What Is a Hammer Candlestick?

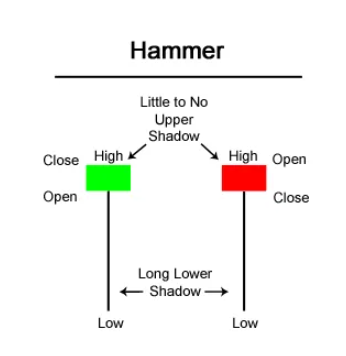

A hammer is one price pattern in candlestick charts that happens when a security trades far below its opening price but rises to close near its opening price. This pattern creates a candlestick in the shape of a hammer, where the lower shadow is at least twice the size of the actual body. The candlestick's body reflects the difference between the opening and closing prices, while the shadow illustrates the period's high and low values.

Understanding Hammer Candlesticks

A hammer occurs following a decline in the price of an asset, indicating that the market is attempting to establish a bottom.

Hammers imply a possible submission by sellers to create a bottom, accompanied by a price increase indicating a potential price reversal. This occurs in a single trading period, when the price declines after the opening but recovers to close near the starting price.

A hammer should resemble the letter "T." This suggests the possibility of a hammer candle. A hammer candlestick does not signal a price reversal to the upside until it is confirmed.

Confirmation happens if the candle that follows the hammer closes above the hammer's closing price. Idealistically, this confirmation candle indicates robust buying. Candlestick traders often seek to enter long positions or exit short ones during or after the confirmation candle.

Even with confirmation, hammers are not typically employed singly. Traders generally confirm candlestick patterns using price or trend analysis or technical indicators.

The Difference Between a Hammer and a Doji Candlestick

A doji is a candlestick style with a small, solid body. A doji represents uncertainty because it has both an upper and a lower shadow. Depending on the confirmation that follows, Dojis may indicate a price reversal or trend continuance. This varies from the hammer, which happens after a price decrease, indicates a possible upward reversal (if confirmed), and merely has a long lower shadow.

Limitations of Hammer Candlesticks

There is no certainty that the price will continue to climb higher after the confirmation candle. Within two sessions, a long-shadowed hammer and a strong confirmation candle may drive the price extremely high. The stop loss may be a considerable distance from the entry point, exposing the trader to unnecessary risk in relation to the potential return.

In addition, hammers do not specify a price objective, making it difficult to estimate the return potential of a hammer trade. Exits need to be determined by additional candlestick patterns or research.

Technical analysis with moomoo

Moomoo stock trading app provides free advanced stock charting tools to help various investors to analyze trends and patterns with 60+ technical indicators and add visuals to charts using 38+ drawing tools. Sign up and download the moomoo app today to access these charting tools!