Zhejiang Sanwei Rubber Item Co., Ltd. (SHSE:603033) shareholders might be concerned after seeing the share price drop 30% in the last quarter. But that scarcely detracts from the really solid long term returns generated by the company over five years. In fact, the share price is 138% higher today. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. The more important question is whether the stock is too cheap or too expensive today. Unfortunately not all shareholders will have held it for the long term, so spare a thought for those caught in the 42% decline over the last twelve months.

Since it's been a strong week for Zhejiang Sanwei Rubber Item shareholders, let's have a look at trend of the longer term fundamentals.

View our latest analysis for Zhejiang Sanwei Rubber Item

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

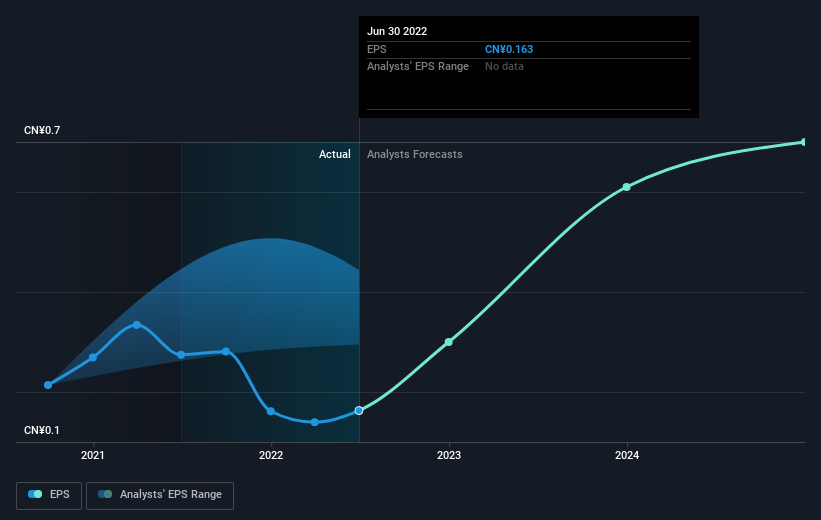

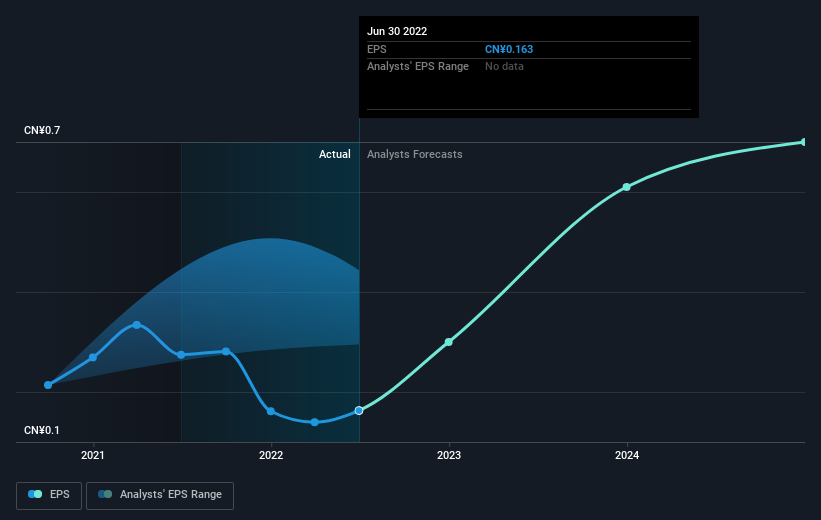

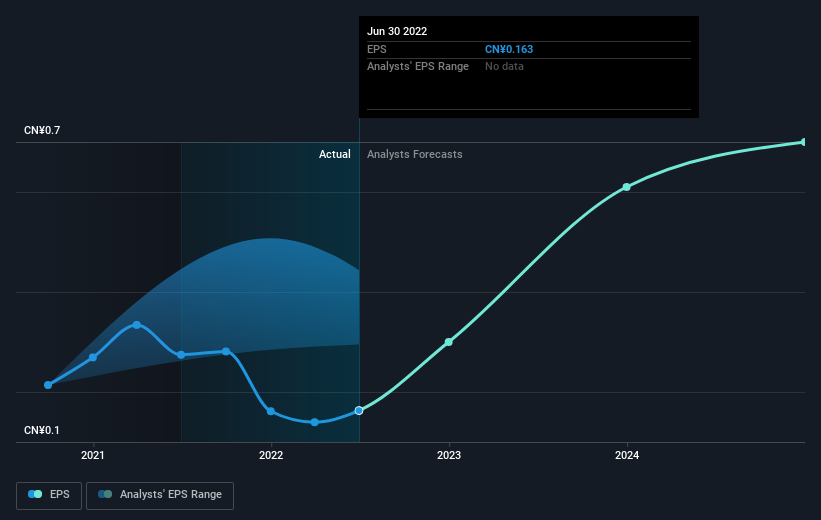

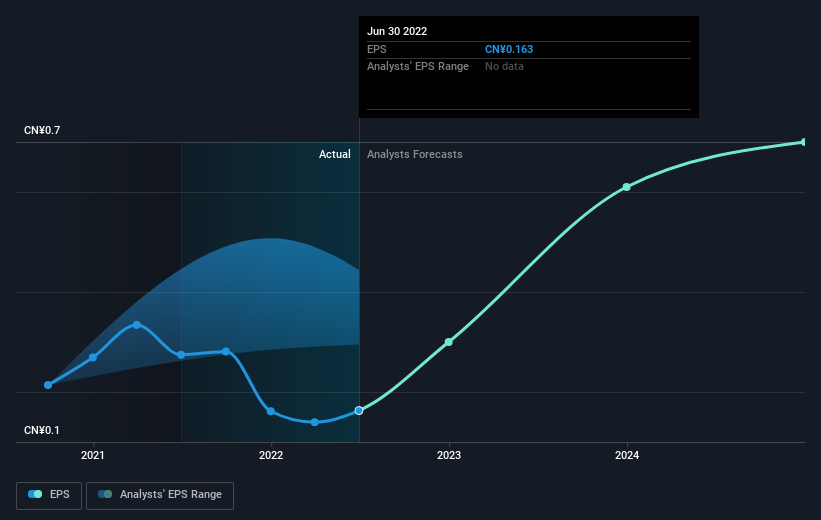

During five years of share price growth, Zhejiang Sanwei Rubber Item achieved compound earnings per share (EPS) growth of 0.7% per year. This EPS growth is lower than the 19% average annual increase in the share price. This suggests that market participants hold the company in higher regard, these days. That's not necessarily surprising considering the five-year track record of earnings growth. This favorable sentiment is reflected in its (fairly optimistic) P/E ratio of 99.58.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

