Reading the Annual Report

The Annual Report: What Is It?

Public companies need to provide their investors with an annual report detailing the previous year's activities and financial status. The introduction section of the report often includes an outstanding combination of graphics, images, and an accompanying narrative. Overall, these elements record the firm's actions over the course of the previous year and may even predict the organization's future. The report includes in-depth information on the business's finance and operations in the last section.

Understanding Annual Reports

After the fall of the stock market in 1929, politicians required standardized corporate financial statements, which resulted in the necessity that publicly traded corporations produce annual reports as a legislative requirement. [1] The purpose of the annual report that a corporation needs to submit is to publicly disclose the firm's operational and financial operations that occurred over the preceding year. In most situations, the analysis is provided to shareholders and other interested parties to assess the company's financial health and make informed investment choices.

The following are examples of parts that are often included in an annual report:

General corporate information

Operating and financial highlights

Letter to the shareholders from the CEO

Narrative text, graphics, and photos

Management's discussion and analysis

Financial statements, including the balance sheet, income statement, and cash flow statement

Notes to the financial statements

Auditor's report

Summary of financial data

Accounting policies

In the United States, a more detailed form of the financial statement is known as Form 10-K, filed with the United States Securities and Exchange Commission (SEC). Businesses can electronically file annual reports through the SEC's Electronic Data Gathering and Analysis (EDGAR) database. Companies that are required to declare their financial information must provide annual reports to their shareholders at the same time as they have their annual meetings to elect directors. Reporting businesses are expected to publish their proxy materials, which may include their annual reports, on the websites of their respective firms in accordance with the proxy regulations. [2]

Things to Keep in Mind

The annual report of a corporation will often include important information about the status of the firm's finances, which may be used for purposes including but not limited to the following:

The ability of a firm to pay its obligations when they come due.

Whether or not a corporation was profitable during the recent fiscal year it completed.

The development of a business over the years

What percentage of a company's profits are set aside for investment in expanding its existing business?

Income as a percentage of total operating costs

If the numbers add up and follow GAAP (Generally Accepted Accounting Principles) guidelines, it will also be clear in the yearly report. In the part of the auditor's report referred to as "unqualified opinion," this confirmation will be emphasized as an "unqualified opinion." [3]

Analyzing the information included in a business's annual report is one method that fundamental analysis uses to try to get insight into the path a company intends to follow in the future.

Is a 10-K Report the Same Thing as an Annual Report?

In a broad sense, a 10-K filing and an annual report are comparable in that both report on the firm's performance over the previous year. Both documents constitute a wrap-up of the company's financial performance for the year. The annual report format is far more user-friendly in terms of visual presentation. They are attractively designed and include both photos and graphics. The 10-K file has no design elements or added flair; it only presents statistics and other qualitative data.

What Is a 10-Q Filing?

A company's quarterly results are summarized on a form known as a 10-Q filing, which is submitted to the Securities and Exchange Commission (SEC) for review. Most publicly traded corporations are required to submit a Form 10-Q to the Securities and Exchange Commission (SEC) to disclose their financial situation for the quarter.

Summary

Publicly traded firms must produce annual reports demonstrating their current financial situation and activities. Annual reports could be used to investigate a business's current financial standing and, perhaps, get insight into the path the firm intends to take in the coming years. These reports work differently for mutual funds; in this instance, they are made accessible at the beginning of each fiscal year and are often less complicated.

