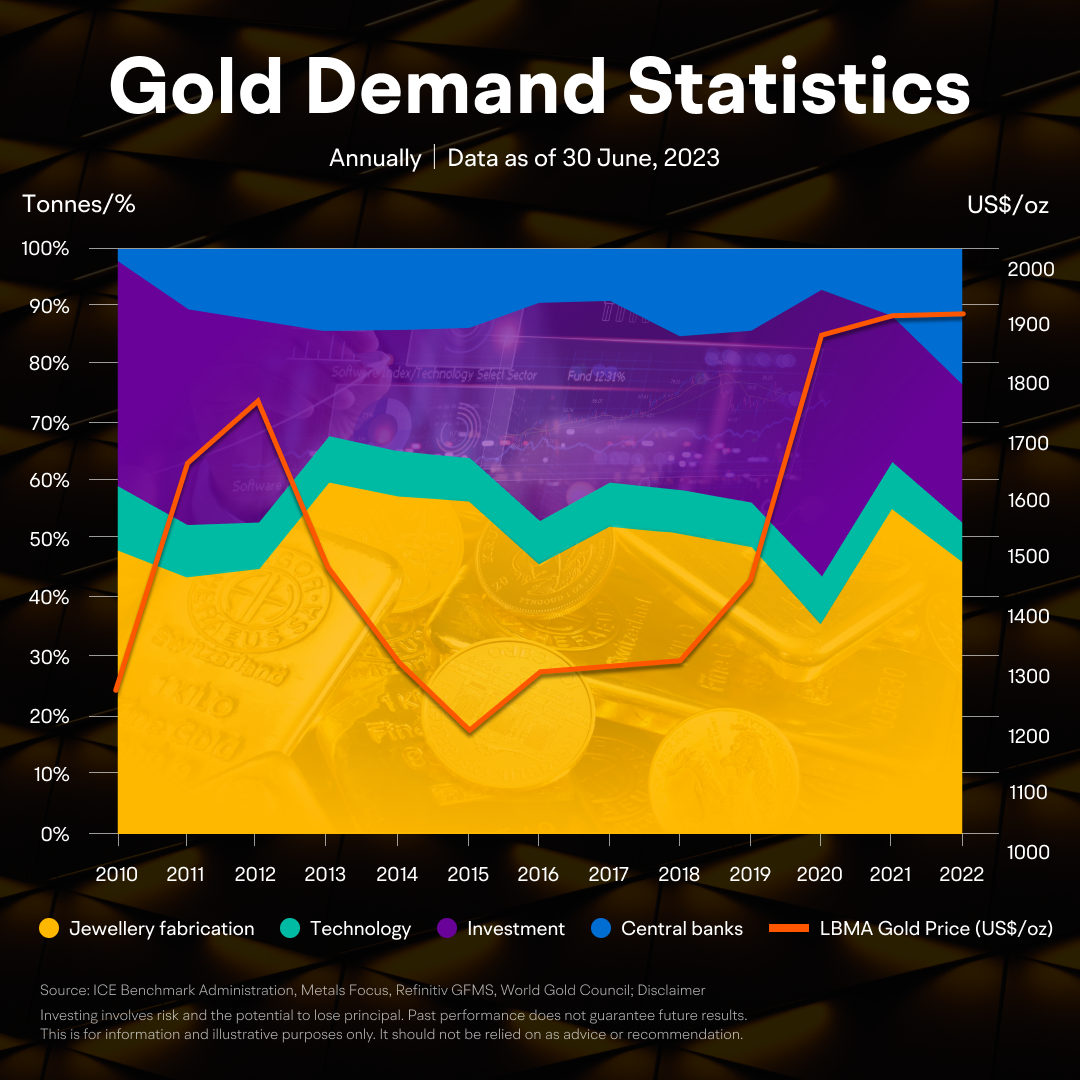

Let's take a look at the basic supply and demand framework of gold.

Production: According to the World Gold Council (WGC), all the gold mined so far would fit into a 22-meter cube. Over 90% of the world's gold has been mined since the California Gold Rush of 1848. In 2022, China, Australia, and Russia were the largest producers of gold.

Consumption: India and China have been the largest consumers of gold since 2010, and they continued to hold this position in 2022. Other major consumers of gold include the United States, Saudi Arabia, Germany, and Turkey.

Gold reserves: Gold is measured by weight. The United States holds the largest gold reserves in the world at over 8,000 tons, which accounts for 4% of the 187,200 tons of gold mined so far.

We all know that gold is a limited resource and its supply cannot be mined indefinitely. This means that the price of gold is highly sensitive to changes in demand.

According to data from the World Gold Council, in 2022, due to large-scale purchases by central banks, strong purchases by individual investors, and a slowdown in ETF outflows, annual demand for gold rose to a new high in 11 years. The total international gold demand amounted to 3,303 metric tons, making it the strongest year for gold demand in over a decade.

Despite facing significant resistance from a stronger US dollar and rising global interest rates, the price of gold rose in 2022. The LBMA average annual gold price reached $1,800 per ounce, setting a new historical record.

