Does the December share price for Shennan Circuit Company Limited (SZSE:002916) reflect what it's really worth? Today, we will estimate the stock's intrinsic value by taking the expected future cash flows and discounting them to their present value. Our analysis will employ the Discounted Cash Flow (DCF) model. Don't get put off by the jargon, the math behind it is actually quite straightforward.

We would caution that there are many ways of valuing a company and, like the DCF, each technique has advantages and disadvantages in certain scenarios. For those who are keen learners of equity analysis, the Simply Wall St analysis model here may be something of interest to you.

See our latest analysis for Shennan Circuit

What's The Estimated Valuation?

We're using the 2-stage growth model, which simply means we take in account two stages of company's growth. In the initial period the company may have a higher growth rate and the second stage is usually assumed to have a stable growth rate. To begin with, we have to get estimates of the next ten years of cash flows. Where possible we use analyst estimates, but when these aren't available we extrapolate the previous free cash flow (FCF) from the last estimate or reported value. We assume companies with shrinking free cash flow will slow their rate of shrinkage, and that companies with growing free cash flow will see their growth rate slow, over this period. We do this to reflect that growth tends to slow more in the early years than it does in later years.

We're using the 2-stage growth model, which simply means we take in account two stages of company's growth. In the initial period the company may have a higher growth rate and the second stage is usually assumed to have a stable growth rate. To begin with, we have to get estimates of the next ten years of cash flows. Where possible we use analyst estimates, but when these aren't available we extrapolate the previous free cash flow (FCF) from the last estimate or reported value. We assume companies with shrinking free cash flow will slow their rate of shrinkage, and that companies with growing free cash flow will see their growth rate slow, over this period. We do this to reflect that growth tends to slow more in the early years than it does in later years.

A DCF is all about the idea that a dollar in the future is less valuable than a dollar today, so we need to discount the sum of these future cash flows to arrive at a present value estimate:

10-year free cash flow (FCF) forecast

| 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 |

| Levered FCF (CN¥, Millions) | CN¥1.00b | CN¥1.60b | CN¥2.09b | CN¥2.55b | CN¥2.97b | CN¥3.34b | CN¥3.67b | CN¥3.96b | CN¥4.21b | CN¥4.44b |

| Growth Rate Estimate Source | Analyst x2 | Analyst x1 | Est @ 30.41% | Est @ 22.24% | Est @ 16.53% | Est @ 12.53% | Est @ 9.73% | Est @ 7.77% | Est @ 6.40% | Est @ 5.44% |

| Present Value (CN¥, Millions) Discounted @ 10% | CN¥910 | CN¥1.3k | CN¥1.6k | CN¥1.7k | CN¥1.8k | CN¥1.9k | CN¥1.8k | CN¥1.8k | CN¥1.7k | CN¥1.7k |

("Est" = FCF growth rate estimated by Simply Wall St)

Present Value of 10-year Cash Flow (PVCF) = CN¥16b

After calculating the present value of future cash flows in the initial 10-year period, we need to calculate the Terminal Value, which accounts for all future cash flows beyond the first stage. The Gordon Growth formula is used to calculate Terminal Value at a future annual growth rate equal to the 5-year average of the 10-year government bond yield of 3.2%. We discount the terminal cash flows to today's value at a cost of equity of 10%.

Terminal Value (TV)= FCF2032 × (1 + g) ÷ (r – g) = CN¥4.4b× (1 + 3.2%) ÷ (10%– 3.2%) = CN¥64b

Present Value of Terminal Value (PVTV)= TV / (1 + r)10= CN¥64b÷ ( 1 + 10%)10= CN¥24b

