Investors Don't See Light At End Of WWPKG Holdings Company Limited's (HKG:8069) Tunnel And Push Stock Down 28%

Investors Don't See Light At End Of WWPKG Holdings Company Limited's (HKG:8069) Tunnel And Push Stock Down 28%

WWPKG Holdings Company Limited (HKG:8069) shareholders that were waiting for something to happen have been dealt a blow with a 28% share price drop in the last month. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 75% loss during that time.

WWPKG 控股有限公司 (HKG: 8069)等待某件事發生的股東在上個月股價下跌了28%,這給他們帶來了打擊。對於股東來說,最近的下跌結束了災難性的十二個月,他們在此期間虧損了75%。

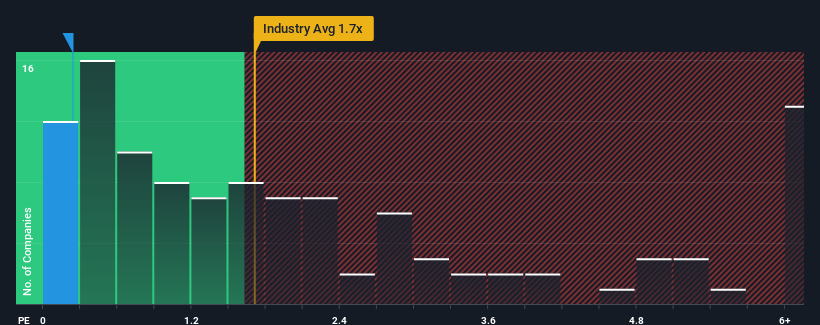

Even after such a large drop in price, WWPKG Holdings' price-to-sales (or "P/S") ratio of 0.2x might still make it look like a buy right now compared to the Hospitality industry in Hong Kong, where around half of the companies have P/S ratios above 1.7x and even P/S above 4x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

即使在價格大幅下跌之後,WWPKG Holdings0.2倍的市盈率(或 “P/S”)與香港的酒店業相比,目前仍可能看起來像是買入,在香港,大約一半的公司的市盈率高於1.7倍,甚至市盈率高於4倍也很常見。但是,僅按面值計算市盈率是不明智的,因爲可能可以解釋爲什麼市盈率有限。

Check out our latest analysis for WWPKG Holdings

查看我們對WWPKG Holdings的最新分析

How Has WWPKG Holdings Performed Recently?

WWPKG Holdings 最近的表現如何?

Recent times have been quite advantageous for WWPKG Holdings as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

最近對WWPKG Holdings來說是相當有利的,因爲其收入增長非常迅速。可能是許多人預計強勁的收入表現將大幅下降,這抑制了市盈率。如果你喜歡這家公司,你會希望情況並非如此,這樣你就有可能在股票失寵的時候買入一些股票。

Is There Any Revenue Growth Forecasted For WWPKG Holdings?

預計WWPKG Holdings的收入會增長嗎?

The only time you'd be truly comfortable seeing a P/S as low as WWPKG Holdings' is when the company's growth is on track to lag the industry.

看到市盈率低至WWPKG Holdings的唯一時機是該公司的增長有望落後於該行業。

If we review the last year of revenue growth, we see the company's revenues grew exponentially. The amazing performance means it was also able to grow revenue by 36% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

如果我們回顧一下去年的收入增長,就會發現該公司的收入呈指數級增長。驚人的業績意味着在過去三年中,它的總收入也增長了36%。因此,可以公平地說,該公司最近的收入增長非常出色。

Comparing the recent medium-term revenue trends against the industry's one-year growth forecast of 65% shows it's noticeably less attractive.

將最近的中期收入趨勢與該行業65%的一年增長預測進行比較表明,它的吸引力明顯降低。

With this in consideration, it's easy to understand why WWPKG Holdings' P/S falls short of the mark set by its industry peers. It seems most investors are expecting to see the recent limited growth rates continue into the future and are only willing to pay a reduced amount for the stock.

考慮到這一點,不難理解爲什麼WWPKG Holdings的市盈率沒有達到業內同行設定的目標。看來大多數投資者都期望看到最近有限的增長率將持續到未來,他們只願意爲該股支付較少的金額。

The Final Word

最後一句話

WWPKG Holdings' P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

WWPKG Holdings的市盈率與股價一起下跌。雖然市售比不應成爲你是否購買股票的決定性因素,但它是衡量收入預期的有力晴雨表。

In line with expectations, WWPKG Holdings maintains its low P/S on the weakness of its recent three-year growth being lower than the wider industry forecast. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. If recent medium-term revenue trends continue, it's hard to see the share price experience a reversal of fortunes anytime soon.

符合預期,WWPKG Holdings維持低市盈率,原因是其最近三年的增長疲軟,低於整個行業的預期。在現階段,投資者認爲收入改善的潛力還不夠大,不足以證明更高的市盈率是合理的。如果最近的中期收入趨勢繼續下去,那麼很難看到股價在短期內出現命運的逆轉。

It is also worth noting that we have found 2 warning signs for WWPKG Holdings (1 is potentially serious!) that you need to take into consideration.

還值得注意的是,我們已經發現 WWPKG Holdings 有 2 個警告標誌 (1 可能很嚴重!)這是你需要考慮的。

If you're unsure about the strength of WWPKG Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

如果你是 不確定WWPKG Holdings的業務實力,爲什麼不瀏覽我們的互動股票清單,爲你可能錯過的其他一些公司提供堅實的商業基本面。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?擔心內容嗎? 取得聯繫 直接和我們在一起。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St 的這篇文章本質上是籠統的。 我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。 它不構成買入或賣出任何股票的建議,也沒有考慮您的目標或財務狀況。我們的目標是爲您提供由基本面數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。簡而言之,華爾街在上述任何股票中都沒有頭寸。

Recent times have been quite advantageous for WWPKG Holdings as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Recent times have been quite advantageous for WWPKG Holdings as its revenue has been rising very briskly. It might be that many expect the strong revenue performance to degrade substantially, which has repressed the P/S ratio. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.