Source: Jinshi data

Author: listener

Over the past two months, there has been a steady stream of negative news about the U.S. housing market: the crash crisis, the bursting of the bubble, the loss of heat, the collapse of buyer demand and the fall of high house prices.

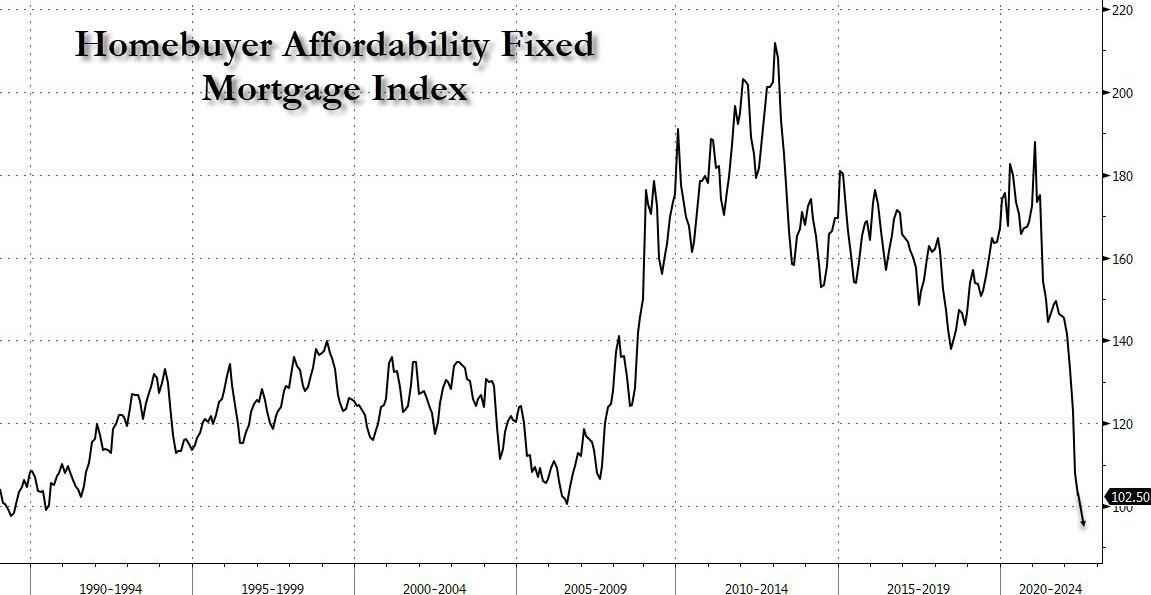

This is actually foreseeable, after all, US mortgage rates are soaring to a 10-year high at the fastest rate on record, and the affordability of American consumers is at an all-time low, according to the data. only 1% of the lucky Americans can realize their dream of home ownership.

This is actually foreseeable, after all, US mortgage rates are soaring to a 10-year high at the fastest rate on record, and the affordability of American consumers is at an all-time low, according to the data. only 1% of the lucky Americans can realize their dream of home ownership.

Zero hedging of the financial blog says that it is just like 2007.It's only a matter of time before the US housing market collapses.。

And once the U. S. housing market falls completely, then as the nation's largest residential and commercial landlord, private equity giant Blackstone Group Inc Group (Blackstone Group Inc) is about to become bigger and stronger. At that time, Blackstone Group Inc will use some (or all) of his record $50 billion to prepare for the upcoming real estate crash.

Blackstone Group Inc Group (Blackstone) is in the final stages of raising money for a new real estate fund, according to the Wall Street Journal. This fund will break the situation of market volatility and financing congestion and become the largest real estate fund.

In a regulatory filing, Blackstone Group Inc said it had fulfilled its commitment to invest a total of $24.1 billion in its main real estate fund, Blackstone Real Estate Partners X.

Blackstone Group Inc Group will allocate about $300m of its own capital and allocate an additional $5.9 billion to investors, according to the Wall Street Journal. When finalized, the fund will reach $30.3 billion. Blackstone Group Inc raised the money in just three months and is expected to become the largest traditional private equity tool in history. Blackstone Group Inc Group raised a $26 billion buyout fund in 2019, setting a previous record. The new real estate fund will be 50 per cent higher than the $20.5 billion raised in 2019.

Including funds focused on Asian and European real estate, Blackstone Group Inc will have more than $50 billion to carry out the so-called"opportunistic investment"These investments are often"risk is as high as potential rate of return."。

According to the Wall Street Journal, this will help Blackstone Group Inc take advantage of the real estate market downturn. That is, when American consumers liquidated their homes on a large scale in order to have enough cash flow, Blackstone Group Inc intervened to "pick up leaks" of real estate at low prices.Once the US economy bottoms out and rebounds, Blackstone Group Inc will become a bigger landowner in the United States and the world.。

There is no doubt that many of Blackstone Group Inc's perfect deals-such as the acquisition of Cosmopolitan casinos and hotels in Las Vegas in 2014 and BioMed Realty Trust, the owner of life sciences buildings in 2016-took place at a time of market turmoil.

It is worth noting that Blackstone Group Inc is not alone in laying out in the real estate market, which is about to hit bottom: this year, the US real estate market is full of private equity funds, even after the sharp fall in US stocks and depressed trading. Many private equity funds are still trying to raise huge amounts of money. The surge in demand for new cash has overwhelmed the investment teams of institutions such as US pension funds and endowments. It also means that many institutions have delayed their commitments to everyone except the top fund managers.

The size and speed of Blackstone Group Inc's latest real estate fund suggest that institutional investors are still eager to pour into financial instruments provided by well-known managers with a good track record. Although the bottom-reading fund in the US housing market of more than $20 billion has been growing, it is still relatively small compared to the large real estate funds of Blackstone Group Inc Group.

As the Wall Street Journal added, Blackstone Group Inc's $298 billion real estate business adopted a themed investment strategy, targeting economic sectors that outperformed inflation, leading it to focus on four key areas:

1. E-commerce company warehousing

2. Life science architecture

3. Leasing business

4. Land for tourism industry and leisure industry.

There is no doubt that Blackstone Group Inc's real estate investment performance in the above four areas is very excellent.

Edit / ping

这其实是可以预见的,毕竟美国房屋抵押贷款利率正以有记录以来最快的速度飙升至十年高位,并将美国消费者的住房负担能力降至历史最低点,数据显示,仅有1%的美国幸运儿能实现“居者有其屋”的梦想。

这其实是可以预见的,毕竟美国房屋抵押贷款利率正以有记录以来最快的速度飙升至十年高位,并将美国消费者的住房负担能力降至历史最低点,数据显示,仅有1%的美国幸运儿能实现“居者有其屋”的梦想。