Among the three leading “Mao Wuyi” wine companies, Wuliangye (000858.SZ) was the first to feel the pressure.

On August 25, Wuliangye released its financial report for the first half of 2023, achieving revenue of 44.506 billion yuan, an increase of 10.39% over the previous year; it recorded net profit of 17.037 billion yuan, an increase of 12.83% over the previous year.

Although the first half of the year recorded a double increase in net revenue and profit, in the second quarter of this year, Wuliangye recorded single-digit net profit growth rates for the first time since the fourth quarter of 2016, at 5.7% and 5.63%, respectively, both falling short of market expectations.

The crux of Wuliangye's growth problem lies in the volume and price problem of the five core products.

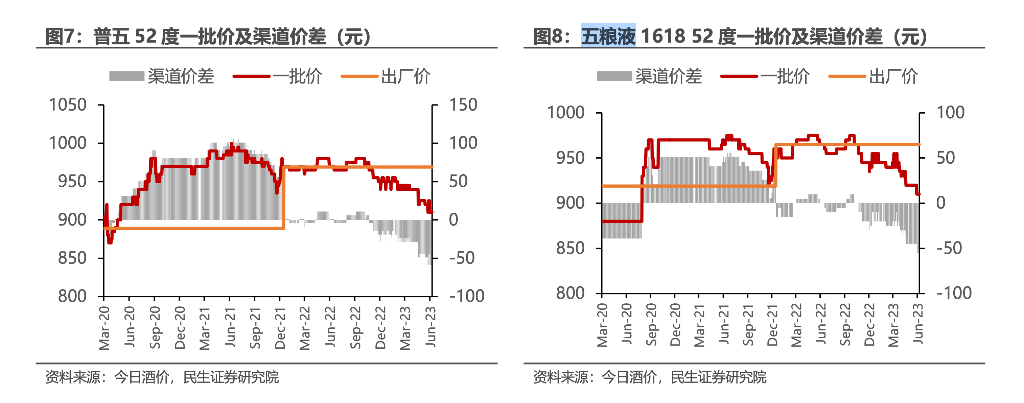

Since Wuliangye raised the factory price of Pu Wu at the end of 2021, dealer costs have increased sharply. Combined with the impact of the external consumption environment, the wholesale price of Pu 5 showed a marked decline. It fell to a low of 930 yuan/bottle in August last year, forming a long-term inversion with the factory price.

In March of last year, Wuliangye raised the recommended retail price of Pu Wu for the second year in a row, and finally raised it to 1,499 yuan/bottle against Flying Maotai. The intention was to boost channel confidence, but due to insufficient channel profits, Pu Wu's wholesale price was still tepid.

Anxin Securities Research Report pointed out that in recent years, Pu Wu has become a “diversion” product in the hands of dealers. The latter does not pursue profit but rather pursues fast turnover to relieve financial pressure, and has lost expectations that Wuliangye products can make money, so it is difficult to increase the wholesale price.

However, in the first half of this year, the pain of the adjustment of Wuliangye followed. The revenue growth rate of Wuliangye products (including Pu 5 products), which account for more than 80% of its revenue, fell sharply by 7.79 percentage points year on year, while tonnage prices fell 5% year on year. The “volume increase and price drop” reaction is indeed Wuliangye's current dilemma where it is difficult to raise prices for the five core products.

TradeWind01 (ID: TradeWind01) asked people involved in Wuliangye about Pu Wu's volume and price planning, etc., but as of press release, no response had been received.

On August 28, Wuliangye's stock price went against the market and turned green. It closed down 2.51% on the same day, closing at 157.49 yuan/share. The decline during the year had reached 10.82%.

Adjustment under pressure

In an environment where external consumption is sluggish, Nongxiangtou Wuliangye is beginning to feel the pressure.

The pressure is first reflected in “Wuliangye products,” which account for over 80% of revenue. Wuliangye's alcohol products achieved revenue of 41,882 billion yuan during the reporting period, an increase of 8.77% over the previous year. Among them, Wuliangye products increased 10.03% year on year to 35.179 billion yuan, and the revenue growth rate decreased by 7.79 percentage points compared to the same period last year. Other wine products (including Wuliang strong wine, fruit wine, etc.) increased by 2.65% year on year to 6.713 billion yuan, changing from negative growth to positive.

From a quantitative perspective, sales of Wuliangye products and other products both achieved significant increases, with year-on-year increases of 15.82% and 33.61%, respectively.

The current situation where sales volume growth exceeds revenue shows that the prices of all Wuliangye products have declined, and that the sub-high-end products Wuliangchun and Wuliangol, with the exception of Pu Wu, have suffered a setback. During the reporting period, the tonnage prices of Wuliangye products and other products decreased by 5% and 23.2%, respectively, and the tonnage prices of other products fell markedly.

A private equity source who has been tracking food and beverages in East China for a long time told TradeWind (ID: TradeWind01) that due to Wuliangye's large number of branded products in the past, the brand was diluted, and the prices of sub-high-end products “collapsed.”

Although the decline in tonnage prices had a negative impact on Wuliangye's profit performance, thanks to strict control of expenses during the reporting period, the sales expense rate and management expense ratio decreased by 0.73 and 0.05 percentage points year-on-year, respectively, while the financial expense ratio decreased by 0.32 percentage points to -2.75%.

