KE Holdings Inc.( (NYSE: $KE Holdings(BEKE.US)$ and HKEX: $BEKE-W(02423.HK)$), a leading integrated online and offline platform for housing transactions and services.

KE Holdings shares surged 12.90% after earnings report.

Business and Financial Highlights for the First Quarter of 2022

Business and Financial Highlights for the First Quarter of 2022

Gross transaction value (GTV) was RMB586.0 billion (US$92.4 billion), a decrease of 45.2% year-overyear. GTV of existing home transactions was RMB374.1 billion (US$59.0 billion), a decrease of 44.5% year-over-year.

GTV of new home transactions was RMB192.7 billion (US$30.4 billion), a decrease of 43.9% year-over-year.

GTV of emerging and other services was RMB19.2 billion (US$3.0 billion), a decrease of 63.6% year-over-year.

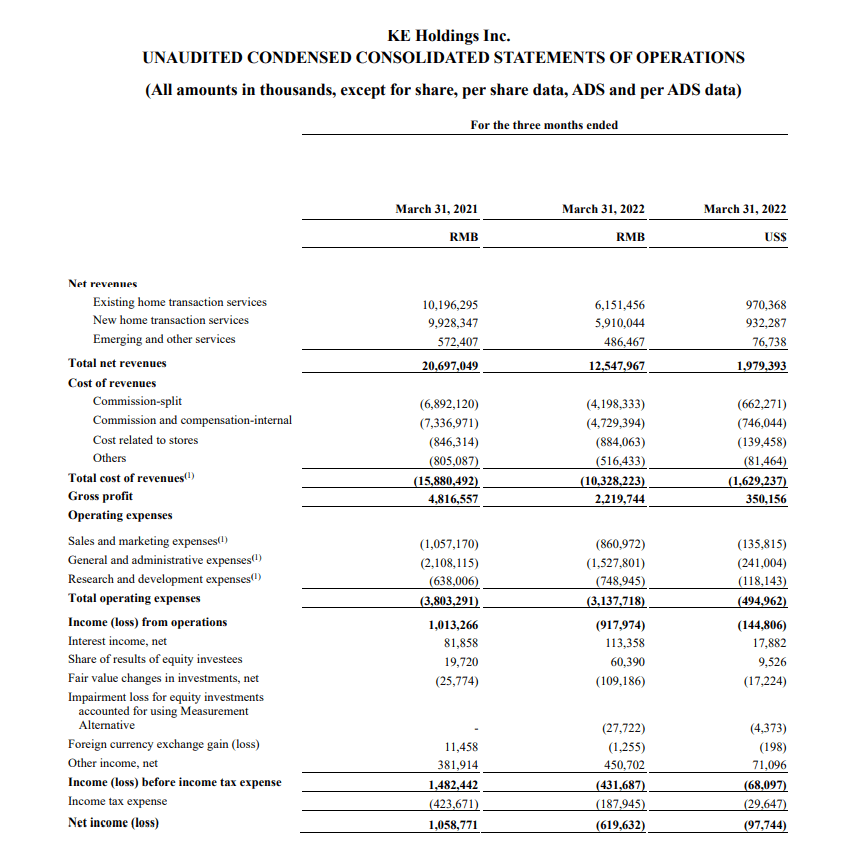

Net revenues were RMB12.5 billion (US$2.0 billion), a decrease of 39.4% year-over-year.

Net loss was RMB620 million (US$98 million). Adjusted net income was RMB28 million (US$4 million).

Number of stores was 45,777 as of March 31, 2022, a 6.0% decrease from one year ago.

Number of active stores was 42,994 as of March 31, 2022, a 4.3% decrease from one year ago.

Number of agents was 427,379 as of March 31, 2022, a 19.1% decrease from one year ago.

Number of active agents was 381,799 as of March 31, 2022, a 20.3% decrease from one year ago.

Mobile monthly active users (MAU) averaged 39.7 million, compared to 48.5 million in the same period of 2021.