Summary

New home sale prices have resumed falling, and we have to go back to early January 2017 to find similarly low prices.

At a preliminary estimate of 4.93 times median household income for September 2019, the falling median new home sale price in the United States is now the lowest it has been since April 2013.

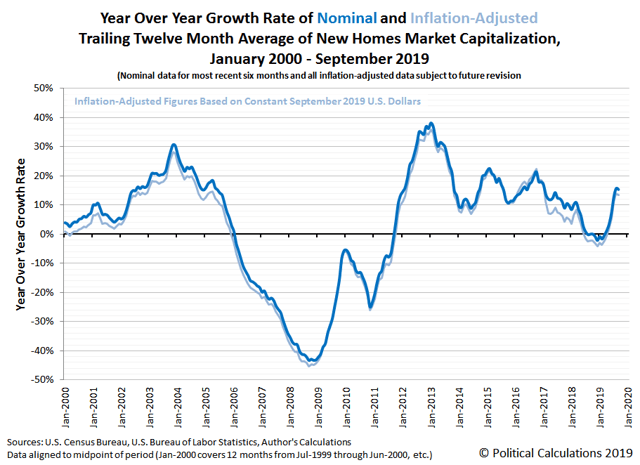

For new homebuilders, the falling trend for sale prices is coming as new home sales are slowing, which we can see in the slowing rise of the industry's market capitalization.

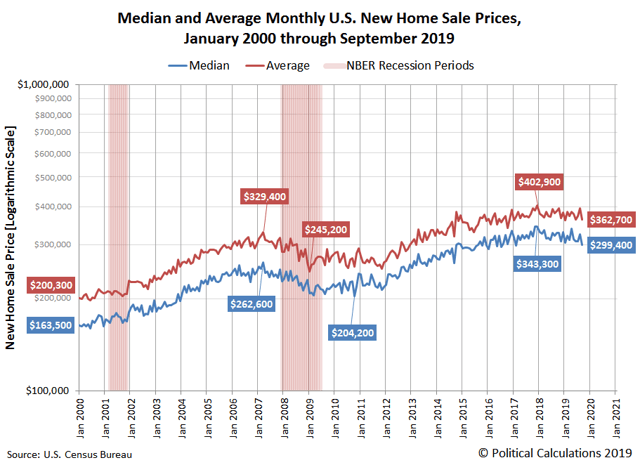

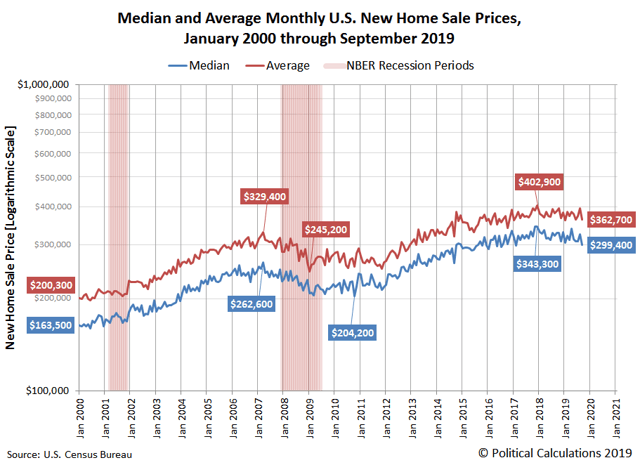

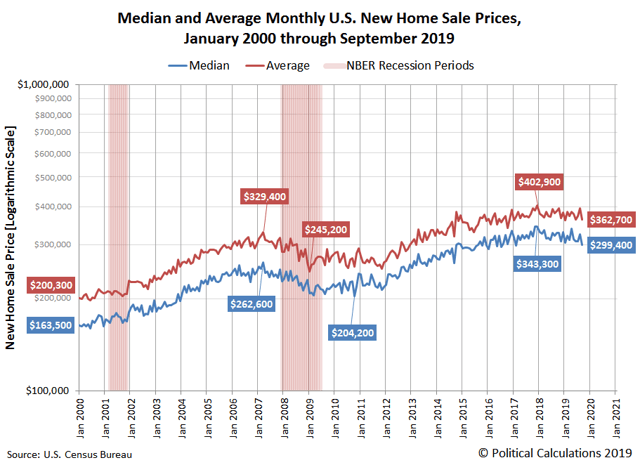

After having held relatively steady in recent months, new home sale prices have resumed falling. The chart below shows the raw median and average new home sale prices reported by the U.S. Census Bureau since January 2000, where we have to go back to early January 2017 to find similarly low prices.

After having held relatively steady in recent months, new home sale prices have resumed falling. The chart below shows the raw median and average new home sale prices reported by the U.S. Census Bureau since January 2000, where we have to go back to early January 2017 to find similarly low prices.

