A report letter said that the actual control of Zhongju Hi-Tech (600872.SH) changed the apprenticeship variables. Baoneng now apparently doesn't want to easily lose the assets of Zhongju Hi-Tech.

On July 12, Zhongshan Runtian Investment Co., Ltd. (“Zhongshan Runtian”), a shareholder of Zhongju Gaoxin Baoneng Group, published a 5,000 word long statement on Baoneng Group's official website stating that it had reported in real name to the Securities Regulatory Commission, the Guangdong Securities Regulatory Bureau, the Shanghai Stock Exchange and other party committees and governments, Zhongju Gaoxin's state-owned shareholder Zhongshan Torch Industry Joint Co., Ltd. (“Zhongshan Torch”), Zhongshan Torch Group Co., Ltd. (hereinafter referred to as “Zhongshan Torch Group”) and co-actors suspected of false lawsuits and manipulation of the securities market, leading listed companies and joint actors The vast majority of 70,000 investors suffered huge economic losses of about 50 billion yuan.

On the evening of the same day, Torch Group issued a “Solemn Statement on Zhongshan Runtian's Release of False Information” on the public platform, stating that the purpose of Zhongshan Runtian's statement and report includes maliciously damaging the reputation of others, disrupting the normal operating order of listed companies, and seriously harming the interests of listed companies and other shareholders of listed companies.

Currently, the shareholding ratio of Zhongshan Runtian of Baoneng has dropped to 9.58%, while the shareholding ratio of Zhongshan Torch and Co-Actors is 19.65%, further widening the gap. However, since Baoneng has four board seats and Zhongshan Torch has only two seats, the current controlling shareholder of Zhongju Hi-Tech is still Zhongshan Runtian, and the actual controller is Yao Zhenhua.

However, Yao Zhenhua's actual control will also not be guaranteed. This may be the main reason Baoneng publicly reported the disaster.

Earlier, Zhongju Hi-Tech announced that it will hold an extraordinary shareholders' meeting on July 24 to review a number of proposals to remove the four Baoneng directors, including Chairman He Hua. If the above bill is passed, the actual controller of Zhongju Hi-Tech will change.

ID: TradeWind01 (ID: TradeWind01) called Zhongju Hi-Tech several times to ask if it would affect the holding of the Extraordinary General Meeting of Shareholders, but it never got through.

On July 12, the stock price of Zhongju Hi-Tech closed down 3.5% and received a regulatory letter from the Shanghai Stock Exchange on the evening of the same day. The next day, Zhongju Hi-Tech fell another 2.29% to 35.06 yuan/share.

Turn over old old accounts

The core content of Baoneng's report focused on three land transfer disputes between Zhongshan Torch Industry Joint Co., Ltd. (hereinafter referred to as “Industrial Union”), an affiliate of the Torch Group, and Zhongju Hi-Tech.

From 1999 to 2001, Zhongju Hi-Tech and Industry jointly signed three “Land Use Rights Transfer Agreements”. At the time, Torch Group was also the largest shareholder of Zhongju Hi-Tech.

