I. Market Overview

A-shares rose sharply last week. The Shanghai and Shenzhen 300, China Securities 500, and GEM indices rose and fell by 1.92%, 1.16%, and 2.53%, respectively, and the Shanghai Index. The Shenzhen Index rose 1.29% and 1.76% respectively. Sci-Innovation 50 fell slightly by 0.03%. Last week's average daily turnover was close to 900 billion yuan; northbound capital had changed from a net outflow from the previous period to a net inflow, with a cumulative net inflow of 19.844 billion yuan for the whole week.

In terms of global stock indexes, Hong Kong stocks performed the best. The Hang Seng Index rose 5.71% in a week, and the Hang Seng Technology Index rose 8.39%; in terms of US stocks, the S&P 500 index rose 2.42% in a week, and the NASDAQ rose 3.32%

The industries with the highest growth rates arePetroleum and petrochemicals, food and beverages, and media; the industries with the biggest declines include real estate, light industry manufacturing, and general.

The industries with the highest growth rates arePetroleum and petrochemicals, food and beverages, and media; the industries with the biggest declines include real estate, light industry manufacturing, and general.

In terms of the conceptual sector,Memory, advanced packaging, chemical raw materials, MCU chips, etc. performed well, while germanium gallium, air transportation, optical modules (CPO), China Shipbuilding, and real estate performed poorly.

Judging from the fund's performance,Funds in the heavy liquor, internet, petrochemicals, and media sectors performed the highest, while themed funds represented by real estate, rare earths, home appliances, and traditional Chinese medicine did not perform well.

II. Capital flow

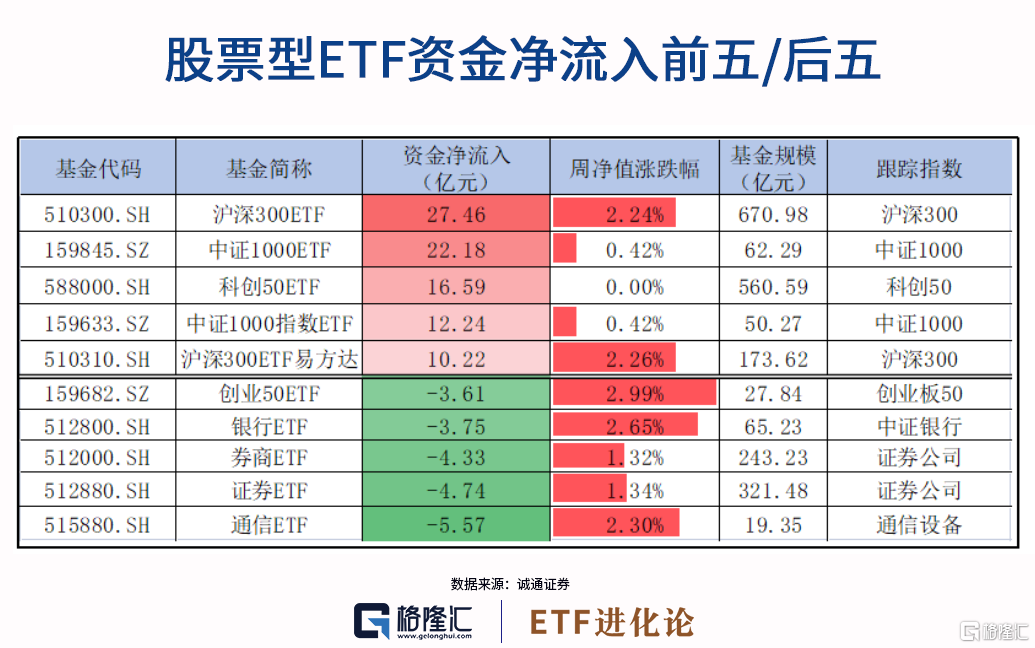

In terms of capital inflows,The net capital inflow of equity ETFs was 9.410 billion yuan. The total net inflow of the five index ETFs was about 3.7 billion yuan last week, of which the Shanghai and Shenzhen 300 ETFs had a net inflow of 2.7 billion yuan.