SHSE:603033 Earnings Per Share Growth October 20th 2022

It might be well worthwhile taking a look at our free report on Zhejiang Sanwei Rubber Item's earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Zhejiang Sanwei Rubber Item's total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Zhejiang Sanwei Rubber Item shareholders, and that cash payout contributed to why its TSR of 145%, over the last 5 years, is better than the share price return.

A Different Perspective

We regret to report that Zhejiang Sanwei Rubber Item shareholders are down 42% for the year. Unfortunately, that's worse than the broader market decline of 17%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Longer term investors wouldn't be so upset, since they would have made 20%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Zhejiang Sanwei Rubber Item is showing 3 warning signs in our investment analysis , and 1 of those makes us a bit uncomfortable...

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CN exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

浙江三威ゴム製品有限会社。(上海証券取引所:603033)前四半期の株価が30%下落した後、株主たちは懸念する可能性がある。しかしこれは同社が5年以内に生み出した真の穏健な長期収益をほとんど減損しないだろう。実は、今日の株価は138%上昇した。したがって,株価下落を見ることは決して面白いことではないが,より長い時間範囲に着目することが重要である.さらに重要な問題は、現在この株が安すぎるか高すぎるかだ。不幸にも、すべての株主がそれを長期的に保有しているわけではありませんので、過去12ヶ月で42%の下落に陥った人を考えてみてください

今週は浙江三威ゴムプロジェクトの株主にとって強い一週間であるため、比較的長期的なファンダメンタルズの動向を見てみよう

浙江三威ゴムプロジェクトの最新分析を調べてください

有効市場仮説は一部の人に伝授され続けているが,市場は過剰反応の動的システムであり,投資家はつねに理性的ではないことが証明されている。市場情緒がどのように時間とともに変化するかを考察する1つの方法は、1社の株価と1株当たり収益(EPS)との相互作用を観察することである