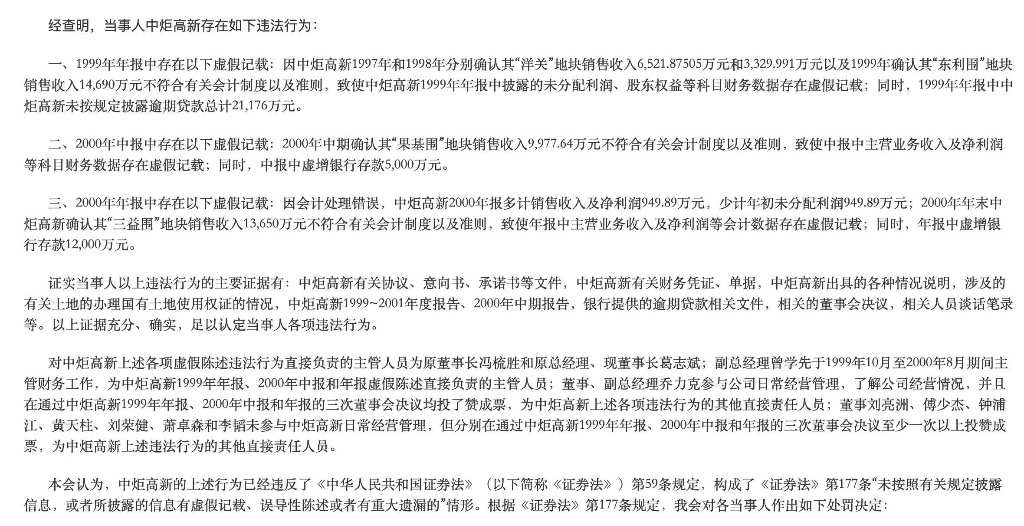

In Baoneng's report letter, Baoneng proposed that in 2001, during an audit, the National Audit Office discovered that Zhongju Hi-Tech had illegal facts such as “using land transfers, related party transactions, and related party asset transfers to fabricate fictitious sales revenue and conceal major related relationships.” On December 31, 2003, the Securities Regulatory Commission imposed penalties on this, finding that Zhongju Hi-Tech had illegal facts such as fictitious sales revenue.

Therefore, Baoneng believes that the three joint land transfers between Zhongju Hi-Tech and Zhongshan mentioned above were “false transactions,” and that the Industrial Union sued under “false contracts.”

On the evening of July 12, the state-owned Torch Group issued a response on its public account, refuting Baoneng's “false transaction” question. It believes that the land use rights sales contracts involved in all three cases are true, legal, and valid contracts. Zhongju Hi-Tech acknowledged the authenticity and legality of the contracts during the first instance trial.

Torch Group pointed out that section 8 of the “Certain Provisions of the Supreme People's Court on Evidence in Civil Litigation” stipulates that during the litigation process, if one party clearly acknowledges the facts of the case stated by the other party, the other party is not required to prove it. The two parties have a real civil legal relationship, which is not a false lawsuit.

ID: TradeWind01 (ID: TradeWind01) checked the official website of the Securities Regulatory Commission and found Baoneng's case where Zhongju Hi-Tech was punished by the Securities Regulatory Commission. The Securities Regulatory Commission only determined that Zhongju Hi-Tech's accounting data on undistributed profit, revenue, net profit, etc. in the 1999 report, 2000 interim report, and annual report contained false records, and did not deny the authenticity of the three land transfer contracts.

On July 14, Baoneng issued another announcement to raise an eight-point counter-question. Baoneng proposed that the Audit Office identified the contracts involved in the three litigation cases as “an untrue transaction carried out by Zhongju Hi-Tech in order to qualify for allotment of shares.” Baoneng asked why it had long been recognized as a “false and untrue transaction contract” became a “true, legal, and valid” contract in the words of the State-owned Torch Group.

At the same time, Baoneng believes that Wan Hequn, the current director of Zhongju Hi-Tech, is also the legal representative and executive director of the Industrial Union, suspected of “concealing major relationships” and “suing himself.”

However, in the 8-point counter question, Baoneng still avoided the question of the authenticity and legality of the Zhongju Hi-Tech approval contract mentioned by the Torch Group in its announcement, and Baoneng also did not provide strong evidence that could prove that the contract involved in the case was a false contract and was invalid.

Blocked by three plots of land

As early as September 2020, Industrial Internet initiated lawsuits over two of the three land transfers mentioned above. On the other side, Zhongju Hi-Tech, which is controlled by Baoneng, is divesting its real estate business.

In August 2021, Zhongju Hi-Tech announced that it would list and sell 89.24% of the shares in the real estate subsidiary Zhonghui Hechuang, but the bill was opposed by Yu Jianhua, director of Zhongshan Torch.

Lawsuits and protection have become a method for state-owned assets to fight against Baoneng's divestment of assets.

On September 13, Zhongju Hi-Tech announced that Zhongju Hi-Tech jointly filed a lawsuit with the Zhongshan Intermediate People's Court, demanding that Zhongju Hi-Tech deliver two plots of land use rights previously identified as sources of inflated income and apply for real estate title certificates to the Joint Industry Company in accordance with the two “Land Use Rights Transfer Contracts” and related supplementary contracts signed by the two parties.