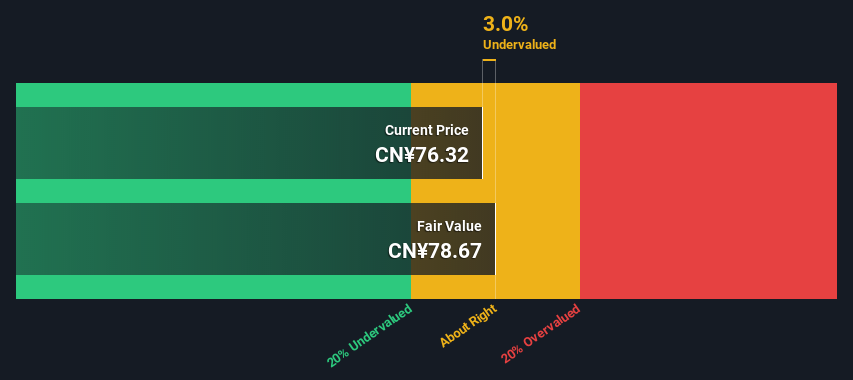

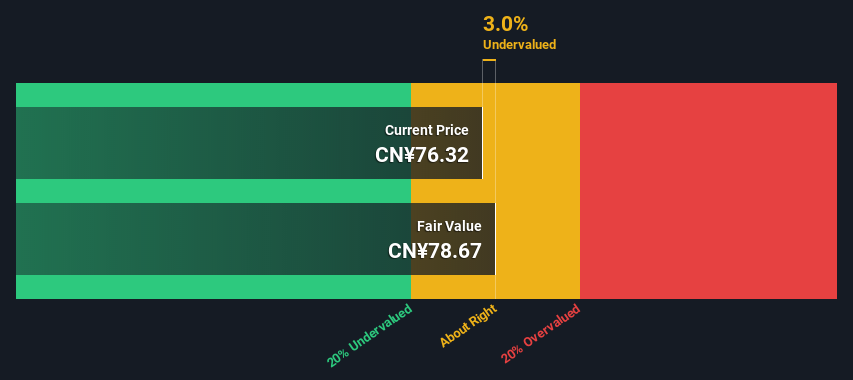

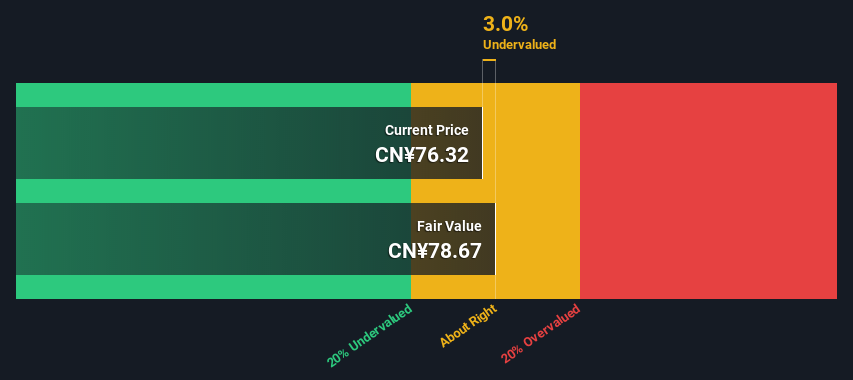

The total value, or equity value, is then the sum of the present value of the future cash flows, which in this case is CN¥40b. In the final step we divide the equity value by the number of shares outstanding. Compared to the current share price of CN¥76.3, the company appears about fair value at a 3.0% discount to where the stock price trades currently. The assumptions in any calculation have a big impact on the valuation, so it is better to view this as a rough estimate, not precise down to the last cent.

SZSE:002916 Discounted Cash Flow December 15th 2022

The Assumptions

We would point out that the most important inputs to a discounted cash flow are the discount rate and of course the actual cash flows. If you don't agree with these result, have a go at the calculation yourself and play with the assumptions. The DCF also does not consider the possible cyclicality of an industry, or a company's future capital requirements, so it does not give a full picture of a company's potential performance. Given that we are looking at Shennan Circuit as potential shareholders, the cost of equity is used as the discount rate, rather than the cost of capital (or weighted average cost of capital, WACC) which accounts for debt. In this calculation we've used 10%, which is based on a levered beta of 1.098. Beta is a measure of a stock's volatility, compared to the market as a whole. We get our beta from the industry average beta of globally comparable companies, with an imposed limit between 0.8 and 2.0, which is a reasonable range for a stable business.

SWOT Analysis for Shennan Circuit

Strength - Earnings growth over the past year exceeded the industry.

