Source: Zhitong Finance and Economics

Price increases by companies to pass on inflationary costs to consumers have led to a slowdown in consumer demand, especially in the US.

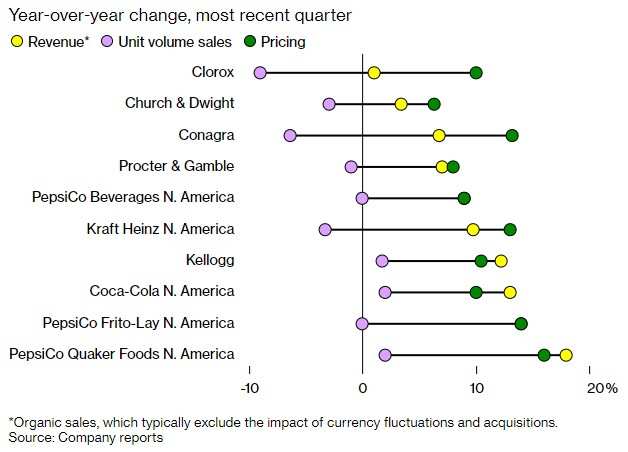

Before the US stock market opened on July 12th$PepsiCo Inc (PEP.US) $Announced a "strange" second-quarter results: sales growth in North America was basically zero, but revenue increased, driven by price increases. And then$Cole (CLX.US) $、$ConAgra (CAG.US) $和$Kraft Heinz (KHC.US) $Major consumer goods companies and other major consumer goods companies have announced results similar to those of PepsiCo Inc, and the overall trend is clear: output growth has stagnated, but revenue has increased moderately due to rising prices.

Davidson&Co. "although this is sales growth, it is not healthy sales growth," said Michael Baker, a retail analyst. It just comes from inflation. "

Danone Group (Danone SA)$ADR (DANOY.US) $It said that in the first half of this year, the company raised prices seven times in North America, with different price increases for different products. Nestl é, the world's largest food manufacturer$ADR (NSRGY.US) $(Nestl é) in the first half of 2022, food prices in North America increased by 9.8% compared with the same period last year, twice the European average.

This combination is not bad for investors at the moment, as the stock market has been rising since the start of the earnings season. However, this combination is not a good thing for consumers who are rapidly losing purchasing power and angry about it, the economy as a whole and the Fed, which is eager to bring inflation down from more than 40-year highs.

Data released last month showed that US GDP recorded negative growth for the second consecutive quarter, halting from last year's rapid rebound. When enterprises do not increase their output, it is naturally very difficult for the economy to grow. The stagnation of sales in the US market is a clear sign that consumers are now feeling stretched after squandering most of their savings during the outbreak.

However, many chief executives do not seem to care that much. For most of the past 20 years, inflation has averaged just over 2%. Today, raising prices is no longer taboo, because in an economy where labour is scarce, it is much easier to increase income through prices than to try to increase output. It does not matter if rising prices lead to a slight decline in sales. In addition, for some commodities, the extraordinary surge in demand during the outbreak is beginning to fade.

Neil Saunders, an analyst at consulting firm GlobalData Plc in the US, said many companies believed that once the economic situation stabilized and the retail market returned to normal, "people will return to the market". "if their market share continues to decline next year, they will pay more attention. At present, it is difficult to judge what is temporary and what is permanent. "

Us factory output fell for the second month in a row in June, dragged down by a decline in consumer goods manufacturing. This month,Bauer Packaging (BALL.US) $It said it would stop production of beverage cans in Phoenix and St. Paul, Minnesota, and delay the construction of factories near Las Vegas. "the price increases taken by companies to pass on inflation costs to consumers have led to a slowdown in consumer demand, especially in the US," the company said. "

$Starbucks Corp (SBUX.US) $、$Coca-Cola Company (KO.US) $、$Kimberly-Clark (KMB.US) $And the manufacturer of Arm&Hammer baking soda and OxiClean washing powder.Church & Dwight (CHD.US) $The quarterly results reported are more or less in the category of weak sales and sharply rising prices.

One of the best examples is ConAgra, a huge Chicago-based food group that reported results on July 14th.

According to the results, one of the company's core revenue indicators rose 6.8% in the three months to May 29, due to a 13% increase in average selling prices and changes in product mix. At the same time, however, merchandise sales fell 6.4 per cent; the biggest declines were in the food and snacks division, which makes Slim Jims and Duncan Hines cake ingredients, and the frozen food division, which makes Birds Eye vegetables and healthy choice packages, which fell 7.2 per cent and 8.1 per cent, respectively; ConAgra said price increases triggered declines in these divisions, which account for the bulk of the company's business.

Some consumer goods companies have been able to raise prices and sales at the same time. This is true for many companies that cater to wealthy customers who are more tolerant of inflation, but even some of the backbone of the mass market are holding their ground. Last quarter$Los (L.US) $Sales and pricing in North America have improved$Procter & Gamble Co (PG.US) $Sales fell, but the company said it was adding capacity to meet growing demand.

On the other hand, some retailers found that demand in some of their product lines was very weak, so they cut prices sharply.$Walmart Inc (WMT.US) $和$Target Corp (TGT.US) $They are all selling household items such as courtyard furniture, kitchen appliances and some clothing, all of which end up in excess inventory. But for now at least, these price cuts are one-off.

$Gap Inc (GPS.US) $Its Old Navy brand publicly promised on July 29 that it would not raise the price of denim jeans until the end of September to help struggling parents buy new clothes. This action and the public response have really grasped the key to the economic situation, and the move has received a lot of attention and praise. Corporate America has clearly learned to play the inflation game.

Edit / Viola