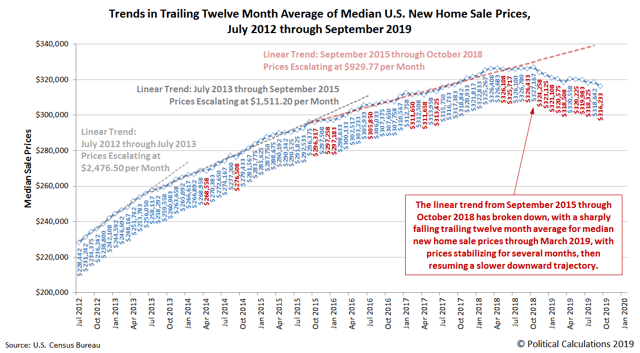

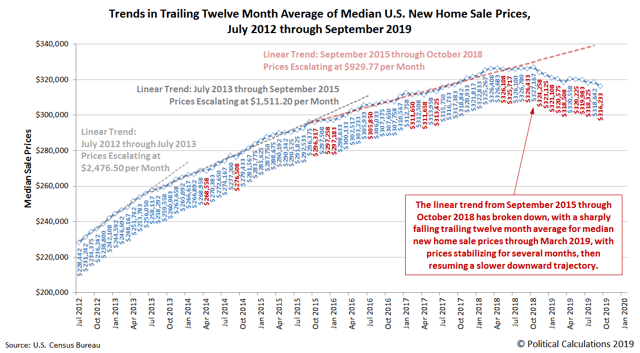

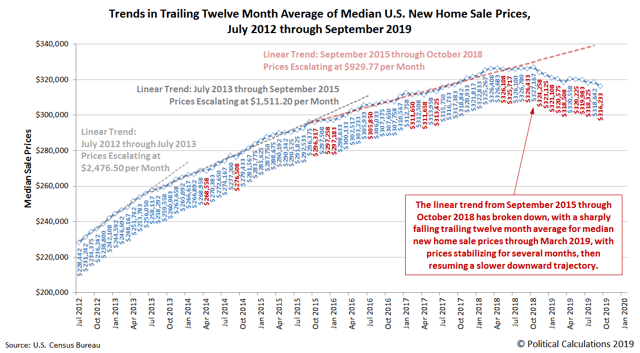

After smoothing out the month-to-month volatility in the data for median new home sale prices by calculating its rolling twelve-month average, we can confirm the resumption of the falling trend that originally began in October 2018 in the following chart that focuses on the period since July 2012.

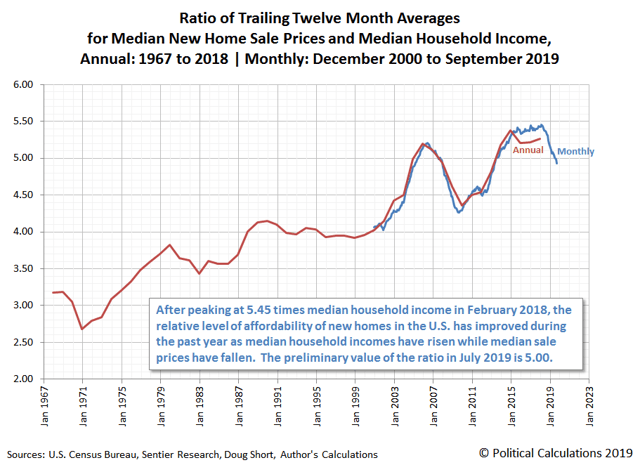

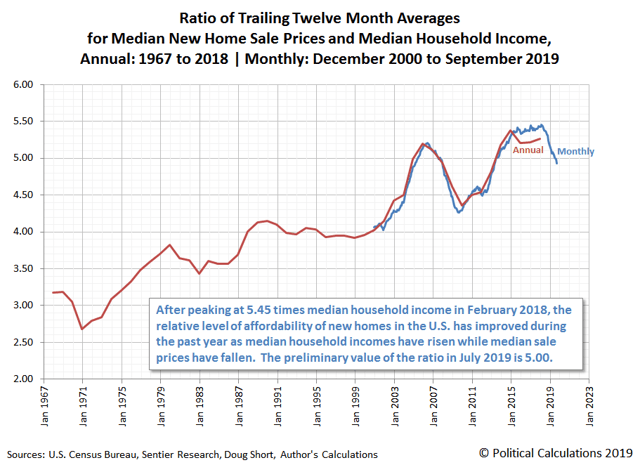

In terms of affordability, at a preliminary estimate of 4.93 times median household income for September 2019, the falling median new home sale price in the United States is now the lowest it has been since April 2013. The following chart shows the ratio of the trailing twelve-month averages of median new home sale prices and median household income from 1967 to the present.