- Debt is not viewed as a risk.

- Balance sheet summary for 002916.

Weakness - Earnings growth over the past year is below its 5-year average.

- Dividend is low compared to the top 25% of dividend payers in the Electronic market.

- Shareholders have been diluted in the past year.

Opportunity - Annual earnings are forecast to grow for the next 3 years.

- Good value based on P/E ratio and estimated fair value.

Threat - Dividends are not covered by cash flow.

- Annual earnings are forecast to grow slower than the Chinese market.

- See 002916's dividend history.

Moving On:

Although the valuation of a company is important, it shouldn't be the only metric you look at when researching a company. DCF models are not the be-all and end-all of investment valuation. Preferably you'd apply different cases and assumptions and see how they would impact the company's valuation. If a company grows at a different rate, or if its cost of equity or risk free rate changes sharply, the output can look very different. For Shennan Circuit, we've put together three relevant elements you should assess:

- Risks: Every company has them, and we've spotted 2 warning signs for Shennan Circuit you should know about.

- Future Earnings: How does 002916's growth rate compare to its peers and the wider market? Dig deeper into the analyst consensus number for the upcoming years by interacting with our free analyst growth expectation chart.

- Other High Quality Alternatives: Do you like a good all-rounder? Explore our interactive list of high quality stocks to get an idea of what else is out there you may be missing!

PS. The Simply Wall St app conducts a discounted cash flow valuation for every stock on the SZSE every day. If you want to find the calculation for other stocks just search here.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

シェナン・サーキット・カンパニー・リミテッド(SZSE: 002916)の12月の株価は、実際の価値を反映していますか?今日は、予想される将来のキャッシュフローを現在価値に割り引いて、株式の本質的価値を見積もります。私たちの分析では、割引キャッシュフロー(DCF)モデルを採用します。専門用語に惑わされないでください。その背後にある数学は実はとても簡単です。

企業を評価する方法はたくさんあり、DCFのように、それぞれの手法には特定のシナリオで長所と短所があることに注意してください。株式分析を熱心に学習している人にとっては、こちらのSimply Wall St 分析モデルに興味があるかもしれません。

シェンナン・サーキットの最新の分析をご覧ください

推定評価額はいくらですか?

私たちは2段階の成長モデルを使っています。つまり、会社の成長の2段階を考慮に入れるということです。初期の段階では会社の成長率が高くなる可能性があり、第2段階では通常、安定した成長率が見込まれます。まず、今後10年間のキャッシュフローを見積もる必要があります。可能な場合はアナリストの見積もりを使用しますが、入手できない場合は、前回の推定値または報告値から前回のフリーキャッシュフロー(FCF)を推定します。フリー・キャッシュ・フローが縮小する企業は縮小速度を遅らせ、フリー・キャッシュフローが増加している企業はこの期間に成長率が鈍化すると想定しています。これは、成長が後年よりも初期の方が鈍化する傾向があることを反映しています。

私たちは2段階の成長モデルを使っています。つまり、会社の成長の2段階を考慮に入れるということです。初期の段階では会社の成長率が高くなる可能性があり、第2段階では通常、安定した成長率が見込まれます。まず、今後10年間のキャッシュフローを見積もる必要があります。可能な場合はアナリストの見積もりを使用しますが、入手できない場合は、前回の推定値または報告値から前回のフリーキャッシュフロー(FCF)を推定します。フリー・キャッシュ・フローが縮小する企業は縮小速度を遅らせ、フリー・キャッシュフローが増加している企業はこの期間に成長率が鈍化すると想定しています。これは、成長が後年よりも初期の方が鈍化する傾向があることを反映しています。

DCFは、将来の1ドルは現在の1ドルよりも価値が低いという考えに基づいています。したがって、現在の価値の見積もりを得るには、これらの将来のキャッシュフローの合計を割り引く必要があります。

