Summary

Japanese equities have been the star performer since September - rising more dramatically than their global peers in a response to a perceived thaw in U.S.-China trade tensions.Trade disputes and geopolitical frictions have become key drivers of the global economy and markets.Japan also is faced with a number of domestic challenges. Japanese equities have been the star performer since September - rising more dramatically than their global peers in a response to a perceived thaw in U.S.-China trade tensions. Yet we maintain our underweight on Japanese equities: They are particularly vulnerable to a growth slowdown in China, and we see no sustained letup in the protectionist push. Yet the recent rally offers a preview of the potential upside in Japanese equities if trade tensions were to fade substantively and growth to reaccelerate.

Japanese equities have been the star performer since September - rising more dramatically than their global peers in a response to a perceived thaw in U.S.-China trade tensions. Yet we maintain our underweight on Japanese equities: They are particularly vulnerable to a growth slowdown in China, and we see no sustained letup in the protectionist push. Yet the recent rally offers a preview of the potential upside in Japanese equities if trade tensions were to fade substantively and growth to reaccelerate.

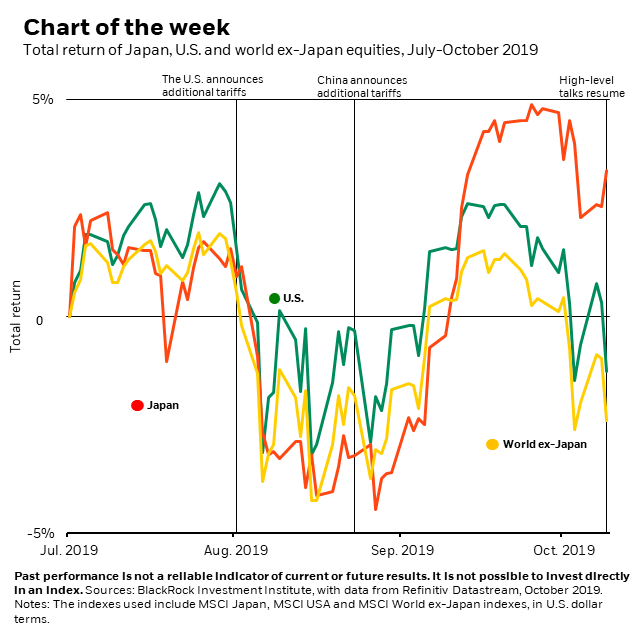

Japan has been the best performer in major equity markets since midyear. The MSCI Japan index has led both U.S. and global markets (ex-Japan) after a significant climb in September, as the chart shows. The main driver? A perceived easing in U.S.-China trade tensions that led to a shift by investors into unloved assets such as value equities, including beaten-down Japanese stocks. We do not see this rotation having staying power though. In the near term we see potential for further bouts of market volatility, as fallout from the trade war is reflected in weak economic data. See an earlier weekly commentary for details. Yet the recent rebound in Japanese equities offers a preview of the potential market reaction should the global economy reaccelerate in 2020. Japanese equities' cheapness could exaggerate any such move. The price-to-earnings ratio of the blue-chip Nikkei 225 Index has fallen to a historical low of 12.

Trade disputes and geopolitical frictions have become key drivers of the global economy and markets, as we outlined in the recent update to our Global investment outlook. Trade dynamics play an outsized role in Japanese equities: As much as half of the revenues of Nikkei 225 companies come from international sales, even though exports' contribution to Japan's GDP is at a much lower 15%. China is the largest market for Japan's exported goods, and orders from China for machines and electronics parts have collapsed since November 2018. We see a lull in China's growth due to the fallout of U.S. tariffs. China's policy stance is likely to ease further to help stabilize growth, yet an incremental boost to growth seems unlikely, in our view. Japan's leverage to global trade leaves it vulnerable to any further downdrafts tied to the protectionist push.

Japan also is faced with a number of domestic challenges. A recent sales tax increase could weigh on consumer spending and growth. The Bank of Japan (BoJ) may be running out of policy space. After years of ultra-loose monetary policy, the central bank's asset holdings have exceeded the country's total GDP - making the BoJ the biggest asset owner among key developed market central banks. We see room for only a modest rate cut by the BoJ at its policy meeting in late October. A potential wildcard: BoJ Governor Haruhiko Kuroda has spoken of the potential for greater coordination between monetary and fiscal policy, echoing the theme of our recent piece Dealing with the next downturn. Any growth slowdown induced by the hike in Japan's sales tax could be met with a fiscal stimulus in early 2020.

Bottom Line

We remain underweight Japanese equities for now. We still expect weakness in global growth data over the next few months, as easier monetary conditions slowly filter through to benefit the broader economy in the next six to 12 months. But if a prolonged trade truce between the U.S. and China were to take place and global manufacturing activities bottomed out, we would need to reassess our view on Japanese equities. Their close correlation with the health of global manufacturing activities and China's growth, as well as their beaten-down valuations, could make them attractive. Another positive in the background: Japanese firms are gradually improving their corporate governance, reflected in increased payouts to investors in the form of dividends and share buybacks.

This post originally appeared on the BlackRock Blog.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.