CXO may not be as pessimistic as market expectations.

On July 31, at a time when the entire pharmaceutical sector was being drastically adjusted, the CXO sector bucked the trend and rose throughout the day due to Kanglong Chemical's performance forecast.

On the evening of the same day, Yao Ming Kangde released its 2023 semi-annual report, which seemed to give the CXO industry a little more confidence.

CXO's leading performance can perform well; excluding COVID-19, growth is still fast

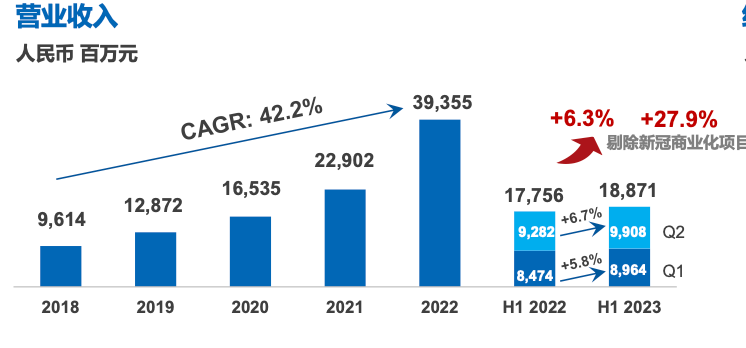

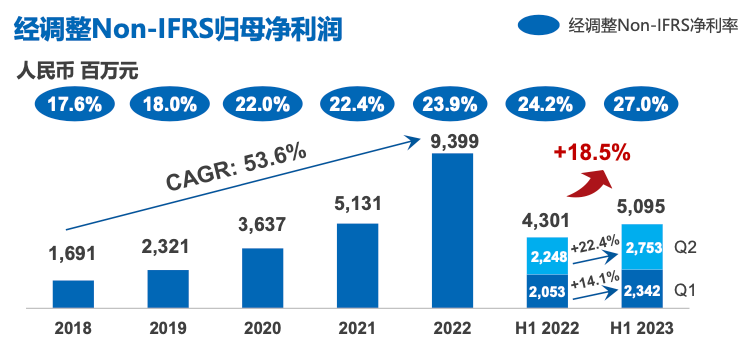

2023H1, Yao Ming Kangde's revenue was 18.871 billion yuan, up 6.3% year on year, and commercialization projects excluding COVID-19 increased 27.9% year on year; net profit for the first half of the year was 5.313 billion yuan, up 14.6% year on year; net profit adjusted for non-IFRS in the first half of the year was 5.095 billion yuan, up 18.5% year on year.

Against the backdrop of a high COVID-19 order base, the company maintained relatively rapid growth. speciallyThe quarterly month-on-month data continues to grow.

20223Q2Revenue was 9.908 billion yuan, up 6.7% year on year, and commercialization projects excluding COVID-19 increased 39.5% year on year;Net profit was 3.145 million yuan, up 5.1% year on year, and up 45.1% month on month.

It is worth noting that Yao Ming Kant has been criticized for a long timefree cash flow, reaching 2.93 billion yuan at the end of this quarter.Significant year-on-year correction.

It is worth noting that Yao Ming Kant has been criticized for a long timefree cash flow, reaching 2.93 billion yuan at the end of this quarter.Significant year-on-year correction.

The GLP-1 target has become a source of high revenue growth, and demand for the development of magic drugs for weight loss is growing steadily

In the past, the highlight of Pharmacomingkant's annual report finally fell on the number of new molecules added, but this year was different; the highlight was the type of molecule.

sinceIt “got” on the fast track of the magic medicine for weight loss.

Insightful researchAs mentioned in the article “Weight Loss Drug Manufacturers Are More Anxious Than Weight Loss Patients | Insight Research”, the drug Ming Kant'sTIDES (related to new molecular types) businessvoorAmong polypeptides and oligonucleotide CRDMO, the fastest growing molecular business is the GLP-1 target-related molecular business of the magic drug for weight loss.

At a time when the magic medicine for weight loss is out of stock around the world, unsurprisingly,Pharmaceutical Kant's GLP-1 target-related polypeptide drug CRDMO business ushered in rapid growth.

At 23H1, TIDES business revenue reached 1.33 billion yuan, an increase of 37.9% over the previous year. As of the end of June 2023,Ongoing orders in the TIDES business increased strongly by 188% year-on-year. incorporationTIDES business revenue is expected to grow by more than 70% for the whole year.

The number of TIDES D&M service customers reached 121, an increase of 25% over the previous year, and the number of service agents reached 207, an increase of 46% over the previous year.

From the '22 annual report, Yao Ming Kant officially split the TIDES business and disclosed it separately, which has shown that the company is very optimistic about the growth of this business.

Judging from the number of GLP-1 R&D worldwide, this target is indeed a fertile ground for current development.

According to Debon Securities statistics, currentlyThere are more than 122 weight loss indications for GLP-1 in the global research pipeline.And this is just an indication for weight loss, not including diabetes, NASH, and other indications.

According to Debon Securities statistics, currentlyThere are more than 122 weight loss indications for GLP-1 in the global research pipeline.And this is just an indication for weight loss, not including diabetes, NASH, and other indications.

Domestically, the number of GLP-1 is also growing.

