GLONGHUI July 13 丨The liquor sector fluctuated and picked up,Jinshiyuan, Shede Liquor, Luzhou Laojiao, Yingjiagong LiquorAn increase of more than 5%,Kouzijiao, Shanxi Fenjiu, Shuijingfang, Wuliangye, Alcoholic Liquor, Shunxin AgricultureMany other stocks rose more than 3%.

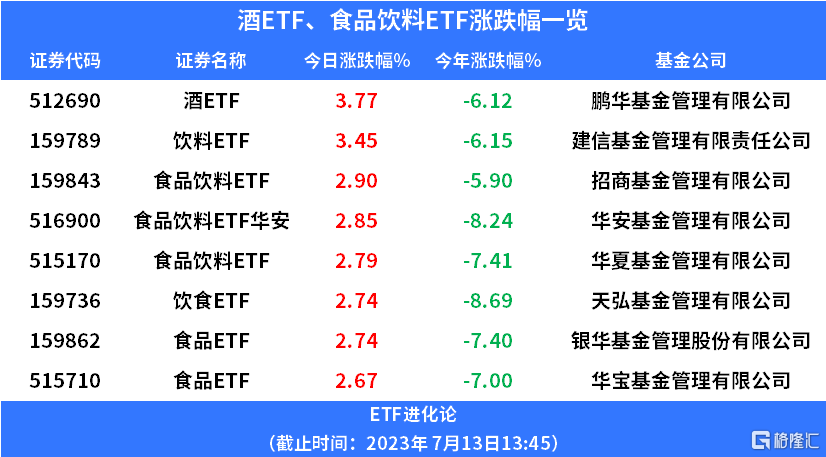

Penghua FundLiquor ETFs rose 3.77%,Jianxin Fundbeverage ETF,China Merchants FundFood and beverage ETFs,Food and beverage ETF Huaan,Huaxia FundFood and beverage ETFs,Tianhong Funddiet ETF,Yinhua Fundfood ETF,Huabao FundFood ETFs rose more than 2.5%.

On July 13, according to the national liquor price survey data released by the Luzhou Liquor Industry Development Promotion Bureau, in early July 2023, the overall national liquor price index was 100.03 month-on-month, up 0.03%. Looking at the classification index, the month-on-month price index for famous wine was 100.02, up 0.02%; the month-on-month price index for local wine was 100.08, up 0.08%; and the month-on-month price index for base wine was 100.00, which remained stable.

Looking at the fixed base price index, in early July 2023, the total fixed base index of wholesale prices of liquor products in the country was 110.99, up 10.99%. Among them, the base price index for famous wine was 114.86, up 14.86%; the local alcohol base price index was 105.98, up 5.98%; and the base alcohol base price index was 108.26, up 8.26%.

Guohai Securities believes that the recent pullback in the liquor sector is mainly due to macro-level concerns rather than liquor. Currently, liquor has room to rise in terms of fundamentals, performance, trends, and valuation. Currently, the industry is still in the off-season. Sales side fluctuations have little impact on wine companies' tasks throughout the year. Terminal research feedback is of little significance. Linear extrapolation can easily amplify fears. The actual objective growth rate performance is still excellent. It is expected that the May-June growth rate will continue the faster trend in January-April, falsifying market concerns.

Anxin Securities said that the main contradiction in the industry this year is “strong supply and weak structural demand.” Currently, this may be the most prominent time period of the year. Liquor companies' growth targets for this year are generally not low, especially when other industries have yet to improve significantly. The pressure on liquor companies was particularly pronounced in the first half of the year. Looking ahead to the third quarter and beyond, the conflict may gradually ease. The industry mainly indicates that pressure at the dealer level is gradually weakening, and sentiment may begin to reverse. Currently, the sector is at the bottom of expectations and valuations, and contradictions in industrial fundamentals will gradually be mitigated.

Dongxing Securities believes that there are two major factors affecting the core pricing of food and beverages: the recovery of macro demand (fundamentals) and international asset pricing (exchange rate) are still the two most important reasons affecting food and beverage asset pricing in the second half of the year. Demand recovery is the general direction, and demand will strengthen as consumption scenarios recover. At the same time, if the macroeconomic economy recovers in the second half of the year and the RMB exchange rate can rise steadily, the overall valuation environment for food and beverages in the second half of this year is friendly, so we are generally optimistic about investment opportunities in food and beverages in the second half of the year.

From a microscopic perspective, the food and beverage industry needs to look at two influencing factors: 1 dealer's inventory cycle. 2 Gross margin changes. The dealer inventory cycle will lengthen the recovery time of the industry, and changes in gross sales gap will reflect on the corporate profit side.

Based on these two influencing factors, in terms of the strategic outlook for the second half of the year, it is believed that the flexibility of the food and beverage optional industry sector will be greater than the required choice. In particular, the performance of sub-high-end liquor and other industries benefiting from increased economic activity will be more obvious. In the process of declining upstream costs, profit performance will be more prominent in industries where terminal prices are less affected by market demand. Industries such as beverages, prepared dishes, and high-end liquor are worth paying attention to.