Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. Importantly, Hainan Meilan International Airport Company Limited (HKG:357) does carry debt. But the more important question is: how much risk is that debt creating?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for Hainan Meilan International Airport

What Is Hainan Meilan International Airport's Net Debt?

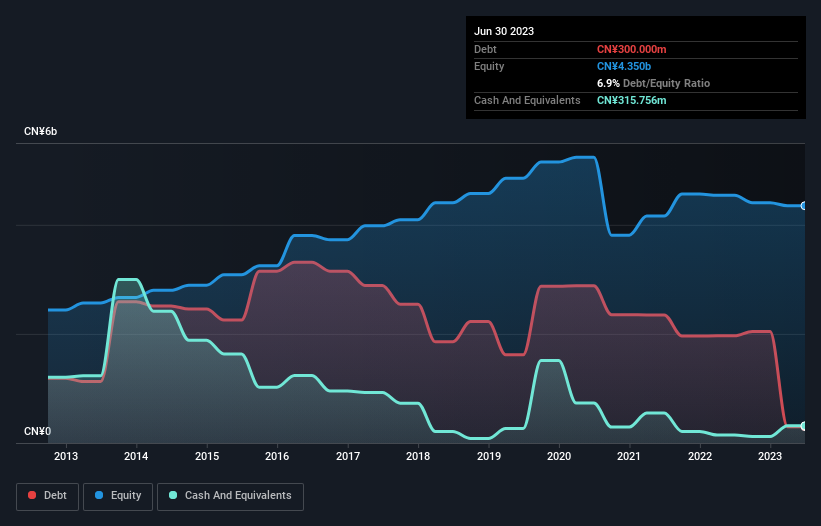

As you can see below, Hainan Meilan International Airport had CN¥300.0m of debt at June 2023, down from CN¥1.96b a year prior. But it also has CN¥315.8m in cash to offset that, meaning it has CN¥15.8m net cash.

As you can see below, Hainan Meilan International Airport had CN¥300.0m of debt at June 2023, down from CN¥1.96b a year prior. But it also has CN¥315.8m in cash to offset that, meaning it has CN¥15.8m net cash.

How Strong Is Hainan Meilan International Airport's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that Hainan Meilan International Airport had liabilities of CN¥6.45b due within 12 months and liabilities of CN¥1.27b due beyond that. On the other hand, it had cash of CN¥315.8m and CN¥433.9m worth of receivables due within a year. So its liabilities total CN¥6.97b more than the combination of its cash and short-term receivables.

This deficit casts a shadow over the CN¥3.30b company, like a colossus towering over mere mortals. So we definitely think shareholders need to watch this one closely. After all, Hainan Meilan International Airport would likely require a major re-capitalisation if it had to pay its creditors today. Given that Hainan Meilan International Airport has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total. The balance sheet is clearly the area to focus on when you are analysing debt. But it is future earnings, more than anything, that will determine Hainan Meilan International Airport's ability to maintain a healthy balance sheet going forward. So if you're focused on the future you can check out this free report showing analyst profit forecasts.

Over 12 months, Hainan Meilan International Airport reported revenue of CN¥1.6b, which is a gain of 19%, although it did not report any earnings before interest and tax. We usually like to see faster growth from unprofitable companies, but each to their own.

So How Risky Is Hainan Meilan International Airport?

While Hainan Meilan International Airport lost money on an earnings before interest and tax (EBIT) level, it actually generated positive free cash flow CN¥65m. So taking that on face value, and considering the net cash situation, we don't think that the stock is too risky in the near term. Given the lack of transparency around future revenue (and cashflow), we're nervous about this one, until it makes its first big sales. To us, it is a high risk play. When we look at a riskier company, we like to check how their profits (or losses) are trending over time. Today, we're providing readers this interactive graph showing how Hainan Meilan International Airport's profit, revenue, and operating cashflow have changed over the last few years.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.