Troncoparati

Oct 21, 2025 08:49

Understanding "The Greeks": A Beginner's Guide to Options Trading Metrics

Beyond Insights

Oct 24, 2025 10:15

[QUIZ] Unlock the Power of Options - Session 5

A multi-leg options order is an order where two or more option transactions are bought and/or sold simultaneously. This could mean the options selected could have more than one strike price and expiration date. Moomoo now supports 2- to 4-leg options orders. Each leg in a multi-leg options order is typically filled at the same time. However, if there are many option contracts under each leg, partial fill may occur, in which case the order will be filled in proportion to the leg ratio. For example, a long straddle strategy contains two legs, i.e. the long call option and the long put option, and the leg ratio is 1:1; if you place a multi-leg option order for 5 straddles that contain 5 call option contracts and 5 put option contracts under each leg, respectively, and 2 call option contracts are executed (i.e. partial fill), then only 2 put option contracts will be executed accordingly.

Multi-leg options orders allow investors to build complex strategies while potentially saving time to a certain extent. In the event where the general market trend is uncertain, investors may use certain multi-leg options orders to potentially benefit from significant fluctuations in the price of the underlying security.

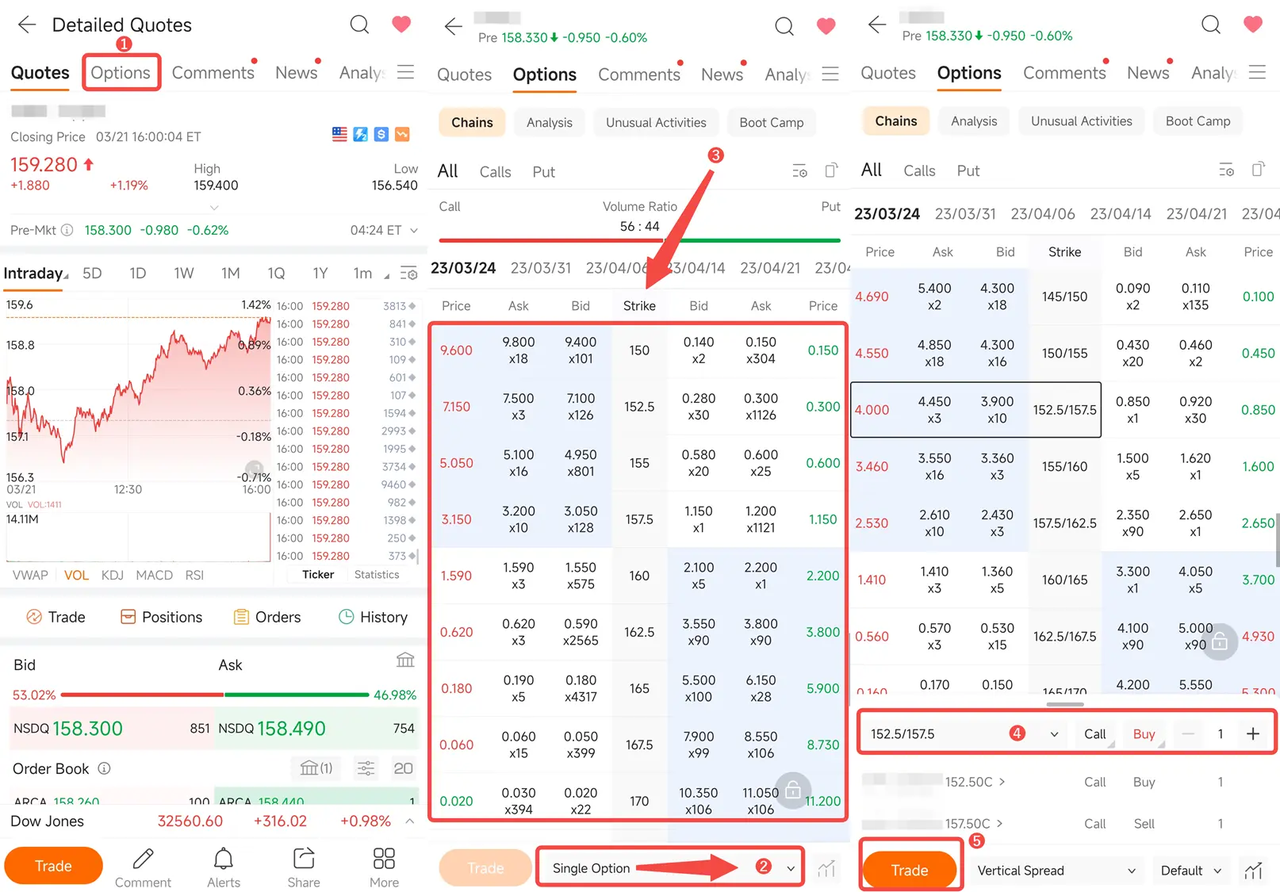

Tap Watchlist > a stock > Options > Chains, select the desirable strategy, and tap the Trade button.

(Any app screenshots are not necessarily up to date, and all securities mentioned are for illustrative purposes only.)

