The Qian Hu Corporation Limited (SGX:BCV) share price has done very well over the last month, posting an excellent gain of 26%. Notwithstanding the latest gain, the annual share price return of 2.2% isn't as impressive.

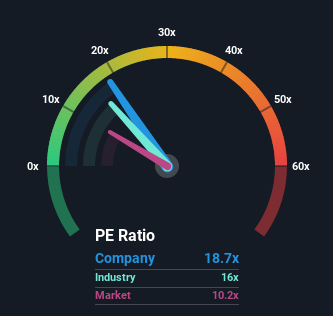

After such a large jump in price, Qian Hu may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 18.7x, since almost half of all companies in Singapore have P/E ratios under 10x and even P/E's lower than 6x are not unusual. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly elevated P/E.

For instance, Qian Hu's receding earnings in recent times would have to be some food for thought. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

View our latest analysis for Qian Hu

View our latest analysis for Qian Hu

Is There Enough Growth For Qian Hu?

In order to justify its P/E ratio, Qian Hu would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 19%. Even so, admirably EPS has lifted 52% in aggregate from three years ago, notwithstanding the last 12 months. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

In contrast to the company, the rest of the market is expected to decline by 2.9% over the next year, which puts the company's recent medium-term positive growth rates in a good light for now.

In light of this, it's understandable that Qian Hu's P/E sits above the majority of other companies. Investors are willing to pay more for a stock they hope will buck the trend of the broader market going backwards. However, its current earnings trajectory will be very difficult to maintain against the headwinds other companies are facing at the moment.

The Bottom Line On Qian Hu's P/E

Qian Hu's P/E is flying high just like its stock has during the last month. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that Qian Hu maintains its high P/E on the strength of its recentthree-year growth beating forecasts for a struggling market, as expected. At this stage investors feel the potential for a deterioration in earnings isn't great enough to justify a lower P/E ratio. Our only concern is whether its earnings trajectory can keep outperforming under these tough market conditions. Otherwise, it's hard to see the share price falling strongly in the near future if its earnings performance persists.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Qian Hu that you should be aware of.

If P/E ratios interest you, you may wish to see this free collection of other companies that have grown earnings strongly and trade on P/E's below 20x.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.