Shanghai Jinfeng Wine Company Limited (SHSE:600616) just released a solid earnings report, and the stock displayed some strength. However, we think that shareholders should be cautious as we found some worrying factors underlying the profit.

See our latest analysis for Shanghai Jinfeng Wine

The Impact Of Unusual Items On Profit

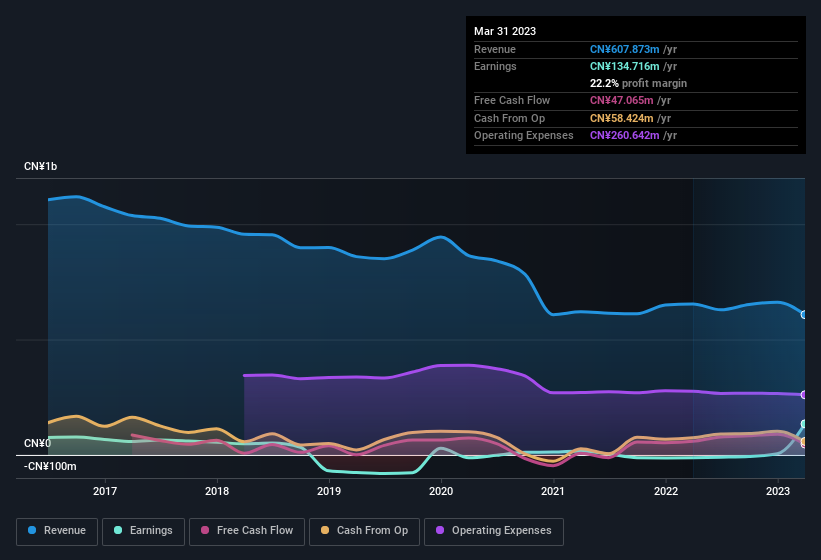

Importantly, our data indicates that Shanghai Jinfeng Wine's profit received a boost of CN¥197m in unusual items, over the last year. We can't deny that higher profits generally leave us optimistic, but we'd prefer it if the profit were to be sustainable. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. And that's as you'd expect, given these boosts are described as 'unusual'. Shanghai Jinfeng Wine had a rather significant contribution from unusual items relative to its profit to March 2023. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Shanghai Jinfeng Wine.

Our Take On Shanghai Jinfeng Wine's Profit Performance

As we discussed above, we think the significant positive unusual item makes Shanghai Jinfeng Wine's earnings a poor guide to its underlying profitability. For this reason, we think that Shanghai Jinfeng Wine's statutory profits may be a bad guide to its underlying earnings power, and might give investors an overly positive impression of the company. On the bright side, the company showed enough improvement to book a profit this year, after losing money last year. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. If you want to do dive deeper into Shanghai Jinfeng Wine, you'd also look into what risks it is currently facing. Case in point: We've spotted 1 warning sign for Shanghai Jinfeng Wine you should be aware of.

Today we've zoomed in on a single data point to better understand the nature of Shanghai Jinfeng Wine's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.