As a result, a total of 26.53% of Zhonghui Hechuang's shares were seized by the Zhongshan Intermediate People's Court of Guangdong Province, which had an adverse effect on the transfer of Zhonghui Hechuang shares by Zhongju Hi-Tech.

In the end, after two years of trial, the court ruled that Zhongju Gaoxin lost the case in the first instance. In the 2022 report, Zhongju Hi-Tech also attributed losses during the reporting period to the impact of lawsuits, accruing estimated liabilities of 1,178 billion yuan.

Baoneng proposed that this is the first time that Zhongju Hi-Tech has lost money since its listing in 28 years. “Zhongju Hi-Tech and its shareholders' interests have all suffered significant losses.”

Furthermore, Baoneng believes that the stock price of Zhongju Hi-Tech fell during the lawsuit, and the Torch Group and its co-actors increased their holdings to 19.65%, “a long-time plot to absorb low prices and maliciously acquire them to manipulate securities transactions.”

On the evening of July 12, Torch Group responded by stating that Torch Group and co-actors mainly obtained shares of listed companies through judicial auctions and bulk transactions, and that they were mainly shares of Baoneng Zhongshan Runtian that entered the judicial auction, and that there was no connection with the progress of the lawsuit.

On the same day, Zhongju Hi-Tech received a regulatory work letter. The Shanghai Stock Exchange put forward three requirements: the majority shareholders of listed companies should regulate the exercise of shareholders' rights, be prudent and objective to avoid misleading the market and investors when publishing information about listed companies, and must not misuse listing information disclosure channels to issue announcements that do not meet the disclosure content and format requirements

Or be “kicked” out of the board

Before Baoneng issued a report letter, it faced a dangerous situation where it would be “kicked” out of the board of directors and loss of actual control of Zhongju Hi-Tech.

On July 7, Zhongju Hi-Tech announced that it will hold an extraordinary shareholders' meeting on July 24 to review five proposals from Torch Group and co-actors to remove the four Baoneng directors, including Chairman He Hua, and to elect new directors.

Song Weiyang, the supervisor of Baoneng Department, objected to the holding of the Extraordinary General Meeting of Shareholders and did not agree to the holding of the Extraordinary General Meeting of Shareholders, but due to the poor number of people, the bill to convene an extraordinary shareholders' meeting was passed by the Board of Supervisors.

Baoneng's report raised questions about the Extraordinary General Meeting of Shareholders, arguing that “the temporary supervisory board meeting convened in violation of regulations is a series of actions taken by Torch Group and its co-actors to further infringe on the interests of Zhongju Hi-Tech. The intention is to clean up the company's board of directors in an attempt to manipulate Zhongju Hi-Tech once again to cooperate with its ongoing false lawsuits through compromises and concessions. The Extraordinary General Meeting of Shareholders was clearly against the law and should have been cancelled.”

If the above proposal is passed, Lieutenant General Wu Bao will be selected as a candidate on the board of directors of Zhongju Hi-Tech, and Yao Zhenhua will lose control of Zhongju Hi-Tech.

Zhongshan Runtian's shareholding ratio is still gradually declining. This is a situation that is difficult for Baoneng to change. Its holdings have been passively reduced from over 20% to 9.58% through multiple judicial auctions.

On July 13, Zhongju Hi-Tech issued an announcement stating that the 9 million shares of Zhongshan Runtian planned to be judicially auctioned were withdrawn because an outsider raised a well-founded objection to the auctioned property.

The withdrawn judicial auction was only a “reprieve”. For Baoneng, the more realistic situation is that it is no longer possible to squeeze out money to increase holdings to regain control.

According to the Tianyan investigation, Shenzhen Baoneng Investment Group Co., Ltd. recently added 2 new pieces of executee information. The total execution target is over 427 million yuan. The enforcement court is the Changsha Intermediate People's Court. The executee in one of these cases includes Yao Zhenhua.

Risk information shows that Shenzhen Baoneng Investment Group Co., Ltd. has more than 80 pieces of information that have been executed, with a total execution amount exceeding 39.8 billion yuan. At the same time, the company has multiple consumer restriction orders, untrustworthy executees, and final case information. The total amount of failure to comply exceeded 200 million yuan.