Judging from the trend, the manufacturer layout has evolved rapidly from GLP-1 single target to dual targets, with three targets.From single G (GLP-1) fast roll to 3G (GLP-1/GIPR/GCGR).

Lilly is representative of the volume in the middle.

Insightful researchAs mentioned in the article “ADA Diet Pills Data Shines, the GLP-1 Battle Is Getting Closer | Insightful Research”, Lilly's star dual-target GLP-1 /GIPR weight loss drug tirzepatide (tirzepatide) directly achieved a 22.5% weight loss effect in 72 weeks.

However, Lilly did not stop, but instead directly prescribed the three-target GLP-1r/gipr/gcgr diet drug retatrutide. It is clear that there is still room for improvement in efficacy.

In addition, Lilly also has the small-molecule oral GLP-1R drug OrforgliPron, which also has remarkable effects.

The determination of Lilly's all-in diet pills and the generous rewards given by the capital market have also made many other manufacturers blush.Starting to go from a single G roll to 3G.

This kind of market atmosphere is also directA large number of orders have been sent to the drug Mingkant.

The chemical business is impressive, and clinical trials are also recovering

Of course, the drug Kangde is far more than just a diet pill.

The state of the split business shows that although Yao Ming Kant's chemical business grew by only 3.8% on paper, this was achieved against the backdrop of a high base of the COVID-19 product outbreak last year.Excluding the novel coronavirus, chemical business revenue increased 36.1% year-on-year, and maintained rapid growth in the global small molecule business.

583 new molecules were added to 2023H1.The number of small molecule CDMO commercialization projects in 23Q2 was 56, an increase of 13 over the previous year and an increase of 1 over 2023Q1. Over the past 12 months, the R plate has converted 120 molecules (21%) to the D&M sector.

583 new molecules were added to 2023H1.The number of small molecule CDMO commercialization projects in 23Q2 was 56, an increase of 13 over the previous year and an increase of 1 over 2023Q1. Over the past 12 months, the R plate has converted 120 molecules (21%) to the D&M sector.

Another thing worth paying attention to is,Clinical business has fully resumed.The company's clinical CRO and SMO revenue for the second quarter was 450 million yuan, up 29.6% year on year; it achieved revenue of 850 million yuan in the first half of the year, up 18.3% year on year. Pharmaceutical Kangde is weak compared to its leading peers in clinical business, which means that the recovery of domestic clinical business may also exceed expectations.

Specifically, look at the sub-business:

The chemical business (WuXi Chemistry) achieved revenue of 13.467 billion yuan, up 3.8% year on year. Excluding COVID-19 commercialization projects, revenue increased strongly by 36.1% year on year. Adjusted non-IFRS gross profit of 6.103 billion yuan, up 14.9% year on year, and gross margin was 45.3%;

The testing business (WuXi Testing) achieved revenue of 3,091 billion yuan, up 18.7% year on year. Adjusted non-IFRS gross profit of 1,168 billion yuan, up 26.1% year on year, and gross margin of 37.8%;

The biology business (WuXi Biology) achieved revenue of 1,233 million yuan, up 13.0% year on year. Adjusted non-IFRS gross profit of 511 million yuan, up 15.1% year on year, and gross margin of 41.5%;

The cell and gene therapy CTDMO business (WuXi ATU) achieved revenue of 714 million yuan, an increase of 16.0% over the previous year. Adjusted non-IFRS gross profit (0.40 million) yuan, and gross margin was (5.7)%;

The Domestic New Drug Research and Development Service Department (WuXi DDSU) achieved revenue of 342 million yuan, a year-on-year decrease of 24.9%, adjusted non-IFRS gross profit of 103 million yuan, a year-on-year decrease of 26.2%, and gross margin of 30.1%. At the same time, the company achieved a breakthrough in customer sales revenue sharing from 0 to 1.

The impact of external factors on CXO has been magnified too much, but the industry still has hidden concerns

Previously, the market did not show much impact on the CXO industry's most concerned external factors in financial reports. 23H1, US clients' revenue is still the fastest growing source.

Specifically, in the first half of the year, the company's revenue from US customers was 12.37 billion yuan, up 42% year on year after excluding COVID-19 commercialization projects; revenue from European customers was 2.22 billion yuan, up 19% year on year; revenue from customers from China was 3.23 billion yuan, up 6% year on year; and revenue from customers from other regions was 1.04 billion yuan, up 6% year on year.

Insightful researchThere have been completely different changes in the number of employees that have been observed since the previous year.Compared to the end of last year, the number of employees dropped by 7%.

By the end of June, Yao Ming Kangde had a total of 41,296 employees, compared to 44,361 employees at the end of last year, a decrease of 3065.

This is similar to previous news on social media. The company may have a sizeable number of employees transferring jobs, regions of work, or leaving their jobs. This means that a gap between capacity planning and actual production capacity may gradually become apparent, andThere may be a clear difference in sentiment between different business segments.

Furthermore, judging from the statistics on fund holdings at the end of the second quarter, CXO's holdings in various types of public funds have reached the level of the first quarter of 2020. In particular, the sharp decline in health fund holdings also reflects that the market is still overly pessimistic about the CXO industry.

Summary: Not only is the high growth in the peptide drug CRDMO business brought about by diet drug targets, but the highlights of PharmacomingKant's financial report also brought light to the recent bleak CXO industry. Perhaps it's time to re-examine and adjust our overly pessimistic expectations about the industry.