Thanks to this, Wuliangye's gross margin fell by only 0.14 percentage points to 76.78%, and even net interest rate increased 0.65 percentage points to 39.1% year on year.

A private equity source in Shanghai told TradeWind01 (ID: TradeWind01) that changes such as a reduction in three-fee expenses and a 15.94 percentage point month-on-month decline in sales cash flow ratio all indicate that management seems to have changed its thinking. The old idea of “price for quantity” will be “discarded.”

This is similar to the seller's point of view. Anxin Securities released a research report commenting on the results, saying, “It is expected that the company's business philosophy will change, that is, the strategy of 'price for volume' focusing on completing tasks will gradually lean towards price recovery.” Huacheng Securities, on the other hand, pointed out in the research report that although Wuliangye has maintained high double-digit growth over the past three years, “it is already moving forward with a heavy burden” and “it should be understood that the company should voluntarily remove the pressure of continued high growth.”

However, for Wuliangye today, it is not that easy to let go of the “price for volume” strategy; Pu Wu's bulk prices did not begin to come under pressure only this year.

The volume-price paradox

As a core product, Pu Wu's volume and price problems have always plagued Wuliangye in recent years.

You need to know that the background behind the launch of today's Pu 5 (8th generation) is that in 2018, there was an inversion in the market prices of seventh-generation products. As a result, Wuliangye launched the eighth-generation Wuliangye product, which had a higher factory price of 100 yuan/bottle, to facilitate the channel's price.

However, in recent years, since Pu Wu's channel profit is smaller than that of Flying Maotai and Guojiao 1573, dealers have had to sell at a price far lower than the recommended retail price in the market in order to complete sales tasks and repay payments.

The Shanghai private equity source mentioned above told TradeWind01 (ID: TradeWind01), “Nationwide, Wuliangye dealers are not making any money.” Because compared to Luzhou Laojiao, which subsidized dealers several times during the year based on market transactions, Wuliangye only offered a “vague rebate” once every year on December 18, “the motivation for dealers not to make money comes from.”

In Anxin Securities's research report, Pu Wu was once defined as a “diversion” product. Dealers have lost their expectations that Wuliangye products will be profitable, so it is even more difficult for Pu Wu's batch prices to be raised.

Wuliangye has also tried to boost channel confidence and increase profits by increasing prices one after another, but the transmission of prices has not been smooth.

At the end of December 2021, Wuliangye's unplanned price for Pu Wu was raised from 999 yuan/bottle to 1,089 yuan/bottle. The planned price remained unchanged at 889 yuan/bottle, and the volume of contracts within and outside the plan was 3:2. According to estimates, the comprehensive factory price of Pu Wu was raised to 969 yuan/bottle, which is consistent with the factory price of 53-degree Flying Maotai.

Immediately after that, in March of last year, Wuliangye raised the recommended retail price of Pu Wu for the second year in a row, from 1,399 yuan/bottle to 1,499 yuan/bottle. As a result, Pu Wu fully benchmarked 53-degree flying Maotai, whether it was the factory price or the recommended retail price.

Faced with the manufacturer's price increase, dealers chose to “vote with their feet”. Not only did Pu Wu circulate faster, but it was also cheaper. In August of last year, the batch price of Pu Wu once fell to a low of 930 yuan/bottle. Compared with the comprehensive factory price difference of 39 yuan, there was a price inversion. The terminal retail price of e-commerce platforms is also always below 1,100.

However, according to data from the Minsheng Securities Research Report, since February of this year, the bulk price of Pu 5 has begun a new round of decline. According to data from Jiuxi.com, the batch price of Pu Wu has stabilized at 935 yuan/bottle for the past month, which means that every time the dealer sells a bottle of Pu Wu, they are selling at a loss of money.

At this year's shareholders' meeting, Wuliangye also raised the issue of channel inventory and price inversion. Management stated that Pu Wu's price is indeed somewhat inverted, “but we are confident that we will achieve a smooth price this year.”

The cost of a smooth price, on the other hand, is short-term pain in performance. Compared with the revenue growth rate of 13.03% in the first quarter, Wuliangye plummeted to 5.7% in the second quarter, and the net profit growth rate also fell to 4.63%. Since the fourth quarter of 2016, Wuliangye's net revenue growth rate has slowed to single digits for the first time.

The companion Yanghe Co., Ltd. (002304.SZ) has also experienced channel problems. At the time, since its channel model was too “flat,” dealers generally acted as distributors, and channel profits were insufficient. As a result, Yanghe Co., Ltd. fell into negative growth for two consecutive years in 2019 and 2020.

Wuliangye's excessive reliance on the channel model of big dealers is determined; its channel reform is bound not to be easy. In the first half of 2023, Wuliangye's top five customers contributed 16.4% of revenue, while Shanxi Fenjiu (600809.SH) was only 7.66% during the same period.

Xiao Zhuqing, chairman of Wuhan Jingkui Technology Co., Ltd., told TradeWind01 (ID: TradeWind01), “If Wuliangye were to 'cut' big business, it was a very painful decision, because it would affect the short-term pattern of interests, as well as Wuliangye's short-term performance.”

The person mentioned above said that the influence of the super-businessman's policy on Wuliangye is reflected in allowing the former to fully use money orders to settle the purchase price, thus helping dealers to save bank interest; furthermore, the customer policy for large dealers is more favorable than that of ordinary dealers, and they also receive more rebates at the end of the year. “This is also the source of the entire Wuliangye price chaos.”