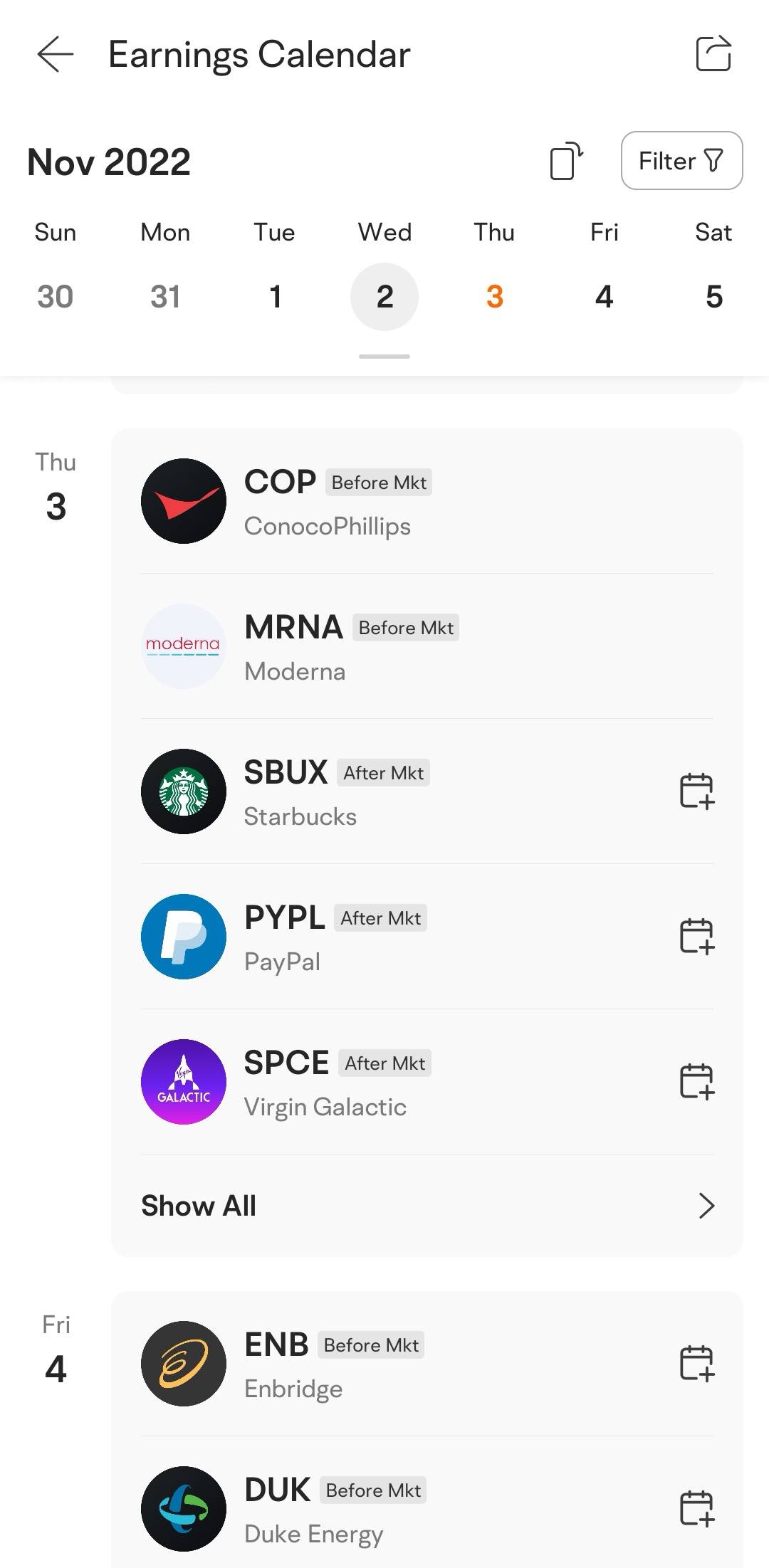

Moomoo trading app will provide the earnings report calendar feature, so traders and investors can track the earnings report schedule more quickly with convenience. Sign up and download the moomoo app today to access the clear and customizable earnings calendar!

Images provided are not current and any securities are shown for illustrative purposes only.

[1] https://www.sec.gov/news/speech/spch100704psa.htm

[2] https://www.investor.gov/introduction-investing/investing-basics/glossary/annual-report

[3]https://www.investor.gov/introduction-investing/general-resources/news-alerts/alerts-bulletins/investor-bulletins/how-read