Summary

Macroeconomic data in Europe has been weak since the start of 2018.Brexit has been a considerable drag on small-cap performance.European small-cap stocks are attractively valued compared to large caps.Green Shoots Appearing in European Economic Data

Macroeconomic data in Europe has been weak since the start of 2018. Global macro headwinds linked to the U.S. - trade wars with China, coupled with domestic structural issues such as tightening of emission regulations - are to blame.

Macroeconomic data in Europe has been weak since the start of 2018. Global macro headwinds linked to the U.S. - trade wars with China, coupled with domestic structural issues such as tightening of emission regulations - are to blame.

Sentiment toward European equities is a weak point, shown by the record outflows of $8.1 billion from European-linked exchange-traded funds in the first 10 months of 2019.1

We believe investors' loss of confidence is probably overdone.

Notably, European economic data is starting to stage a turnaround.

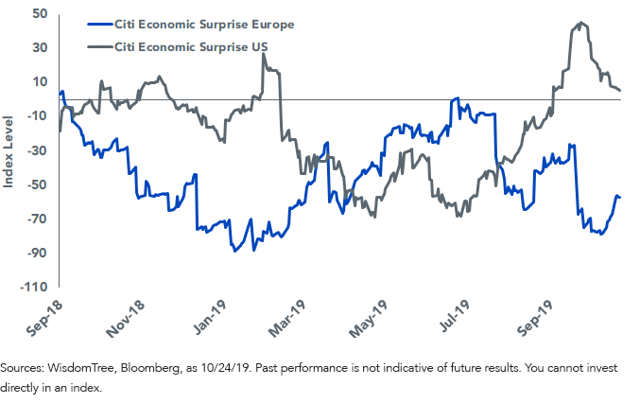

Figure 1: European Economic Data Starts to Improve

For definitions of Indexes referenced in the chart, please visit our glossary.

Early Lead of Small-Caps'; Price Performance Could Signal Further Upside in Macroeconomic Data

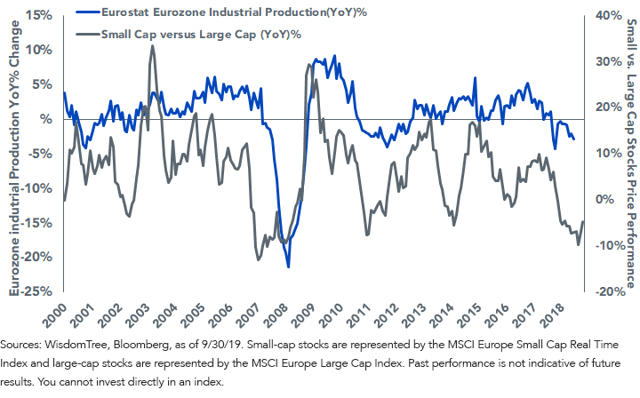

European small-cap stocks have historically tracked the annual change in eurozone industrial production since 2000.

The chart below illustrates the annual change of industrial production in the eurozone with a three-month lag plotted against the performance of small- versus large-cap European stocks.

Figure 2: Small vs. Large Cap Stock Performance Compared to EU Industrial Production (3-month lag)

The industrial sector constitutes the highest sector weight across European small caps (22%) in comparison to large caps (11%). The improvement in price performance of small- versus large caps European stocks has historically signaled a rebound in eurozone industrial production.

Brexit and German Fiscal Boost - The Next Catalysts for European Small Caps

- Improvement in Organization for Economic Co-operation and Development (OECD) lead indicators

- Additional fiscal easing from Germany

- Easing of Brexit-related uncertainty as the odds of a no-deal exit reduces.

Brexit has been a considerable drag on small-cap performance. The U.K. is the largest and oldest small-cap market in Europe, representing 33% of the small-cap universe in Europe. As we receive more clarity on the path U.K. might follow in its departure from the EU, this removes one major challenge to investor sentiment.

The next largest small-cap region is in Germany, at 11% of the European small-cap market share. Europe's largest economy has been hit hardest by trade, the Chinese slowdown, and the ongoing U.S.-China trade wars. Germany has a continent-wide supply chain that accounts for 29% of eurozone GDP. Its government recently announced a €54 billion ($59 billion) climate spending package aimed at reaching the 2030 emissions reduction target on September 20, 2019. This is expected to be financed from existing surpluses in the energy and climate fund, implying a minor net fiscal net boost of less than 1.6% of GDP.

We believe this is far from sufficient to fight the German economy's downturn. We expect the recent run of weak German economic data releases to eventually persuade the country to unleash a more meaningful round of fiscal stimulus.

Small-Cap Stocks Are Not a Value Trap

Further, European small-cap stocks are attractively valued compared to large caps. The price-to-earnings ratio (P/E) of small- versus large-cap European stocks is trading at a 7% discount compared to its average since 2007. The estimated dividend yields for the MSCI Europe Small Cap Real Time Index at 2.97% is in line with the average since 2007.

With the cautious outlook on Europe, investors have crowded into defensive sectors, which constitute a larger proportion of large caps compared to small caps.2

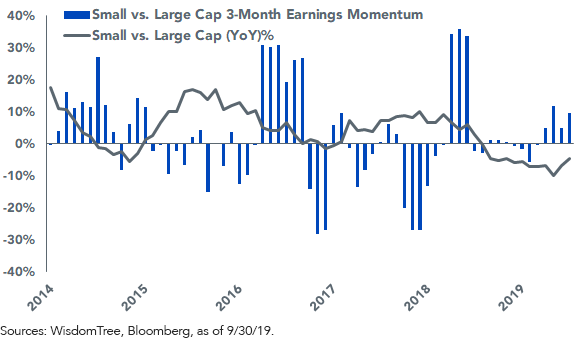

Interestingly, the relative earnings momentum of small- versus large-cap European stocks has started to improve over the second half of 2019, and this is clearly being reflected in the outperformance of small- versus large-cap European stocks, which we believe is still at a nascent stage.

Figure 3: Small-Cap vs. Large-Cap European Price Performance vs. Earnings Momentum 3-Month % Change

European small-cap stocks are known to be more inefficient than large caps, which offer a greater possibility of alpha generation.

While sentiment remains weak across Europe, favorable valuations, positive earnings momentum, coupled with a slowly improving macro backdrop, provide a timely opportunity to invest in European small caps.

1Sources: WisdomTree, Bloomberg

2Small cap stocks are represented the MSCI Europe Small Cap Real Time Index and large-cap stocks are represented by the MSCI Europe Large Cap Index.

Jeremy Schwartz, CFA, Executive Vice President, Global Head of Research

Jeremy Schwartz has served as our Executive Vice President, Global Head of Research since November 2018 and leads WisdomTree's investment strategy team in the construction of WisdomTree's equity indexes, quantitative active strategies and multi-asset model portfolios. Mr. Schwartz joined WisdomTree in May 2005 as a Senior Analyst, adding to his responsibilities in February 2007 as Deputy Director of Research and thereafter, from October 2008 to October 2018, as Director of Research. Prior to joining WisdomTree, he was head research assistant for Professor Jeremy Siegel and helped with the research and writing of Stocks for the Long Run and The Future for Investors. Mr. Schwartz also is co-author of the Financial Analysts Journal paper, What Happened to the Original Stocks in the S&P 500? He received his B.S. in Economics from The Wharton School of the University of Pennsylvania and hosts the Wharton Business Radio program Behind the Markets on SiriusXM 132. Mr. Schwartz is also a member of the CFA Society of Philadelphia.

Editor's Note: The summary bullets for this article were chosen by Seeking Alpha editors.