![saupload_ratio-of-ttma-median-new-home-sale-prices-and-median-household-income-annual-1967-2017-monthly-200012-201909_thumb1.png]()

This median affordability ratio has generally only been higher during periods of time when the real estate market experienced bubble conditions or, more accurately, supply shortage conditions.

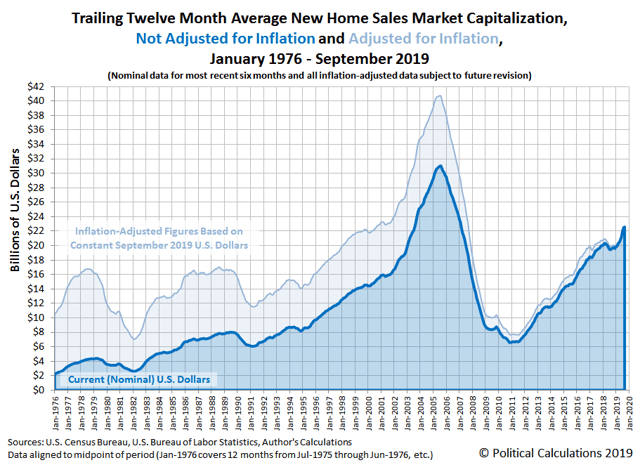

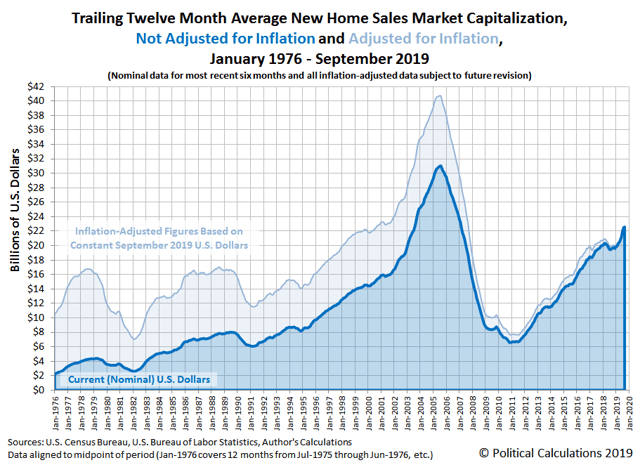

For new homebuilders, the falling trend for sale prices is coming as new home sales are slowing, which we can see in the slowing rise of the industry's market capitalization, the aggregate value of all new home sales across the United States.

![saupload_ttma-new-home-sales-market-capitalization-nominal-inflation-adjusted-197601-201909_thumb1.png]()

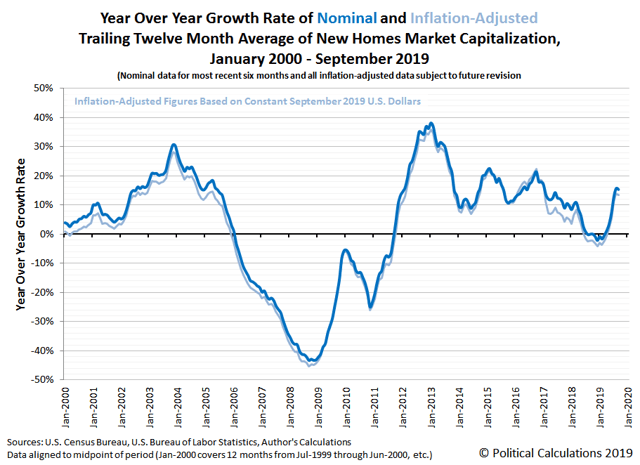

While preliminary data indicates the U.S. new home market cap is still rising, September 2019 saw the first deceleration in that growth in the months since falling mortgage rates sparked a rebound in the national new home market following its recent recessionary trough, which ran from mid-2018 to early 2019. September 2019's sudden deceleration is easier to see in the following chart showing the year-over-year rate of growth of the U.S. new homes market cap.

![saupload_yoy-growth-rate-nominal-inflation-adjusted--ttma-new-homes-market-capitalization-200001-201909_thumb1.png]()

Unfortunately, the U.S. Census Bureau's new home sales data doesn't allow for the kind of state- or local-level analysis we can do with existing homes data, but their available regional data points to the West region as having seen significantly falling sales in September 2019. When the state-level existing homes sales data for September 2019 becomes available next month, we'll take a closer look at the West region, where we assume that whatever is happening with the trends for new homes in those states will be paralleled in the much more detailed existing homes sales data.

Original Post

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Summary

New home sale prices have resumed falling, and we have to go back to early January 2017 to find similarly low prices.