Many investors see gold as not just beautiful but also resistant to inflation, especially during economic volatility. Here are the key benefits of investing in gold:

Commodity Function: Gold's resistance to tarnishing, malleability, and scarcity make it a popular symbol of wealth. According to the World Gold Councill, 49% of all gold mined today is used in jewelry.

Help Hedge Inflation: Inflation reduces currency value over time, while gold tends to maintain its value. By investing in gold, investors may help protect their wealth from the effects of inflation.

Safe Haven: During periods of economic or geopolitical uncertainty, currency values can be highly volatile, while gold tends to remain relatively stable. As a result, gold can serve as a safe haven asset during times of crisis.

Portfolio Diversification: Since gold has low correlation with traditional financial assets such as stocks and bonds, including it in a portfolio can help to reduce overall risk exposure from these traditional securities and provide stabilization and capital preservation even when other markets decline due to inflation or instability.

It's important for investors to be aware of the potential risks associated with investing in gold.

Prices can drop or stagnate: Like any asset, gold prices are subject to fluctuations due to economic data, geopolitical events, and changes in investor sentiment. The price of gold has been more volatile over the past decade. For example, if you bought gold in October 2012 before the price plummeted, you would've suffered a loss unless you'd held onto it until August 2020 when the price rebounded.

Doesn't generate cash flow or dividends: While you can earn returns on gold investments due to price increases, it doesn't pay dividends or interest and doesn't generate cash flow.

Physical gold requires storage and security: If you opt to buy physical gold, you'll incur transportation, storage and security costs.

There are several ways to invest in gold, depending on whether the investor prefers direct or indirect investment.

1. Physical Gold

One of the ways to invest in gold is through physical gold, such as jewelry or gold bars. In the past decade, small gold bars and coins accounted for two-thirds of annual gold investment demand and one-quarter of global gold demand. However, it should be noted that physical gold may lack liquidity, and investors need to ensure safe storage.

2. Gold Futures

Gold futures are contracts with standardized terms that give investors the right to buy or sell gold at a particular price and date in the future. These contracts are traded on regulated exchanges, and their market prices can fluctuate based on supply and demand factors. Due to the involvement of numerous professional investors, the gold futures market typically has high liquidity and efficiency. Investors have the flexibility to either go long or short on gold by purchasing gold futures. As a result, corporate clients frequently use gold futures for risk management purposes.

Notes: Future trading is not offered by Moomoo Financial Inc and Futu Securities (Australia) Ltd, and is not available to US and AU customers. Futures trading involves high risks and is not suitable for all investors. The amount you could lose may be greater than your initial investment.

3. Gold ETFs

Some investors like to hold stocks of companies specializing in gold mining and refining, and these gold mining stocks can also be purchased through exchange-traded funds (ETFs) and mutual funds. According to statistics, ETFs and other exchange-traded investment tools account for about one-third of gold investment demand.

Gold ETF prices typically track the performance of spot gold prices and can be bought and sold on exchanges like company stocks. Since the minimum investment amount is only the price of one share of the ETF, this method may be more convenient than directly owning physical gold for small investors. Moreover, the average expense ratio of the gold ETFs traded on the US market is usually around 0.61%, generally much lower than the fees and expenses of most public funds and other investments.

The term "gold price" can be confusing for many investors. Is it the spot or futures price? With so many different gold prices in the market, which one is the most important?

Simply put, let's classify three types of gold prices:

Spot Price: The price for buying or selling physical gold bars is usually based on the spot price of gold. This means the price is determined by the market at the time of purchase and can fluctuate due to changes in supply and demand.

Fixing Price: The fixing price is an average gold price calculated through multiple adjustments and testing of spot prices. It helps offset minute-to-minute price fluctuations. Institutions such as LBMA or Comex set the fixing price, and it is fixed twice a day.

Futures Contract Price: It is the agreed-upon price for investors and suppliers to buy or sell gold on a specific date. The gold derivatives market is separate from the actual gold commodity market, so the futures price does not strictly follow the movement of the commodity price.

In summary, banks and monitoring committees calculate the average spot and fixing prices based on the supply and demand situation in the gold futures derivatives market.

Gold is traded 24/7 globally and priced in US dollars. The over-the-counter (OTC) market has the largest trading volume, with about 90% of global gold trading occurring in OTC markets like London, New York COMEX, or the Shanghai Gold Exchange. Therefore, the OTC market plays a crucial role in setting gold prices.

Investors can pay attention to three indicators of gold prices:

Spot Price: The spot price of gold is the most commonly used standard for measuring the current exchange rate of gold. It changes every few seconds during market trading hours and is calculated in troy ounces. Most gold bullion dealers determine the exact charge price for specific coins or bars based on the spot price of gold.

LBMA Gold Price: The London Bullion Market Association (LBMA) is internationally recognized as the gold and silver market, accounting for about 70% of global nominal trading volume. The LBMA gold price is priced in US dollars and is a reference benchmark for the gold market. It has two pricing opportunities per day, and is operated and managed by ICE Benchmark Administration (IBA).

