曾经有“油茅”之称的金龙鱼似乎正陷入盈利困境,上半年净利润同比下降51.13%,扣非净利同比大降99.40%。

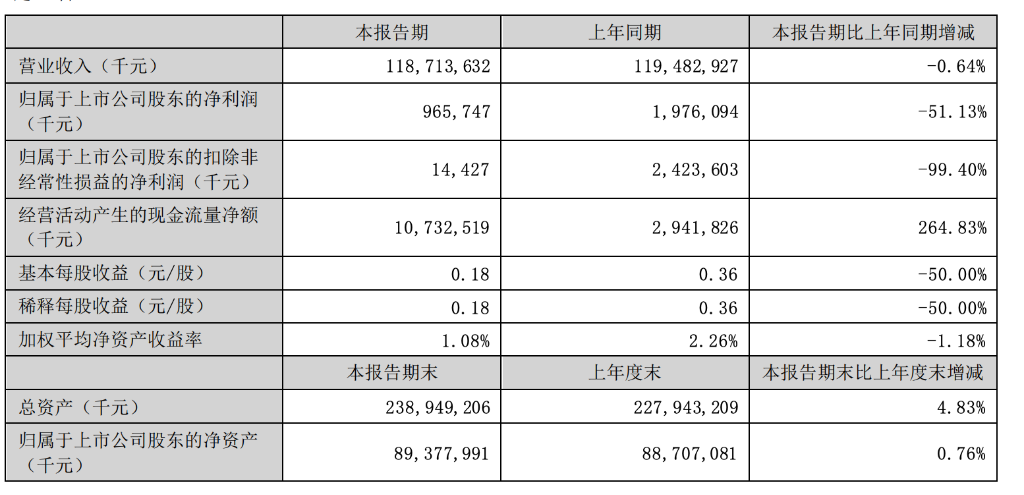

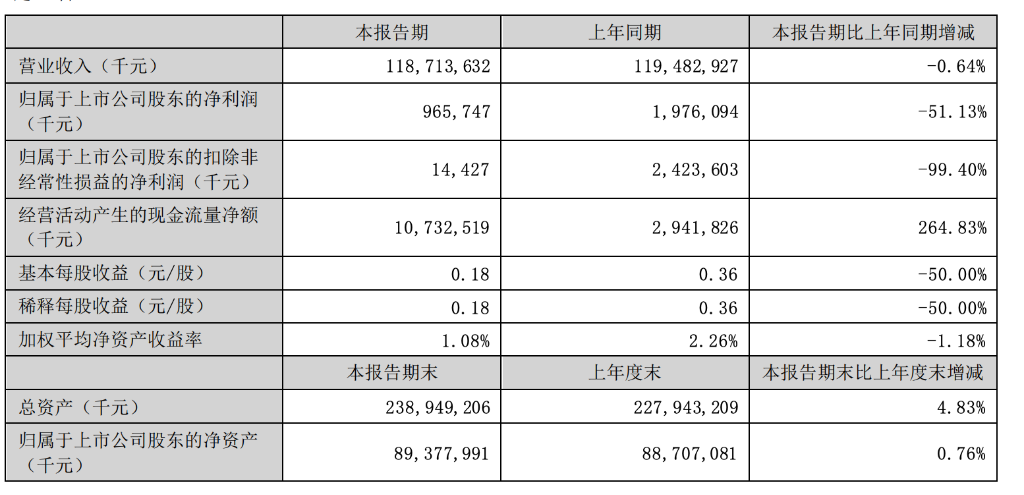

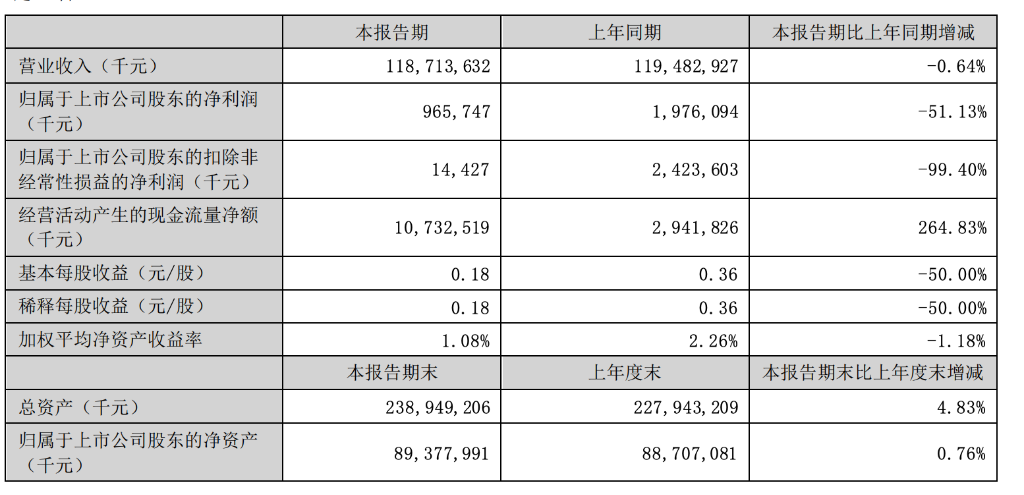

8月11日下午,金龙鱼公布2023年半年度报,截至6月30日,金龙鱼营业收入1187.14亿元,同比下降0.64%;归属于上市公司股东的净利润9.66亿元,同比下降51.13%;归属于上市公司股东的扣除非经常性损益的净利润1442.7万元,同比下降99.40%;基本每股收益0.18元,较上年同期的0.36元大幅下挫50%。

今年一季度金龙鱼净利润为8.54亿元,二季度金龙鱼净利润仅为1.12亿元,环比下降87%。

值得一提的是,自上市以来,金龙鱼的盈利能力整体下滑。2020年至2023年一季度,金龙鱼的毛利率分别为11.01%、8.18%、5.68%、5.13%,四个报告期合计下降5.88个百分点;净利率分别为3.37%、1.98%、1.21%、1.25%,四个报告期合计下降2.12个百分点。

而今年上半年金龙鱼的毛利率为4.15%,较今年一季度的5.13%进一步下滑;净利率仅为0.67%,下滑趋势明显。

分业务看,厨房食品类产品收入735.25亿元,同比下滑3.43%;饲料原料及油脂科技类产品收入444.64亿元,同比增长4.70%;其他类产品收入7.25亿元,同比下滑17.45%。

金龙鱼在报告中指出,营业收入较去年同期略有下降,主要是因为价格因素的影响:

随着国内经济逐步恢复,公司厨房食品、饲 料原料和油脂科技产品的销量较去年同期有所上涨,但是产品的价格随着大豆、大豆油及棕榈油等主要原材料价格下跌有所回落。

对于利润率大幅下滑,金龙鱼在财报中指出:

