I. Market Overview

Last week (July 3rd - July 7th), the three major indices fluctuated and closed lower. The Shanghai index initially rose but then fell, slipping below 3200 points. The Chinext price index led the decline with a drop of over 2%, while the Shenzhen Composite Index fell by 1.25%. Trading volume further shrank, with an average daily turnover of less than 900 billion yuan. Northbound capital recorded a cumulative net outflow of 9.16 billion yuan last week.

Overseas stock markets generally performed poorly last week. In the Hong Kong market, the Hang Seng Index dropped 2.91% over the week, while the Hang Seng Tech Index showed resilience, falling only 0.26%; In the U.S. market, the S&P 500 Index declined by 1.16% over the week, and the Nasdaq fell by 0.92%.

In terms of global sectors,the industries with significant gains last week included: comprehensive finance (+3.78%), coal (+3.41%), and autos (+3.00%); industries with major declines included: media (-4.73%), computers (-2.90%), and power equipment and new energy (-2.41%).

In terms of global sectors,the industries with significant gains last week included: comprehensive finance (+3.78%), coal (+3.41%), and autos (+3.00%); industries with major declines included: media (-4.73%), computers (-2.90%), and power equipment and new energy (-2.41%).

In terms of gainianbankuai,gallium germanium, air transportation, complete automobiles, and shipping performed well, while online games, Chinese corpus, traditional Chinese medicine, medical insurance payment reform, and asia vets performed poorly.

In terms of fund performance,Funds heavily invested in sectors such as tourism, coal, autos, and transportation performed well, while thematic funds represented by online games, photovoltaics, traditional chinese medicine, and cloud computing performed poorly.

II. Capital Trends

Last week, the allocation of funds in broad indices began to show divergence, with net inflows leading in ETFs tracking the sse science and technology innovation board 50 index, csi 1000 index, csi 300 index, and chinext price index, along with the hwabao wp csi medical service etf. In contrast, the largest net outflows were seen in ETFs tracking the csi 1000 index and those tracking the csi 500 index, sse 50, and military industry indices.

Among them, five index ETFs experienced a total net outflow of approximately 0.6 billion yuan last week, with the chinaamc star50 etf seeing a net inflow of 2.8 billion yuan, while the 500etf and chinaamc shanghai a50 exchange traded fund respectively had net outflows of 2.6 billion yuan and 2.5 billion yuan.

In terms of industry thematic ETFs, the hwabao wp csi medical service etf, csi health care etf, and penghua csi alcoholic drink etf saw net inflows of 1 billion yuan, 0.476 billion yuan, and 7.61 billion yuan respectively.

On the side of fund reductions, e fund csi technology 50 etf, central enterprise technology etf, and jungongetf experienced net outflows of 0.6 billion yuan, 0.556 billion yuan, and 5.23 billion yuan respectively.

III. ETF Performance Changes

In the ETF sector, among the 806 ETFs in the city last week, 226 ETFs recorded positive gains while 541 ETFs recorded negative gains over the week.