In terms of capital outflows,There was an outflow of 361 million yuan from 50 ETFs for entrepreneurship, and a large outflow of capital from large finance-themed ETFs. Bank ETFs, brokerage ETFs, and securities ETFs had outflows of 375 million yuan, 433 million yuan, and 474 million yuan respectively.

III. The rise and fall rate of ETFs

The A-share market fluctuated upward last week. The average net worth of equity ETFs rose 1.71%; the average net worth of cross-border ETFs rose 4.65%; and the average net worth of commodity ETFs rose 1.07%.

In terms of ETFs, the weekly increase of 87% ETFs in the ETF market last week was positive. Out of 809 ETFs, 709 ETFs had positive weekly gains, and 74 ETFs had negative weekly gains.

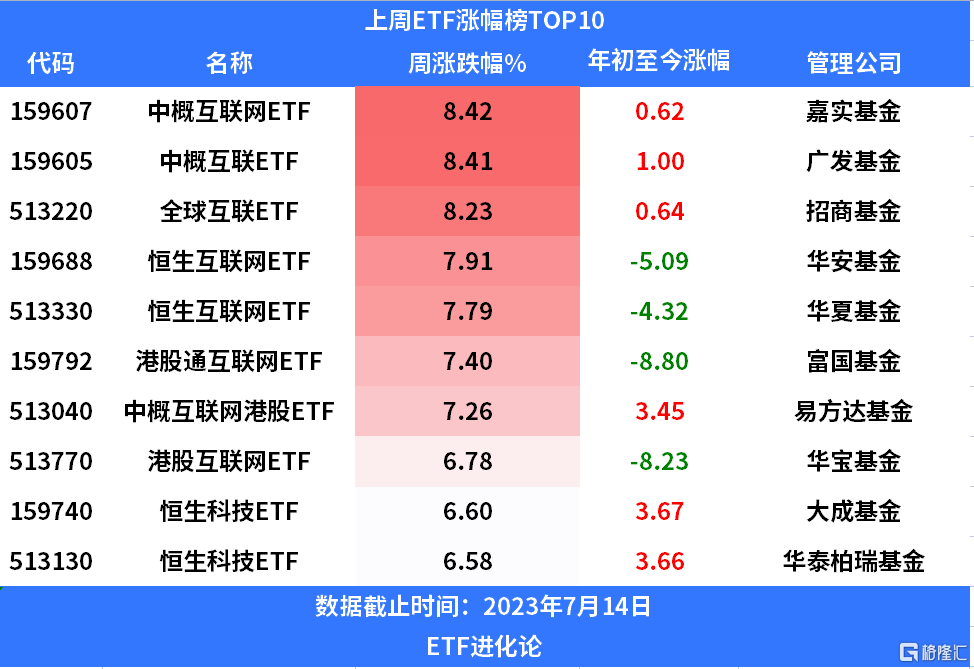

Among them, ETFs with the theme of China Securities Internet and Hong Kong Stock Technology Network performed the best last week, dominating the list of the top 10 weekly gains. Among them, the Harvest Fund Zhonggai Internet ETF, the Guangfa Fund Zhongyi Internet ETF, and the China Merchants Fund Global Internet ETF all rose more than 8% during the week.

Real estate-themed ETFs fell across the board last week, while China Southern Fund real estate ETFs fell 2% last week. The rare earth ETF was adjusted, and the rare earth ETF fell 1.14% last week.

IV. Changes in fund shares

There were mixed increases and decreases in the shares of the five major index ETFs last week. The Shanghai and Shenzhen 300 ETF, the Science and Innovation 50 ETF, the China Securities 500 ETF, and the GEM ETF increased by 678 million shares, 666 million shares, 73 million and 046 million shares, respectively, while the Shanghai Stock Exchange 50 ETF decreased by 80 million shares.

Specifically, funds continue to buy Hang Seng Healthcare ETFs. The share of Bosh Fund's Hang Seng Healthcare ETF increased by 878 million shares last week.

The Sci-Tech Innovation 50 Index has been falling for 4 weeks, hitting a new low since March. However, capital continued to fall and buy more. The share of the largest Sci-Tech Innovation 50 ETF in the market increased by 666 million last week, surpassing 67 billion shares, reaching a record high. The share of the 50 ETF on the Science and Technology Innovation Board increased by 477 million shares last week.