COMEX: The world's largest real-time derivatives market from the perspective of futures contracts is the Chicago Mercantile Exchange (CME), also known as Comex, and the New York Mercantile Exchange.

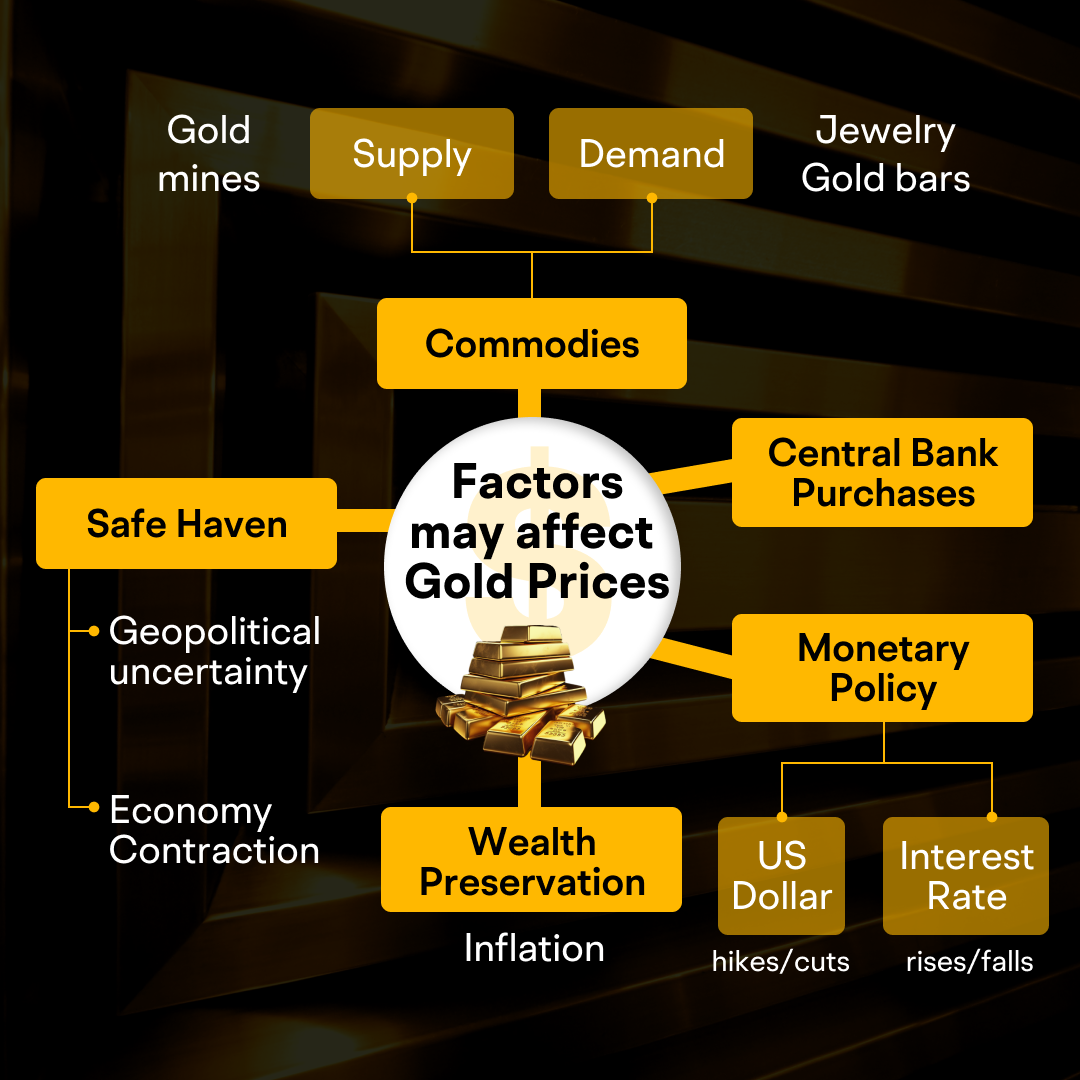

Factors Affecting Gold Prices

The factors that influence gold prices are closely tied to the rationale for investing in gold discussed earlier. These six primary factors play a crucial role:

Based on the factors mentioned in the table, let's look at two examples of factors that impact gold prices:

According to the Financial Times, during the first three quarters of 2023, inflation and currency devaluation sparked a surge in demand for gold as a means of preserving value. As a result, central banks in emerging markets bought large amounts of gold to reduce their reliance on the US dollar. Among them, the People's Bank of China has purchased a historically high amount of gold worldwide, followed closely by Poland and Turkey.

In addition, BNN Bloomberg reported that between July 2022 and June 2023, gold prices rose by around 15%, driven by indications that the US interest rate cycle was nearing its end, central bank purchases, and a series of safe haven demands.

Wanna learn more?

Check out the macro analysis in the "Advanced" section to learn more about the gold market. Update yourself with the latest data and market trends to make more informed investment decisions!