上半年小麦、 面粉及副产品的价格整体下行,公司消耗前期的高价小麦库存导致业绩下滑。另一方面,随着外出就餐的增加,家庭消费为主的零售渠道产品的销量同比有所减少,但是原材料成本的下降带动零售渠道产品的毛利率和利润同比有所增长。

总体来看,零售渠道产品利润的增长未能完全抵消餐饮渠道产品利润下降的影响,使得厨房食品利润同比下降。

扣非后净利润同比下降70.94%。

截至8月11日收盘,金龙鱼股价为41.2元,总市值为2234亿元,股价已跌回至2020年10月份水平。相比昔日历史高点145.36元,股价跌幅超过七成,市值蒸发了5600亿元。

金龙鱼的盈利困境

金龙鱼上市之初,被外界视为“油茅”,然而,在2021年,也就是上市第二年便出现增收不增利现象,且公司毛利率和净利率数据不断走低,相比其它食品饮料龙头稍显逊色。

当年,该公司实现营收2262亿,同比增长16.06%;实现归属净利润185亿,同比下降31.15%。

2022年,金龙鱼实现营收2575亿,同比增长13.82%;实现归属净利润30.11亿,同比下降27.12%。

2023年一季度,金龙鱼实现营收610.4亿,同比增长7.97%;实现归属净利润8.541亿,同比增长645.99%。不过,该公司扣非净利润仅为2.404亿,同比下降70.94%,分析认为,这一数据说明公司主业低迷。

有投资者曾针对金龙鱼“增收不增利”提问,该公司回复称,与宏观环境以及农产品价格等因素有关。

近年来,金龙鱼正在发力新业务,包括日化、调味品、预制菜等高毛利产品。

7月,金龙鱼在互动平台表示,公司杭州、重庆、周口、西安的中央厨房项目已投产,目前产能处于爬坡期,没有披露央厨产品产销量的具体数据。中央厨房是公司非常重要的新业务板块,公司现有的业务基本上都会在中央厨房上发挥作用。公司拥有生产、营销、配送等一系列成本优势,且产品质量优质,相信会带来不错的效益。