10年間のフリー・キャッシュフロー(FCF)予測

| 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 |

| レバレッジ付きFCF(人民元、百万円) | 10億人民元 | 16億中国人民元円 | 209億CN円 | 25億5000万中国人民元 | 29億7,000万中国人民元 | 334億円 | CN¥3.67億円 | 39億6,000万中国人民元 | 42.1億人民元 | 44.4億人民元 |

| 成長率推定ソース | アナリスト x2 | アナリスト x1 | 東部標準時 @ 30.41% | 東部標準時 @ 22.24% | 推定値 16.53% | 推定 12.53% | Est @ 9.73% | Est @ 7.77% | Est @ 6.40% | Est @ 5.44% |

| 現在価値(CN¥、百万円)を10%割引 | 910 中国人民元です | 1.3k 中国人民元 | 1.6k 中国人民元 | 17k 中国人民元 | 1.8k 中国人民元 | 1.9k 中国人民元 | 1.8k 中国人民元 | 1.8k 中国人民元 | 17k 中国人民元 | 17k 中国人民元 |

(「Est」= シンプリー・ウォール・ストリートが推定したFCF成長率)

10年間のキャッシュフロー(PVCF)の現在価値 = 16億中国人民元

最初の10年間の将来のキャッシュフローの現在価値を計算したら、第1段階以降の将来のすべてのキャッシュフローを考慮した最終価値を計算する必要があります。ゴードン・グロースの公式は、10年国債利回り3.2%の5年間の平均に等しい将来の年間成長率で最終価値を計算するために使用されます。ターミナルのキャッシュフローを 10% の自己資本コストで今日の価値に割り引きします。

ターミナルバリュー (TV)= FCF2032 × (1 + g) ÷ (r — g) = 4.4億中国人民元× (1 + 3.2%) ÷ (10% — 3.2%) = 640億人民元です

最終価値 (PVTV) の現在価値= テレビ/(1 + 時間)10= CN¥640億÷ (1 + 10%)10= 240億人民元

その場合、総価値、つまり株式価値は、将来のキャッシュフローの現在価値、この場合は400億人民元です。最後のステップでは、株式の価値を発行済み株式数で割ります。現在の株価76.3CNと比較すると、同社は現在の株価よりも約3.0%割引された公正価値のように見えます。どんな計算でも仮定は評価に大きな影響を与えるので、これを最後の1セントまで正確に見るのではなく、大まかな見積もりと見なしたほうがいいです。

SZSE: 002916 割引後のキャッシュフロー 2022年12月15日

前提条件

割引キャッシュフローへの最も重要なインプットは、割引率と、もちろん実際のキャッシュフローであることを指摘しておきます。これらの結果に同意できない場合は、自分で計算を試して、仮定を試してみてください。DCFは、業界の循環性や企業の将来の資本要件も考慮していないため、企業の潜在的な業績の全体像を把握していません。私たちはシェナン・サーキットを潜在的な株主と見なしているので、負債の原因となる資本コスト(または加重平均資本コスト、WACC)ではなく、自己資本コストが割引率として使用されます。この計算では、1.098のレバレッジド・ベータに基づく10%を使用しました。ベータは、市場全体と比較した株式のボラティリティの尺度です。私たちのベータは、世界的に比較可能な企業の業界平均ベータから得られます。0.8から2.0の間の制限は、安定したビジネスにとっては妥当な範囲です。

瀋南サーキットのSWOT分析

弱点 - 過去1年間の収益の伸びは、5年間の平均を下回っています。

- 配当金は、電子市場の上位25%の配当支払者に比べて低いです。

機会 - 年間収益は今後3年間で増加すると予測されています。

脅威 - 年間収益の伸びは中国市場よりも遅いと予測されています。

次に進む:

会社の評価は重要ですが、会社を調査するときに見る指標はそれだけであってはなりません。DCFモデルは投資評価のすべてではありません。できれば、さまざまなケースや仮定を適用して、それらが会社の評価にどのように影響するかを確認するでしょう。会社の成長率が異なる場合や、自己資本コストやリスクフリーレートが急激に変化した場合、アウトプットは大きく異なる可能性があります。瀋南サーキットでは、評価すべき3つの関連要素をまとめました。

- リスク: どの企業にもあり、私たちが発見したことがあります 瀋南サーキットの2つの警告標識 知っておいた方がいいよ

- 将来の収益: 002916の成長率は、同業他社や市場全体と比べてどうですか?無料のアナリストの成長期待チャートを見て、今後数年間のアナリストのコンセンサス数値をより深く掘り下げてください。

- その他の高品質代替品: 優れたオールラウンダーは好きですか?高品質の株式のインタラクティブなリストを調べて、他に見逃している可能性のあるものを見つけてください!