In terms of share reduction,Capital holdings of large finance-themed ETFs are declining overall. Although the share of e-Fangda Securities and Insurance ETFs increased by 442 million shares last week, Cathay Pacific Fund Securities ETFs, Huabao Fund Brokerage ETFs, and Huabao Fund Bank ETFs decreased by 544 million, 475 million, and 298 million shares, respectively.

The share of electricity ETFs fell by 438 million shares and telecommunications ETFs by 407 million shares last week.

5. Newly released products

6. Fund Hot News

[Public Funds Disclosure of the 2023 Second Quarterly Report kicks off, and Qiu Dongrong's latest views are revealed]

Qiu Dongrong of Zhonggeng Fund said in the newly disclosed second quarterly report that the overall valuation level of A-shares has reached a historically low level. A moderate economic recovery is still conducive to a bottom-down recovery in corporate profits. Equity assets correspond to higher levels of risk compensation, and the opportunities outweigh the risks. From a structural point of view, opportunities are more widely distributed among value stocks and growth stocks anticipated for industrial transformation, and more attention will be paid to the continuous improvement of the fundamentals and profitability of enterprises. Furthermore, the overall valuation level of Hong Kong stocks is basically around 10%, which is the lowest in history. Hong Kong stocks are very cost-effective, and some companies are scarce, so they continue to be strategically allocated.

[Over 70% of “fixed income +” fund products achieved positive returns during the year, increasing the total scale to 1.46 trillion yuan]

According to Wind data, as of July 13, there were a total of 2,380 “fixed income +” fund products, including hybrid second-tier bonds and partial debt hybrids (calculated separately by A/C), with a total scale of 1.46 trillion yuan, an increase of 60 billion yuan during the year. Among them, the number of products that achieved positive returns during the year was nearly 1,730, accounting for 72.69%.

[A number of fund companies have taken steps one after another to actively lay out floating rate funds]

According to the China Fund Report, as early as July 8, the first batch of 3 variable management rate products linked to scale and 8 floating management rate products linked to performance were reported and officially accepted. Recently, a medium-sized fund company in Shanghai reported a three-year regular open hybrid fund called “Share New Opportunities”. The name is slightly similar to the floating management rate linked to previous performance, or it is also a floating management fee fund.

[The new participation rate for this year's public offering fell below 85%! The “New Year for All” event is difficult again]

According to Wind data, as of July 15, this year's new public offering participation rate was 83%, falling below 85% for the first time in the past five years. The amount allotted for the new fund accounts for 15% of total IPO financing, which is also about 6 percentage points lower than the high point. A number of industry insiders said in this regard that due to factors such as the high breakout rate of new shares, limited increase in earnings from the IPO, and the comprehensive registration system raising the market value threshold for IPO purchases on the Main Board, etc., they have all led to a decline in the participation rate and amount of funds allocated to this year's public offering.

[Fang Xinghai: Further expand the investment power of private equity funds and gradually expand the introduction of long-term funds such as insurance funds, social security funds, and pensions]

Fang Xinghai, Vice Chairman of the Securities Regulatory Commission, spoke at the “Regulations on the Supervision and Administration of Private Equity Funds” symposium: The introduction and implementation of the regulations should be used as an opportunity to comprehensively and systematically sort out the rules and regulations of private equity funds, and use methods such as “reform and abolition” in an integrated manner to further strengthen the construction of supporting infrastructure systems for the industry. With the implementation of private equity regulations as a starting point, we will work with all parties to optimize the development environment of the industry, break through the pain points and blockages in all aspects of “fund-raising and investment management and withdrawal”, and further strengthen the investment power of private equity funds. Enrich funding sources and gradually expand the introduction of long-term funds such as insurance funds, social security funds, and pensions

涨幅靠前行业有,石油石化、食品饮料、传媒;跌幅较大的行业有:房地产、轻工制造、综合。

涨幅靠前行业有,石油石化、食品饮料、传媒;跌幅较大的行业有:房地产、轻工制造、综合。