Zhejiang Chang'an Renheng Technology Co., Ltd. (HKG:8139) shareholders that were waiting for something to happen have been dealt a blow with a 29% share price drop in the last month. For any long-term shareholders, the last month ends a year to forget by locking in a 53% share price decline.

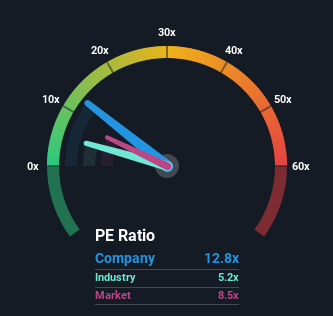

Even after such a large drop in price, given close to half the companies in Hong Kong have price-to-earnings ratios (or "P/E's") below 8x, you may still consider Zhejiang Chang'an Renheng Technology as a stock to avoid entirely with its 12.8x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

As an illustration, earnings have deteriorated at Zhejiang Chang'an Renheng Technology over the last year, which is not ideal at all. One possibility is that the P/E is high because investors think the company will still do enough to outperform the broader market in the near future. If not, then existing shareholders may be quite nervous about the viability of the share price.

See our latest analysis for Zhejiang Chang'an Renheng Technology

See our latest analysis for Zhejiang Chang'an Renheng Technology

SEHK:8139 Price Based on Past Earnings October 6th 2022 Although there are no analyst estimates available for Zhejiang Chang'an Renheng Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow.

SEHK:8139 Price Based on Past Earnings October 6th 2022 Although there are no analyst estimates available for Zhejiang Chang'an Renheng Technology, take a look at this free data-rich visualisation to see how the company stacks up on earnings, revenue and cash flow. Is There Enough Growth For Zhejiang Chang'an Renheng Technology?

The only time you'd be truly comfortable seeing a P/E as steep as Zhejiang Chang'an Renheng Technology's is when the company's growth is on track to outshine the market decidedly.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 35%. Still, the latest three year period has seen an excellent 273% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

This is in contrast to the rest of the market, which is expected to grow by 20% over the next year, materially lower than the company's recent medium-term annualised growth rates.

With this information, we can see why Zhejiang Chang'an Renheng Technology is trading at such a high P/E compared to the market. It seems most investors are expecting this strong growth to continue and are willing to pay more for the stock.

What We Can Learn From Zhejiang Chang'an Renheng Technology's P/E?

A significant share price dive has done very little to deflate Zhejiang Chang'an Renheng Technology's very lofty P/E. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Zhejiang Chang'an Renheng Technology revealed its three-year earnings trends are contributing to its high P/E, given they look better than current market expectations. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 4 warning signs for Zhejiang Chang'an Renheng Technology you should be aware of, and 2 of them are significant.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a P/E ratio below 20x).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.