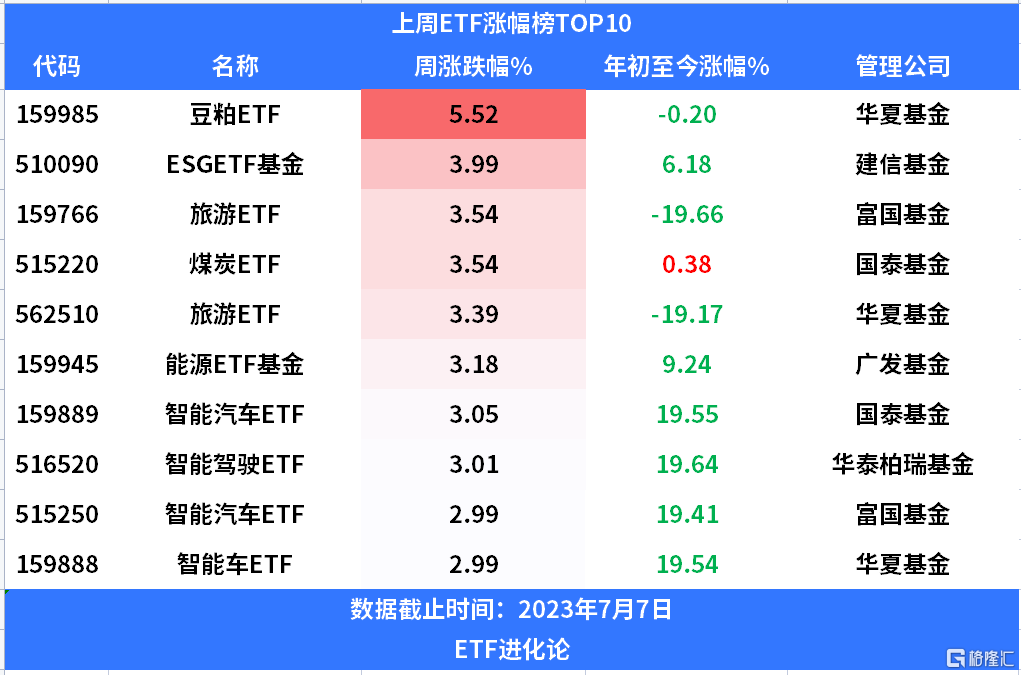

Last week, the net asset value increase for ETFs tracking soybean meal futures, tourism, and coal energy indices ranked high. The ETFs themed around intelligent driving also performed well.

Last week, AI applications across the board retreated, with the gaming ETF and media ETF seeing the largest declines, as three gaming-themed ETFs all experienced weekly drops exceeding 9%. The photovoltaic ETF also performed poorly, with a cumulative drop of over 5% last week. The traditional Chinese medicine ETF experienced a significant retreat, with a cumulative drop of 4% last week.

IV. Changes in Fund Shares

Last week, five major index ETFs saw a mixed change in shares, with the chinaamc star50 etf, yifangda gem etf, and 300etf increasing by 2.651 billion shares, 0.557 billion shares, and 164 million shares respectively.

Conversely, the chinaamc shanghai a50 exchange traded fund and 500etf reduced their shares by 0.99 billion and 431 million shares respectively. The csi 1000 enhanced ETF, csi 1000 index ETF, and 1000 enhanced ETF collectively decreased by 1.847 billion shares.

The sse science and technology innovation board 50 index fell below 1,000 points last week, reaching a new low in more than three months. Capital flowed into the market through the etf to buy the dip, with the largest sse science and technology innovation board 50 index etf exceeding 66.6 billion shares, a new historical high.

In terms of sector theme etfs, 29 funds had their shares increase by over 0.1 billion last week, among which the hwabao wp csi medical service etf, csi health care etf, and penghua csi alcoholic drink etf saw increases of 2.38 billion shares, 1.119 billion shares, and 982 million shares respectively.

In terms of outflows, last week, 21 sector theme etfs saw their shares decrease by more than 0.1 billion, with technology leading the etf, central enterprise technology etf, and jungongetf showing decreases of 0.598 billion shares, 0.561 billion shares, and 462 million shares respectively.

V. New product launches

VI. Fund hot news

The CSRC announced measures to reduce fees for actively managed equity funds, with management and custody fees not exceeding 1.2% and 0.2%, respectively.

According to a July 8 announcement on the CSRC's official website, starting from today, the fee levels for actively managed equity funds will be lowered. The management and custody fees for newly registered products will not exceed 1.2% and 0.2%, respectively; some leading institutions have already announced that the management and custody fees for their existing products will be reduced to below 1.2% and 0.2%; the management and custody fees for other existing products will aim to be reduced to below 1.2% and 0.2% by the end of 2023.

The 'hidden rules' regarding fund stock trading commissions have come to an end.

Some funds' commission rates for buying and selling stocks are still around 0.08%, significantly higher than the 0.03% charged to retail investors. This 'hidden rule' has persisted for a long time and is a cancer that harms the interests of fund investors. With regulatory authorities stating that they will gradually standardize public fund securities trading commission rates by the end of the year, it means that this 'hidden rule' is also coming to an end.

The regulations on the supervision and administration of private investment funds have been officially released and will take effect from September 1.

The 'Regulations on the Supervision and Administration of Private Investment Funds' have been officially released and will take effect from September 1, 2023. The regulations consist of seven chapters and sixty-two articles, focusing on five main areas.

行业板块方面,上周涨幅靠前的行业有:综合金融(+3.78%)、煤炭(+3.41%)、汽车(+3.00%);跌幅较大的行业有:传媒(-4.73%)、计算机(-2.90%)、电力设备及新能源(-2.41%)。

行业板块方面,上周涨幅靠前的行业有:综合金融(+3.78%)、煤炭(+3.41%)、汽车(+3.00%);跌幅较大的行业有:传媒(-4.73%)、计算机(-2.90%)、电力设备及新能源(-2.41%)。