Junda shares, a successful cross-border photovoltaic cell, recently posted a beautiful report card, which can be said to have successfully seized the dividend period of TOPCon, but don't forget that recently, HJT's copper plating technology has also ushered in new progress, helping HJT to reduce costs rapidly and taking advantage of the first mover. Is it possible for TOPCon to be overtaken by HJT again?

01Seized the TOPCon bonus period, Junda shares handed in a beautiful report card.

When it comes to cross-border, everyone's first reaction is unreliable, is a gimmick, but last year's cross-border photovoltaic rookie, Junda shares, after the independent industry from car interior decoration to photovoltaic cells, the performance soared all the way, it can be said that the transformation has been successfully achieved.

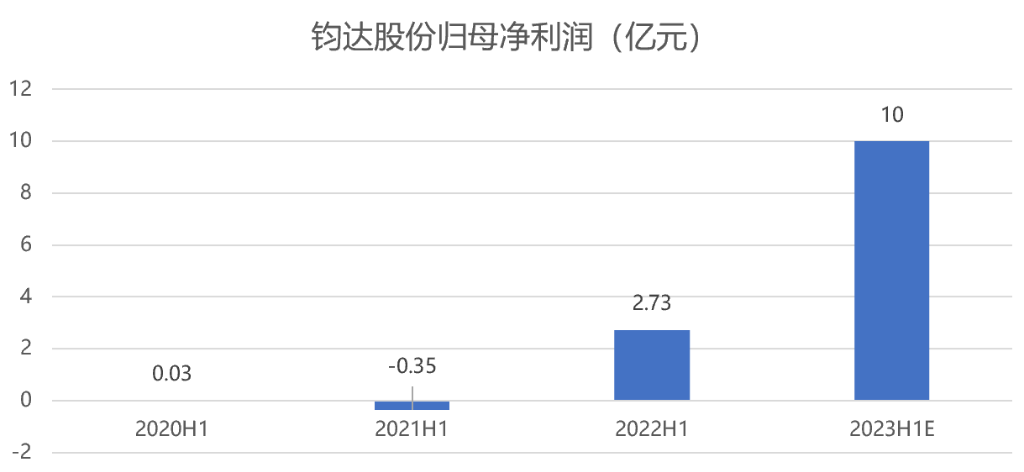

Recently, Junda shares announced a pre-increase in the first half of 2023, showing that it achieved a net profit of 9-1.1 billion in the first half of the year, an increase of 230-300% compared with the same period last year. Deducting the non-return net profit of 8.5-1.05 billion, an increase of 1330-1670% over the same period last year. It is estimated that in the second quarter, the net profit of returning to the mother is 5.5-750 million, and the net profit of deducting non-return is 5.1-710 million.

(note: the median net profit of homing in the first half of 2023 is 9-1.1 billion)

Year-on-year profit growth has risen sharply, although this is partly due to a low profit base last year: the company's main business in the same period last year also included anaemic car accessories business, and Jettel, which was in the photovoltaic business at the time, included only 51% in the consolidated statement. But the more important reason is that after its transformation, it cut into the TOPCon track quickly and ruthlessly, seizing the current dividend period of TOPCon volume.

At present, Junda is the first professional battery manufacturer in the industry to achieve large-scale mass production of n-type TOPCon batteries.

Since the rapid decline in silicon prices, the profits of the industrial chain have been gradually transferred to the downstream battery chips and components. In particular, the battery sector, since the second half of last year, large-size batteries have shown a structural shortage, battery leader Aixu shares quickly achieved profit repair in the second half of the year.

Since the beginning of this year, the acceptance of N-type TOPCon products by downstream operators has increased significantly, and the number of domestic bidding projects has been significantly increased from about 10% in the past to about 40%. And the current suppliers of TOPCon, compared with PERC, are still a small number, in the dividend release period.

At this stage, Junda and JinkoSolar Holding Co Ltd can be mass produced on a large scale, and Tongwei, Jinao and Tianhe can also contribute some of the volume. The market share of TOPCon this year is about 25%, which is basically carved up by these heads. Next year, it is expected that the market share of TOPCon will account for 50%. So this year and next year is the key dividend period for TOPCon, companies that seize such opportunities, even if they face the situation of overcapacity in most links of photovoltaic. But you can still make structural money.

Therefore, the pre-increase announcement of Junda exceeding expectations is reasonable.

02 TOPConHow long will the dividend last? Will it be threatened by the accelerated progress of HJT?

This year and next year is the year of mass production of TOPCon. I believe the industry knows that, but what everyone is worried about is how long the dividend of TOPCon can be eaten.

In the competition of new photovoltaic cell technology, mainly HJT, TOPCon, XBC and perovskite. The staunch supporter of XBC is Aixu, and perovskite is still in the early stage, so HJT and TOPCon are generally favored by large photovoltaic battery manufacturers one after another, but because HJT costs are relatively high and cost reduction is slow, TOPCon, with its cost-effective advantage, expanded rapidly in the head during 2022-2023 and already had the advantage of first mover. Although positive factors such as HJT conversion efficiency and easier stacking make HJT more imaginative, enterprises still choose pragmatic TOPCon to expand production on a large scale in the short term.

But recently there seems to be signs of reversal, that is, the key technology of HJT cost reduction, the landing rhythm of the industrialization of copper plating seems to be accelerating, then if the industrialization of copper plating can be successfully landed, it means that HJT products may have an impact on the industrial status of TOPCon in the next 1-2 years.

If the verification results in the mass production stage of copper plating pass both cost and efficiency, and can continue to produce, then it is very likely that HJT will surpass TOPCon again, and the two can compete again in a short period of 1-2 years. If there are some difficulties in the follow-up mass production of copper plating, then TOPCon will still occupy a more leading position.

At present, the feedback of the industry chain is that the enthusiasm of HJT for the verification of copper plating has increased, while the silver paste consumption of sterling silver is decreasing. For example, Sunwell New Energy also said that its first large test line for HJT copper interconnection, which is independently developed and manufactured, has been successfully accepted on the client side, which means that the low-cost copper process plan of HJT pioneered by Sunwell has been transformed from laboratory to industrialization. It is expected that some large factories will choose to expand the production of HJT in 2024.

So, from Junda's performance can be seen, TOPCon development is now in full swing, and next year's permeability will accelerate again, this year and next is the core benefit period of leading enterprises, but also to focus on tracking HJT technology progress, because photovoltaic technology changes quickly, if copper plating technology goes smoothly, HJT is no longer limited to cost issues, photovoltaic cell pattern may be another earthquake.