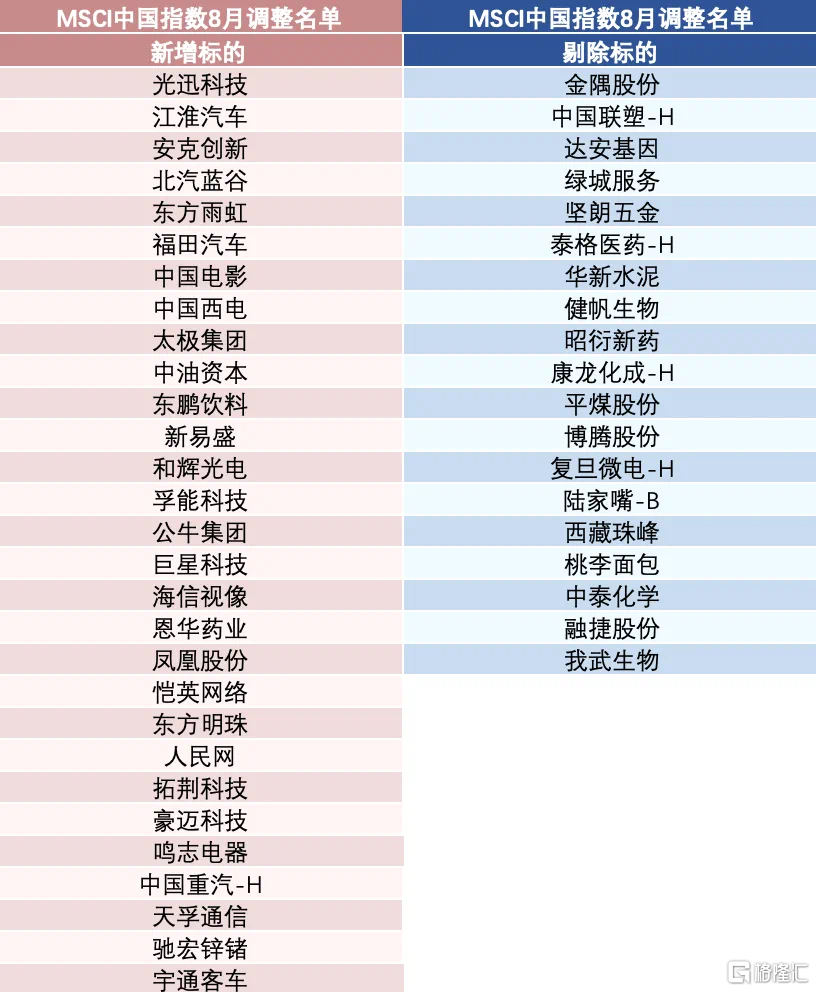

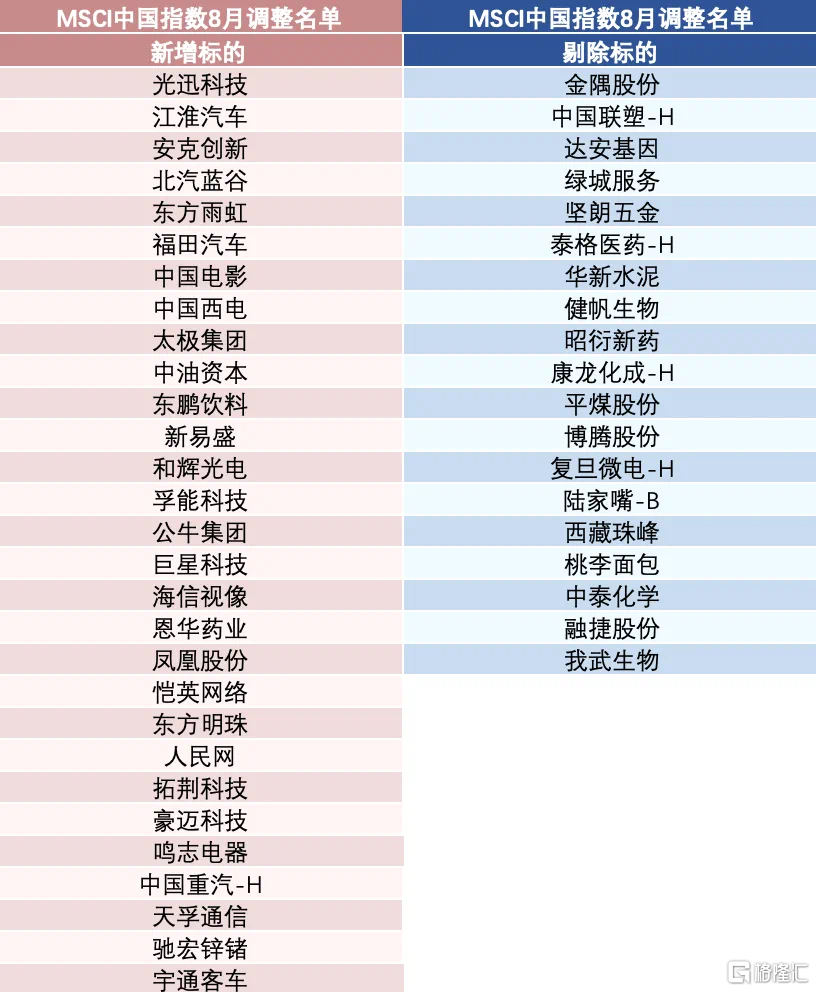

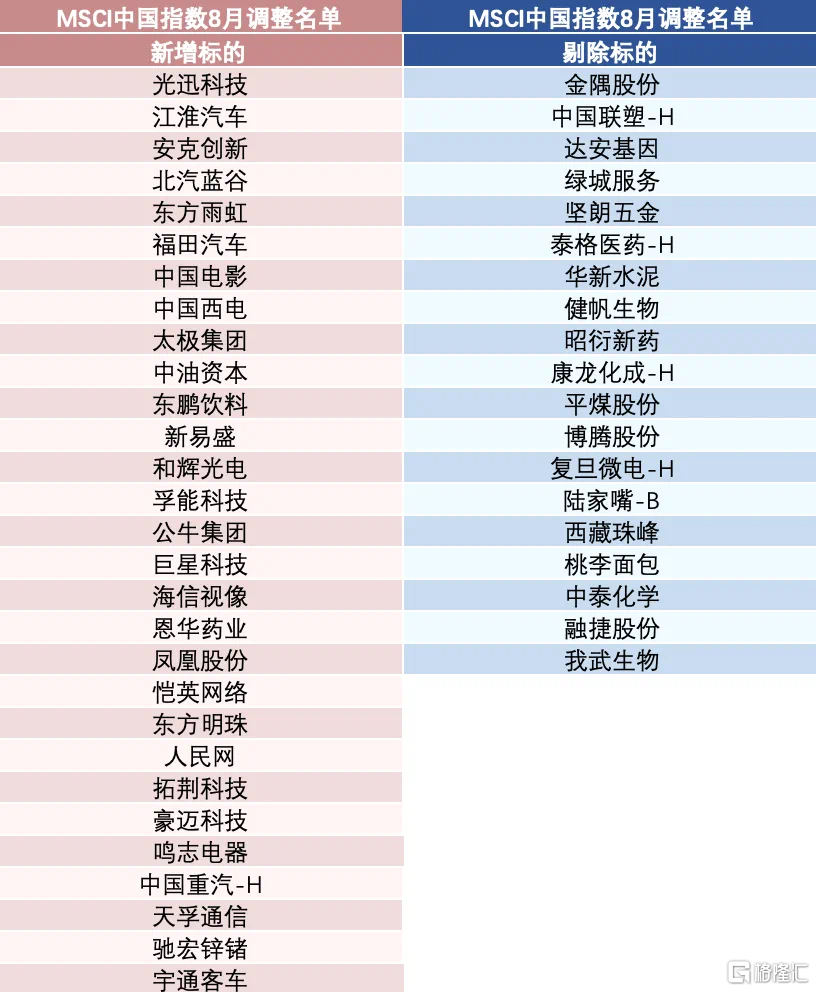

格隆汇8月11日丨国际指数编制公司MSCI公布了2023年8月指数审议结果,本次调整中,MSCI中国指数新纳入29只中国股票,剔除19只。

具体来看,港股纳入1只,为中国重汽。A股新纳入28只,按纳入后权重排序排名靠前的公司包括东鹏饮料、中油资本、公牛集团、拓荆科技、东方雨虹、新易盛、天孚通信、人民网、北汽蓝谷、江淮汽车、恺英网络、和辉光电-U、宇通客车、福田汽车、中国电影、海信视像、驰宏锌锗、太极集团、安克创新、中国西电、东方明珠、巨星科技、孚能科技、凤凰传媒、恩华药业、豪迈科技、鸣志电器和光迅科技。同时,此次调整剔除了19只成分股,其中包括5只港股,分别为康龙化成、泰格医药、上海复旦、绿城服务以及中国联塑。同时还有13只A股以及1只B股也被剔除,分别为坚朗五金、金隅集团、华新水泥、健帆生物、中泰化学、我武生物、平煤股份、昭衍新药、桃李面包、博腾股份、西藏珠峰、融捷股份、达安基因以及陆家B股。

