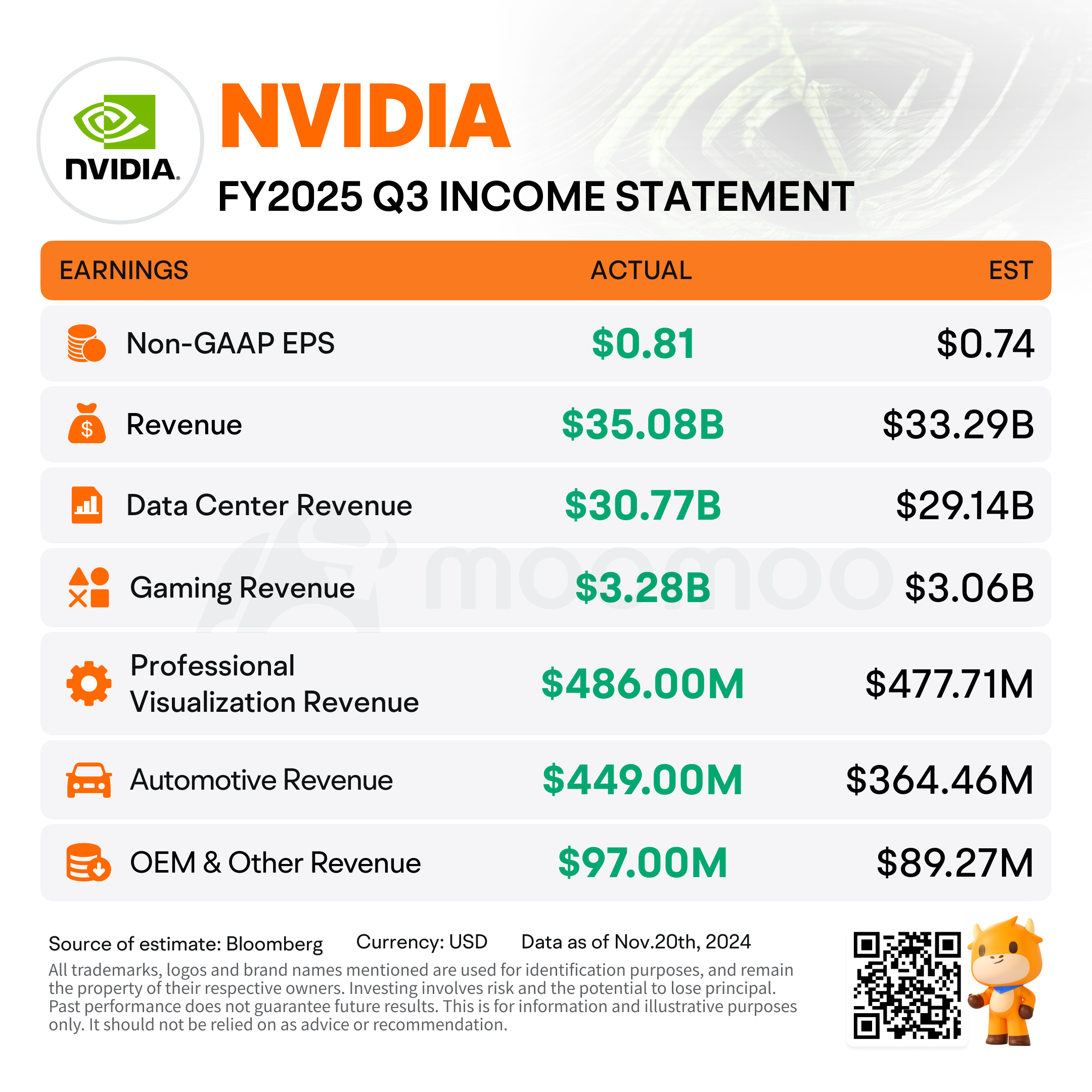

$NVIDIA (NVDA.US)$ reported Q3 2025 adjusted earnings of $0.81/share, vs estimates of $0.74/share, on revenue of $35.08 vs estimates of $33.25B Wednesday. In a release, the firm said the Blackwell Chips are on the way, due for shipped release in the current fourth quarter, but they do have known issues.

In light of the AI chip firms' stellar year, investors picked through the firm forward-looking numbers for an ounce of weakness. Nvidia reported guidance of $37.5 B vs. estimates calling for adjusted EPS of $0.82 on revenue of $37.08B. The highest estimates were at $41B, meaning Nvidia's outlook was below midpoints.

"We completed a successful mask change for Blackwell, our next Data Center architecture, that improved production yields. Blackwell production shipments are scheduled to begin in the fourth quarter of fiscal 2025 and will continue to ramp into fiscal 2026," CFO Colette M Kress said in an earnings commentary. "We will ship both Hopper and Blackwell systems in the fourth quarter of fiscal 2025 and beyond. Both Hopper and Blackwell systems have certain supply constraints, and the demand for Blackwell is expected to exceed supply for several quarters in fiscal 2026."

Earnings per share were up from a year ago when the firm posted earnings of 40C on revenue of $18B. EPS came in 8.9% above estimates.

Earnings per share were up from a year ago when the firm posted earnings of 40C on revenue of $18B. EPS came in 8.9% above estimates.

Eyes were following Data Center Revenue closely, at $30.77B vs. street estimates of $29.14B. Last quarter, the firm beat most estimates, but its forward-looking guidance lagged, sending the stock to the lowest place on the NASDAQ 100 by a total percentage decline the following day.

A month and a half later, the stock hit all-time highs.