What Is the Spot Rate?

The price quoted for immediate settlement on a rate of interest, commodities, security, or currencies is the spot rate. The "spot price" or "spot rate" refers to the market value of an item at the time of the quotes for immediate delivery. This value is derived from the equilibrium between the asking and selling prices, which is based on the present market value and the anticipated future market value.

Even though prices at the spot market are dependent on both time and location, in a global economy, most goods and investments on the spot market tend to be rather consistent across countries when exchange rates are considered. Futures and forward prices are contracts for the purchase and sale of an asset for future delivery.

Understanding the Spot Rates

The need for transactions in a foreign currency determines the spot rate. This demand may come from people or firms who seek to do business in a different country's currency. It can also come from forex traders. From the viewpoint of the foreign currency market, the "spot rate" is sometimes referred to as the "benchmark rate," the "straightforward rate," and the "outright rate."

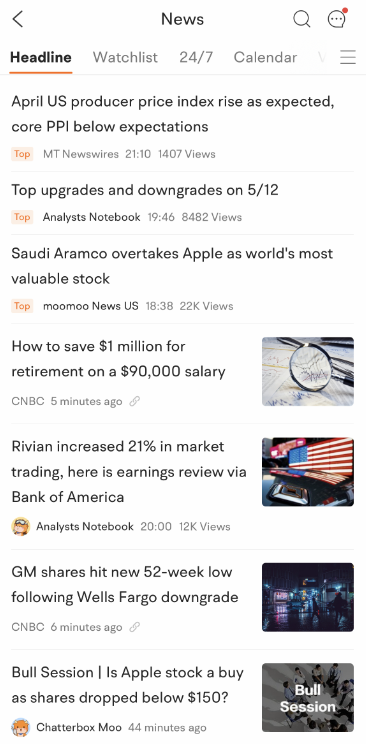

Spot rates may be obtained for various assets, including currencies, commodities (such as crude oil, traditional gasoline, propane, cotton, gold, copper, coffee, wheat, and timber), and bonds. The supply and demand for a particular commodity are considered while determining its spot price, whereas the zero-coupon rate determines bond spot prices. Traders may obtain information on the spot rate from various sources, including Bloomberg, Morningstar, and Thomson Reuters. The same spot rates, in particular currency pairs and commodity prices, are widely reported on in the news.

Moomoo provides investors with 24/7 global financial and technology news with an accompanying detailed analysis from Bloomberg, Dow Jones, and more. Sign up and download the moomoo app today to get free access to the latest global news.

Images provided are not current and any securities are shown for illustrative purposes only.

The Forward Rate and the Spot Rate

Spot settlement, often referred to as the transfer of monies that finishes off a spot contract transaction, typically takes place one or two working days after the trading date, also referred to as the horizon. The spot date is the date when settlement occurs. Even if market conditions change between the time the trade is made and when it resolves, the deal will still settle at the predetermined spot rate.

Since the predicted future market of a commodity, security, or currency depends in part on the present value, in part on the risk-free price, and in part on the time until the contract expires, the spot rate is employed in estimating a forward rate, the price of a long term financial transactions. Investors can extrapolate a spot rate need to know if they know the market price, the risk-free rate, and the amount of time before maturity.

Spot Prices and Futures Prices in Relationship

There is sometimes a sizeable gap between the prices at which futures contracts are traded and spot prices. Prices for futures may be said to be in either contango or backwardation. The condition known as contango occurs when the futures prices decrease to match the lower spot price. The term "backwardation" refers to a situation in which the values of futures contracts increase to match the higher spot price. As the expiration date of a futures contract approaches, its price often rises to the spot price level, creating a backwardation that benefits net long holdings. When there is a contango, it is advantageous to take short positions since the value of the futures will decrease as the contract nears its expiration date and eventually converges with the lower spot price.

Futures trading can go from implied volatility to backwardation or vice versa, and they can also remain in either condition for short or lengthy periods of time, depending on the situation. Futures traders will benefit from keeping an eye on both the current spot pricing and the futures prices.