由于业务刚刚起步,且公司现有的米面油业务基数较大,预计短期内在营收中的占比很小。

曾經有“油茅”之稱的金龍魚似乎正陷入盈利困境,上半年淨利潤同比下降51.13%,扣非淨利同比大降99.40%。

8月11日下午,金龍魚公佈2023年半年度報,截至6月30日,金龍魚營業收入1187.14億元,同比下降0.64%;歸屬於上市公司股東的淨利潤9.66億元,同比下降51.13%;歸屬於上市公司股東的扣除非經常性損益的淨利潤1442.7萬元,同比下降99.40%;基本每股收益0.18元,較上年同期的0.36元大幅下挫50%。

今年一季度金龍魚淨利潤爲8.54億元,二季度金龍魚淨利潤僅爲1.12億元,環比下降87%。

值得一提的是,自上市以來,金龍魚的盈利能力整體下滑。2020年至2023年一季度,金龍魚的毛利率分別爲11.01%、8.18%、5.68%、5.13%,四個報告期合計下降5.88個百分點;淨利率分別爲3.37%、1.98%、1.21%、1.25%,四個報告期合計下降2.12個百分點。

而今年上半年金龍魚的毛利率爲4.15%,較今年一季度的5.13%進一步下滑;淨利率僅爲0.67%,下滑趨勢明顯。

分業務看,廚房食品類產品收入735.25億元,同比下滑3.43%;飼料原料及油脂科技類產品收入444.64億元,同比增長4.70%;其他類產品收入7.25億元,同比下滑17.45%。

金龍魚在報告中指出,營業收入較去年同期略有下降,主要是因爲價格因素的影響:

隨着國內經濟逐步恢復,公司廚房食品、飼 料原料和油脂科技產品的銷量較去年同期有所上漲,但是產品的價格隨着大豆、大豆油及棕櫚油等主要原材料價格下跌有所回落。

對於利潤率大幅下滑,金龍魚在業績中指出:

上半年小麥、 麪粉及副產品的價格整體下行,公司消耗前期的高價小麥庫存導致業績下滑。另一方面,隨着外出就餐的增加,家庭消費爲主的零售渠道產品的銷量同比有所減少,但是原材料成本的下降帶動零售渠道產品的毛利率和利潤同比有所增長。

總體來看,零售渠道產品利潤的增長未能完全抵消餐飲渠道產品利潤下降的影響,使得廚房食品利潤同比下降。

扣非後淨利潤同比下降70.94%。

截至8月11日收盤,金龍魚股價爲41.2元,總市值爲2234億元,股價已跌回至2020年10月份水平。相比昔日曆史高點145.36元,股價跌幅超過七成,市值蒸發了5600億元。

金龍魚的盈利困境

金龍魚上市之初,被外界視爲“油茅”,然而,在2021年,也就是上市第二年便出現增收不增利現象,且公司毛利率和淨利率數據不斷走低,相比其它食品飲料龍頭稍顯遜色。

當年,該公司實現營收2262億,同比增長16.06%;實現歸屬淨利潤185億,同比下降31.15%。

2022年,金龍魚實現營收2575億,同比增長13.82%;實現歸屬淨利潤30.11億,同比下降27.12%。

2023年一季度,金龍魚實現營收610.4億,同比增長7.97%;實現歸屬淨利潤8.541億,同比增長645.99%。不過,該公司扣非淨利潤僅爲2.404億,同比下降70.94%,分析認爲,這一數據說明公司主業低迷。

有投資者曾針對金龍魚“增收不增利”提問,該公司回覆稱,與宏觀環境以及農產品價格等因素有關。

近年來,金龍魚正在發力新業務,包括日化、調味品、預製菜等高毛利產品。

7月,金龍魚在互動平台表示,公司杭州、重慶、周口、西安的中央廚房項目已投產,目前產能處於爬坡期,沒有披露央廚產品產銷量的具體數據。中央廚房是公司非常重要的新業務板塊,公司現有的業務基本上都會在中央廚房上發揮作用。公司擁有生產、營銷、配送等一系列成本優勢,且產品質量優質,相信會帶來不錯的效益。

由於業務剛剛起步,且公司現有的米麪油業務基數較大,預計短期內在營收中的佔比很小。