PS。Simply Wall Stアプリは、SZSEのすべての株式の割引キャッシュフロー評価を毎日実施しています。他の株の計算方法を知りたい場合は、こちらを検索してください。

この記事に関するフィードバックはありますか?内容が気になりますか? 連絡を取る 私たちと直接一緒に。 または、編集チーム (at) simplywallst.com にメールしてください。

Simply Wall Stによるこの記事は、本質的に一般的なものです。 過去のデータやアナリストの予測に基づく解説は、偏りのない方法論のみを使用しており、記事は財務上のアドバイスを目的としたものではありません。 これは株式の売買を推奨するものではなく、お客様の目的や財務状況を考慮したものでもありません。私たちは、ファンダメンタルデータに基づいた長期的に焦点を絞った分析を提供することを目指しています。当社の分析では、価格に敏感な最新の企業発表や定性的な資料を考慮していない場合があることに注意してください。簡単に言えば、ウォールストリートは言及されたどの株式にもポジションを持っていません。

私たちは2段階の成長モデルを使っています。つまり、会社の成長の2段階を考慮に入れるということです。初期の段階では会社の成長率が高くなる可能性があり、第2段階では通常、安定した成長率が見込まれます。まず、今後10年間のキャッシュフローを見積もる必要があります。可能な場合はアナリストの見積もりを使用しますが、入手できない場合は、前回の推定値または報告値から前回のフリーキャッシュフロー(FCF)を推定します。フリー・キャッシュ・フローが縮小する企業は縮小速度を遅らせ、フリー・キャッシュフローが増加している企業はこの期間に成長率が鈍化すると想定しています。これは、成長が後年よりも初期の方が鈍化する傾向があることを反映しています。

私たちは2段階の成長モデルを使っています。つまり、会社の成長の2段階を考慮に入れるということです。初期の段階では会社の成長率が高くなる可能性があり、第2段階では通常、安定した成長率が見込まれます。まず、今後10年間のキャッシュフローを見積もる必要があります。可能な場合はアナリストの見積もりを使用しますが、入手できない場合は、前回の推定値または報告値から前回のフリーキャッシュフロー(FCF)を推定します。フリー・キャッシュ・フローが縮小する企業は縮小速度を遅らせ、フリー・キャッシュフローが増加している企業はこの期間に成長率が鈍化すると想定しています。これは、成長が後年よりも初期の方が鈍化する傾向があることを反映しています。  SZSE: 002916 割引後のキャッシュフロー 2022年12月15日

SZSE: 002916 割引後のキャッシュフロー 2022年12月15日

We're using the 2-stage growth model, which simply means we take in account two stages of company's growth. In the initial period the company may have a higher growth rate and the second stage is usually assumed to have a stable growth rate. To begin with, we have to get estimates of the next ten years of cash flows. Where possible we use analyst estimates, but when these aren't available we extrapolate the previous free cash flow (FCF) from the last estimate or reported value. We assume companies with shrinking free cash flow will slow their rate of shrinkage, and that companies with growing free cash flow will see their growth rate slow, over this period. We do this to reflect that growth tends to slow more in the early years than it does in later years.

We're using the 2-stage growth model, which simply means we take in account two stages of company's growth. In the initial period the company may have a higher growth rate and the second stage is usually assumed to have a stable growth rate. To begin with, we have to get estimates of the next ten years of cash flows. Where possible we use analyst estimates, but when these aren't available we extrapolate the previous free cash flow (FCF) from the last estimate or reported value. We assume companies with shrinking free cash flow will slow their rate of shrinkage, and that companies with growing free cash flow will see their growth rate slow, over this period. We do this to reflect that growth tends to slow more in the early years than it does in later years.