有効市場仮説は一部の人に伝授され続けているが,市場は過剰反応の動的システムであり,投資家はつねに理性的ではないことが証明されている。市場情緒がどのように時間とともに変化するかを考察する1つの方法は、1社の株価と1株当たり収益(EPS)との相互作用を観察することである

5年間の株価増加の中で、浙江三威ゴムプロジェクトは1株当たり収益(EPS)の年平均0.7%の複合成長を実現した。この1株当たりの収益の伸びは同社の株価の平均年19%の伸びを下回っている。これは、ここ数日、市場参加者の同社に対する評価がより高いことを示している。5年間の利益増加の記録を考慮すると、これは必ずしも驚くべきことではない。この有利な情緒は,その(かなり楽観的な)市況率99.58に反映されている

EPSが時間とともにどのように変化しているかを次の図で見ることができます(グラフをクリックすると正確な値を見ることができます)

上海証券取引所:2022年10月20日1株当たり収益増加603033

私たちを見る価値があるかもしれません無料です浙江三威ゴムプロジェクトの収益、収入とキャッシュフローを報告した

では総株主報酬(TSR)はどうでしょう?

浙江三威ゴムの違いはなおさらだ株主総リターン(TSR)及びその株価リターンそれは.TSRは、配当金の価値(再投資されたような)と、株主に提供される任意の割引資本の仮定価値とを計上しているため、より完全なリターン計算方法であるといえる。配当金は浙江三威ゴムプロジェクトの株主にとって確かに有益であるが、現金支払いも同社の過去5年間の145%のTSRが株価リターンよりも良い原因の一つである

異なる視点

私たちは残念ながら、浙江三威ゴムプロジェクトの株主は今年に入って42%下落したと報告した。不幸にも、これは大盤の17%の下落よりも悪い。しかし、これは株価がより広い市場緊張感の影響を受けているだけかもしれない。機会が発生しないように基本的な面に集中する必要があるかもしれない。彼らは5年以内に毎年20%の収益を得るので、長期的な投資家はそんなに落胆しないだろう。最近の売りは機会かもしれないので、長期的な増加傾向の兆しを探すためにファンダメンタルデータを見る価値があるかもしれない。株価を企業の業績を測る長期的な指標とすることは非常に興味深いことが分かった。しかし、本当に洞察力を得るためには、私たちはまた他の情報を考慮しなければならない。それでも、浙江三威ゴムプロジェクトは展示されていますのでご注意ください私たちの投資分析における3つの警告信号はそのうちの1つは私たちを不快にさせて..

他の会社を見たいなら、財務状況がもっと良いかもしれませんが、これを逃してはいけません無料です自分が利益成長を達成できることが証明された会社のリスト

本明細書で参照される市場リターンは、現在CN取引所で取引されている株式の市場加重平均リターンを反映していることに留意されたい。

この文章に何かフィードバックはありますか。内容が心配ですか。 連絡を取り合う私たちに直接連絡します。あるいは,編集グループに電子メールを送信することも可能であり,アドレスはimplywallst.comである.

本稿ではSimply Wall St.によって作成され,包括的である私たちは歴史データとアナリスト予測に基づくコメントを偏りのない方法で提供するだけで、私たちの文章は財務アドバイスとしてのつもりはありません。それは株を売買する提案にもなりませんし、あなたの目標やあなたの財務状況も考慮していません。私たちの目標はあなたにファンダメンタルデータによって駆動される長期的な重点分析をもたらすことです。私たちの分析は最新の価格に敏感な会社の公告や定性材料を考慮しないかもしれないことに注意してください。Simply Wall St.上記のいずれの株に対しても在庫を持っていない.

有効市場仮説は一部の人に伝授され続けているが,市場は過剰反応の動的システムであり,投資家はつねに理性的ではないことが証明されている。市場情緒がどのように時間とともに変化するかを考察する1つの方法は、1社の株価と1株当たり収益(EPS)との相互作用を観察することである

有効市場仮説は一部の人に伝授され続けているが,市場は過剰反応の動的システムであり,投資家はつねに理性的ではないことが証明されている。市場情緒がどのように時間とともに変化するかを考察する1つの方法は、1社の株価と1株当たり収益(EPS)との相互作用を観察することである 上海証券取引所:2022年10月20日1株当たり収益増加603033

上海証券取引所:2022年10月20日1株当たり収益増加603033

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).  SHSE:603033 Earnings Per Share Growth October 20th 2022

SHSE:603033 Earnings Per Share Growth October 20th 2022