ThredUp Inc. (NASDAQ:TDUP) shares have continued their recent momentum with a 31% gain in the last month alone. Still, the 30-day jump doesn't change the fact that longer term shareholders have seen their stock decimated by the 61% share price drop in the last twelve months.

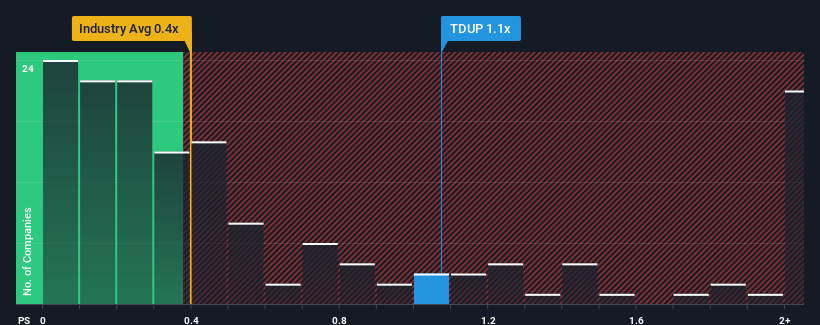

Since its price has surged higher, given close to half the companies operating in the United States' Specialty Retail industry have price-to-sales ratios (or "P/S") below 0.4x, you may consider ThredUp as a stock to potentially avoid with its 1.1x P/S ratio. However, the P/S might be high for a reason and it requires further investigation to determine if it's justified.

View our latest analysis for ThredUp

How Has ThredUp Performed Recently?

With revenue growth that's superior to most other companies of late, ThredUp has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying to much for the stock.

With revenue growth that's superior to most other companies of late, ThredUp has been doing relatively well. The P/S is probably high because investors think this strong revenue performance will continue. However, if this isn't the case, investors might get caught out paying to much for the stock.

What Are Revenue Growth Metrics Telling Us About The High P/S?

There's an inherent assumption that a company should outperform the industry for P/S ratios like ThredUp's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 15% last year. This was backed up an excellent period prior to see revenue up by 76% in total over the last three years. So we can start by confirming that the company has done a great job of growing revenues over that time.

Looking ahead now, revenue is anticipated to climb by 15% each year during the coming three years according to the eleven analysts following the company. With the industry only predicted to deliver 6.9% per annum, the company is positioned for a stronger revenue result.

With this in mind, it's not hard to understand why ThredUp's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

The Bottom Line On ThredUp's P/S

The large bounce in ThredUp's shares has lifted the company's P/S handsomely. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of ThredUp's analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless these conditions change, they will continue to provide strong support to the share price.

You need to take note of risks, for example - ThredUp has 3 warning signs (and 1 which makes us a bit uncomfortable) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.