值得注意的是,多只生物医药个股被剔除,包括泰格医药、达安基因、健帆生物、昭衍新药、康龙化成等被剔除。除全球指数系列外,MSCI中国全股票指数以及 MSCI 中国 A 股在岸指数的成分股名单也有所调整。MSCI全球股票指数将新增61只个股,剔除46只个股。纳入MSCI新兴市场指数的市值前三大个股分别为韩国Ecopro Co、A股中油资本和公牛集团。MSCI中国A股在岸指数增加成份股10只,包括光迅科技、安克创新、太极集团等;剔除50只标的,包括金禾实业、安通控股、道通科技等。前些年MSCI概念火热,过去A股市场也发行了一些跟踪MSCI指数的ETF,其中规模最大的是MSCI中国A50ETF。

今年以来,MSCI中国相关ETF涨跌不一。

今年以来,MSCI中国相关ETF涨跌不一。

![big]()

本次MSCI季度指数调整将于8月31日收盘后正式生效,回看过往情况,被MSCI中国指数新纳入个股,或将在当天尾盘迎来海外被动指数资金卡点买入。

Gelonghui August 11th 丨The international index compiling company MSCI announced the results of the August 2023 index review.In this adjustment, the MSCI China Index included 29 new Chinese stocks, excluding 19.

Specifically, Hong Kong stocks are included in 1, which is Sinotruk. 28 new A-shares were included. The top companies ranked by weight after inclusion include Dongpeng Drinks, CNPC Capital, Bull Group, Tuojing Technology, Dongfang Yuhong, Xinyisheng, Tianfu Communications, People's Online, BAIC Blue Valley, Jianghuai Automobile, Kaiying Network, Hehui Optoelectronic-U, Yutong Bus, Foton Motor, Chinese Film, Hisense Video, Chihong Zinc Germanium, Taiji Group, Anke Innovation, China Xidian, Oriental Pearl, Superstar Technology, Fuheneng Technology, Enhua Technology, Fenghuang Technology, Enhua Technology, Fenghuang Technology, Enhua Technology, Fenghuang Technology, Enhua Technology, Fenghuang Technology, Enhua Technology, Fenghuang Technology, Enhua Technology, Fenghuang Technology, Enhua Technology, Fenghuang Technology, Enhua Technology, Fenghuang Technology, Enhua Technology, Fenghuang Technology, Enhua Technology, and Phoenix Technology Pharmaceutical, Haomai Technology, Mingzhi Electric, and Guangxun Technology. Meanwhile, the adjustment excluded 19 constituent stocks, including 5 Hong Kong stocks, Kanglong Chemical, Tiger Pharmaceuticals, Shanghai Fudan, Greentown Services, and China Lianplastic. At the same time, 13 A-shares and 1 B-share were also excluded, namely Jianlang Hardware, Jinyu Group, Huaxin Cement, Jianfan Biology, Zhongtai Chemical, Wawu Biology, Pingmei Co., Ltd., Zhaoyan New Pharmaceutical, Taoli Bread, Boteng Co., Ltd., Tibet's Everest, Rongjie Co., Ltd., Daan Gene, and Lujia B shares.

Notably, a number of individual biomedical stocks were removed, including Tiger Pharmaceuticals, Daan Gene, Jianfan Biotech, Zhaoyan New Pharmaceuticals, and Kanglong Chemical.In addition to the global index series, the list of constituent stocks of the MSCI China All Stock Index and the MSCI China A-share Onshore Index has also been adjusted. The MSCI Global Stock Index will add 61 new stocks, excluding 46 stocks. The top three stocks by market capitalization included in the MSCI Emerging Markets Index were Korea's EcoPro Co, an A-share CNPC Capital, and Bull Group. The MSCI China A-share Onshore Index increased its constituent stocks by 10, including Guangxun Technology, Anke Innovation, Taiji Group, etc.; 50 targets were excluded, including Jinhe Industrial, Antong Holdings, Daotong Technology, etc. The MSCI concept was popular a few years ago. In the past, the A-share market also issued a number of ETFs tracking the MSCI index. The largest of these was the MSCI China A50 ETF.

Since this year,MSCI China-related ETFs have had mixed ups and downs.

Since this year,MSCI China-related ETFs have had mixed ups and downs.

![big]()

The MSCI quarterly index adjustment will officially take effect after the closing of the market on August 31. Looking back on the past situation, individual stocks were newly included in the MSCI China Index, and overseas passive index fund card purchases may be introduced at the end of the day.

Since this year,MSCI China-related ETFs have had mixed ups and downs.

Since this year,MSCI China-related ETFs have had mixed ups and downs.

今年以来,

今年以来,