What Is Bullish and Bearish Breakaway Candlestick Pattern?

Candlestick patterns are among the components of technical analysis. For those who aren't familiar, a candlestick is a chart that shows the high and low prices for a particular time and the daily starting and closing prices. Three parts make up the candlestick: the body, the two shadows, and the top. The shadows are lines extending above and below the candlestick's body. The line in the higher shade is referred to as the wick, while the line in the lower shadow is referred to as the tail.

Newbies are better to learn to interpret single candlesticks before moving on to more complex candlestick patterns. The starting price of a bearish candle is greater than the closing price. When looking at a candle chart, a bullish candle will always have an open price lower than the closing price. In 15 trading days, there are 15 candlesticks since each candlestick typically reflects a single day. After two or more trading days, several candlestick patterns appear instead of a single candlestick pattern.

The breakaway candlestick pattern is the most important of the several candlestick patterns that may illustrate the movement of prices and trends. Breakaway refers to a trend reversal. It is made up of five candles and based on the height and placement of each of these candles, traders can forecast whether or not there will be a bullish or bearish reversal of the trend over the subsequent several short-term periods.

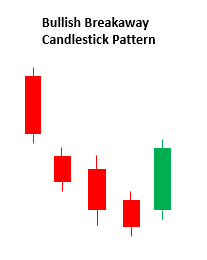

Bullish Breakaway Candlestick Pattern

The bullish breakaway pattern consists of five bars, and the characteristics of this pattern may be understood as follows:

As the first bar illustrates, the predominant emotion in the market is pessimism. This first bar is lengthy and bearish.

Even though they are shorter, the following three candlesticks all reflect a negative attitude. This indicates that the bears are starting to lose some ground in the battle, or, to put it another way, the bearish trend is beginning to lose its strength.

The last bar, which pushes through the trend of the previous three bars and breaks away, is where the ultimate reversal occurs. It becomes bullish and suggests that the market may be toward the bulls.

Bearish Breakaway Candlestick Pattern

The bearish breakaway candlestick pattern is the opposite of the bullish candlestick pattern, which contains five bars. This pattern manifests itself during an upward trend in the market.

The first candle is a tall one, which indicates that the market is bullish at the moment.

The second candle may be lengthy, resulting in a price gap since the market opens higher.

The third might be either bullish or bearish, but it does not stop the price from rising.

The third candle's pattern continues into the fourth candle.

The fifth bar, on the other hand, shatters the pattern and transforms into a bearish one, which causes the trend to change in the other direction.

Breakaway Patterns: Some Things to Keep in Mind

Occasionally there might be groupings of breakaway patterns near the bottom of trends. Some of these patterns are not necessarily breakaway and might be misleading signs that arise during moments of volatility or shortly before a market starts to change.

With bullish and bearish breakaway candlestick patterns, the first Day is a long bar and always continues the present trend. The second Day's candle is likewise the same shade as Day One. On the third and fourth days, the closures maintain the last movement, but on the final Day, the candle in the opposite trend emerges.

Conclusion

Candlestick patterns are adaptable and may be used to analyze price trends and movements across various market situations. After commencing the first Day in the dominant trend, a breakaway candlestick pattern reveals the appearance of the opposite trend on the fifth Day. They might be both bearish and bullish candlestick patterns and can be utilized by traders to obtain a better sense of the markets and trend reversals.

Technical analysis with moomoo

Moomoo stock trading app provides free advanced stock charting tools to help various investors to analyze trends and patterns with 60+ technical indicators and add visuals to charts using 38+ drawing tools. Sign up and download the moomoo app today to access these charting tools!