新房銷售價格已經恢復下跌,我們必須回到2017年1月初才能找到類似的低價。

At a preliminary estimate of 4.93 times median household income for September 2019, the falling median new home sale price in the United States is now the lowest it has been since April 2013.

初步預估為2019年9月家庭收入中位數的4.93倍,美國不斷下降的新屋銷售價格中位數目前為2013年4月以來最低。

For new homebuilders, the falling trend for sale prices is coming as new home sales are slowing, which we can see in the slowing rise of the industry's market capitalization.

對於新屋建築商來説,隨着新房銷售放緩,銷售價格下跌的趨勢正在到來,我們可以從該行業市值上升放緩中看出這一點。

After having held relatively steady in recent months, new home sale prices have resumed falling. The chart below shows the raw median and average new home sale prices reported by the U.S. Census Bureau since January 2000, where we have to go back to early January 2017 to find similarly low prices.

在近幾個月保持相對穩定之後,新房銷售價格重新開始下跌。下圖顯示了新屋銷售的原始中值和平均價格。已報告自2000年1月以來,美國人口普查局一直在尋找類似的低價,我們必須回到2017年1月初才能找到類似的低價。

After smoothing out the month-to-month volatility in the data for median new home sale prices by calculating its rolling twelve-month average, we can confirm the resumption of the falling trend that originally began in October 2018 in the following chart that focuses on the period since July 2012.

在通過計算新房銷售價格中值數據的12個月滾動平均值來平滑數據的環比波動後,我們可以在以下圖表中確認最初始於2018年10月的下跌趨勢的恢復,該圖表關注的是自2012年7月以來的一段時間。

In terms of affordability, at a preliminary estimate of 4.93 times median household income for September 2019, the falling median new home sale price in the United States is now the lowest it has been since April 2013. The following chart shows the ratio of the trailing twelve-month averages of median new home sale prices and median household income from 1967 to the present.

在可負擔性方面,初步估計2019年9月家庭收入中位數的4.93倍,美國不斷下降的新屋銷售價格中位數現在是2013年4月以來的最低水平。下圖顯示了1967年至今新房銷售價格中值和家庭收入中值的過去12個月均值的比率。

This median affordability ratio has generally only been higher during periods of time when the real estate market experienced bubble conditions or, more accurately, supply shortage conditions.

這一可負擔率的中位數通常只在房地產市場經歷泡沫狀態,或者更準確地説,供應短缺的情況下才會更高。

For new homebuilders, the falling trend for sale prices is coming as new home sales are slowing, which we can see in the slowing rise of the industry's market capitalization, the aggregate value of all new home sales across the United States.

對於新屋建築商來説,隨着新房銷售放緩,銷售價格下降的趨勢正在到來,我們可以從該行業市值(全美所有新房銷售的總價值)上升放緩中看出這一點。

While preliminary data indicates the U.S. new home market cap is still rising, September 2019 saw the first deceleration in that growth in the months since falling mortgage rates sparked a rebound in the national new home market following its recent recessionary trough, which ran from mid-2018 to early 2019. September 2019's sudden deceleration is easier to see in the following chart showing the year-over-year rate of growth of the U.S. new homes market cap.

雖然初步數據顯示,美國新房市場上限仍在上升,但2019年9月出現了自抵押貸款利率下降引發全國新房市場反彈以來幾個月來的首次減速。最近的衰退低谷從2018年年中持續到2019年初。2019年9月的突然減速在下面的圖表中更容易看到,該圖表顯示了美國新房市場市值的同比增長率。

Unfortunately, the U.S. Census Bureau's new home sales data doesn't allow for the kind of state- or local-level analysis we can do with existing homes data, but their available regional data points to the West region as having seen significantly falling sales in September 2019. When the state-level existing homes sales data for September 2019 becomes available next month, we'll take a closer look at the West region, where we assume that whatever is happening with the trends for new homes in those states will be paralleled in the much more detailed existing homes sales data.

不幸的是,美國人口普查局的新房屋銷售數據沒有考慮到這種州或地方級分析我們可以利用現房數據,但他們的可獲得的區域數據指出西部地區在2019年9月的銷售額大幅下降。當2019年9月的州級現房銷售數據在下個月公佈時,我們將更仔細地關注西部地區,我們假設,無論這些州的新房趨勢發生什麼,都會出現在更詳細的現房銷售數據中。

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.

編者注:本文的摘要項目符號是由尋找Alpha編輯選擇的。

After having held relatively steady in recent months, new home sale prices have resumed falling. The chart below shows the raw median and average new home sale prices

After having held relatively steady in recent months, new home sale prices have resumed falling. The chart below shows the raw median and average new home sale prices