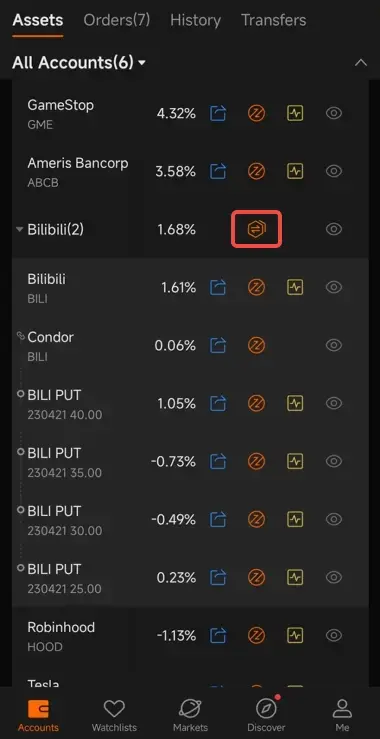

Right-swipe on the position list, tap the icon indicated in the illustration below, and you can open or close a position in an entire option strategy (applicable only in the Option Strategy View).

(Any app screenshots are not necessarily up to date, and all securities mentioned are for illustrative purposes only.)

Right-swipe on the position list, tap the icon indicated in the illustration below, and you can close out multiple positions as you want with a multi-leg options order (applicable whether in the Option Strategy View or not).

(Any app screenshots are not necessarily up to date, and all securities mentioned are for illustrative purposes only.)

A vertical spread strategy is to simultaneously buy and sell two options of the same underlying stock, same type (calls or puts), and same expiration date, but with different strike prices.

| Type | Definition | Strike Price Comparison | Debit/Credit | Theoretical Max Profit | Theoretical Max Loss | Breakeven |

| Long Call Spread (Bullish) | Long Call (C1)+Short call (C2) | C2>C1 | Debit | C2 - C1 -Net Debit Paid | Net Debit Paid | C1 + Net Debit Paid |

| Short Call Spread (Bearish) | Long Call (C1)+Short Call (C2) | C1>C2 | Credit | Net Credit Received | C1 - C2 - Net Credit Received | C2 + Net Credit Received |

| Short Put Spread (Bullish) | Long Put (P1)+Short Put (P2) | P2>P1 | Credit | Net Credit Received | P2 - P1 - Net Credit Received | P2 - Net Credit Received |

| Long Put Spread (Bearish) | Long Put (P1)+Short Put (P2) | P1>P2 | Debit | P1 - P2 -Net Debit Paid | Net Debit Paid | P1 - Net Debit Paid |

A vertical spread strategy is mainly used to serve the following two purposes:

① For debit spreads, it is used to reduce the payable net premium.

② For credit spreads, it is used to lower the risks of short-selling option positions.

A straddle strategy is to simultaneously hold a call option and a put option of the same underlying stock, same strike price, and same expiration date.

A long straddle strategy aims to profit from volatility. Long straddle strategy may be considered when the underlying stock is predicted to have large swings (sharp rises or falls). Conversely, short straddle strategy may be considered when the underlying stock is predicted to remain unchanged or moderately volatile.

A strangle strategy is to simultaneously hold a call option and a put option of the same underlying stock and same expiration date, but with different strike prices.

A long strangle strategy aims to profit from volatility. A long strangle strategy may be considered when the underlying stocks is predicted to have large swings (sharp rises or falls). Conversely, a short strangle strategy may be considered when the underlying stock is predicted to remain unchanged or moderately volatile.

A butterfly strategy is to simultaneously hold three call/put options of the same underlying stock, same expiration date, and usually with the same strike distance, with a ratio of 1:2:1.

A long butterfly strategy may be considered when an investor is neutral on a stock, since it may benefit when the underlying trades near the short strikes. Conversely, short butterfly strategy may be considered when huge swings are expected in a stock, since it may benefit from a substantial move in the underlying price.

A condor strategy is to simultaneously hold four call/put options of the same underlying stock, same expiration date, and same strike distance, with a ratio of 1:1:1:1.

A condor strategy aims to make a profit by predicting price volatility. Long condor strategy may be considered when an investor is neutral on a stock. Conversely, if an investor expects huge swings in a stock, a short condor strategy may be considered.

An iron butterfly strategy is to simultaneously hold two call options and two put options of the same underlying stock, same expiration date, and usually with the same strike distance, with a ratio of 1:1:1:1.

A condor strategy aims to make a profit by predicting price volatility. Short iron butterfly strategy may be considered when an investor is neutral on a stock. Conversely, if an investor expects huge swings in a stock, a long iron butterfly strategy may be considered.

An iron condor strategy is to simultaneously hold two call options and two put options of the same underlying stock, same expiration date, and usually with the same strike distance, with a ratio of 1:1:1:1.

An iron condor strategy aims to make a profit by predicting price volatility. Short iron condor strategy may be considered when an investor is neutral on a stock. Conversely, if an investor expects huge swings in a stock, a long iron condor strategy may be considered.

A calendar spread strategy involves buying and selling two options of the same stock, type (call or put), and strike price, but different expiration dates. This strategy aims to make money from time decay.

If you think the stock will trade sideways after experiencing large swings, then you can use a long calendar spread to gain profits. On the other hand, if you anticipate large swings in the underlying stock price near-term but it will remain steady in the long term, then a short calendar spread may be used to profit.

A diagonal spread strategy involves buying and selling two options of the same stock, type (calls or puts) at the same time, but with different expiration dates and strike prices.

This strategy can be used to make a profit from time decay of options, or to trade in either a bullish or bearish direction by taking advantage of the difference between the bought and sold options' strike prices.

A custom strategy allows you to form an option strategy by selecting 2-4 options with different expiration dates.

Note: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy.

- No more -