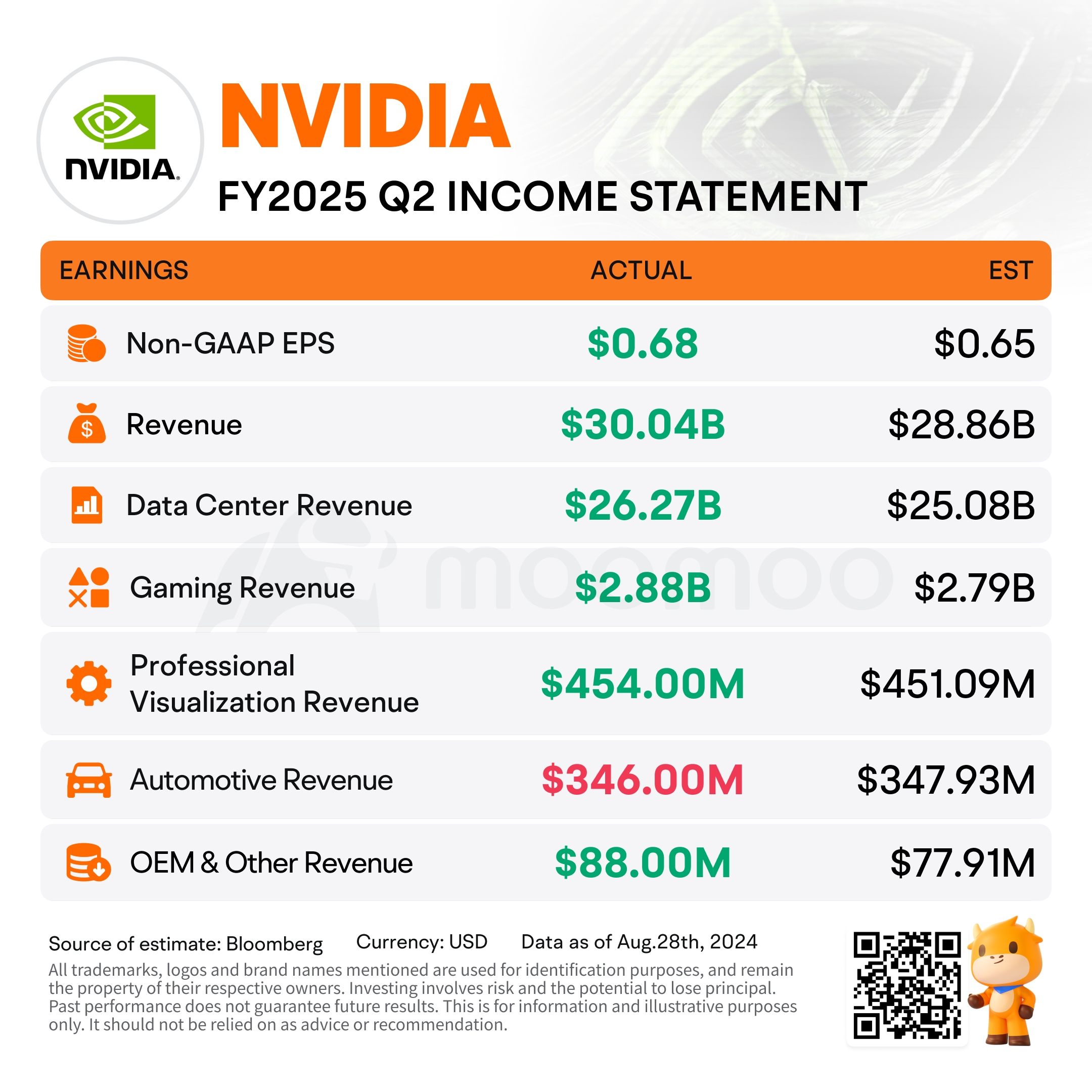

$NVIDIA (NVDA.US)$ reported Q2 earnings that beat expectations Wednesday. The stock fell after the results. The firm showed adjusted EPS of $0.68/share, and a $50B stock buyback. Analysts expected just $0.65/share. The firm reported a revenue of $30.04B, up 15% QoQ and 122% from last year.

Earnings per share were up 11% from the previous quarter and up 152% from a year ago. Eyes were following Data Center Revenue closely, up $26.3B, above street estimates of $25.08B. Not every segment of revenue beat: Automotive missed estimates.

“Hopper demand remains strong, and the anticipation for Blackwell is incredible,” said Jensen Huang, founder and CEO of NVIDIA. “NVIDIA achieved record revenues as global data centers are in full throttle to modernize the entire computing stack with accelerated computing and generative AI.”

Commentators on Bloomberg Radio said the firm had not lived up to the highest expectations for the rest of Fiscal 2025. The firm expects revenue of $32.5 billion, plus or minus 2%.

Commentators on Bloomberg Radio said the firm had not lived up to the highest expectations for the rest of Fiscal 2025. The firm expects revenue of $32.5 billion, plus or minus 2%.