Shenzhen Liantronics Co.,Ltd's (SZSE:300269) Prospects Need A Boost To Lift Shares

Shenzhen Liantronics Co.,Ltd's (SZSE:300269) Prospects Need A Boost To Lift Shares

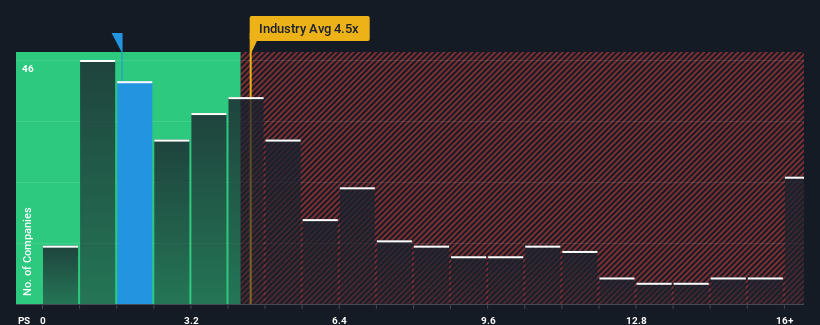

Shenzhen Liantronics Co.,Ltd's (SZSE:300269) price-to-sales (or "P/S") ratio of 1.7x might make it look like a strong buy right now compared to the Electronic industry in China, where around half of the companies have P/S ratios above 4.5x and even P/S above 9x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

深圳市聯創電子有限公司深圳證券交易所股票代碼:300269)1.7倍的本益比(或稱“P/S”),與中國的電子行業相比,現在看起來似乎是一筆強勁的買入。在電子行業,大約一半的公司的本益比高於4.5倍,即使是本益比高於9倍的S也相當常見。儘管如此,我們還需要更深入地挖掘,以確定本益比大幅下降是否有合理的基礎。

View our latest analysis for Shenzhen LiantronicsLtd

查看我們對深圳聯創股份有限公司的最新分析

What Does Shenzhen LiantronicsLtd's P/S Mean For Shareholders?

深圳聯創股份有限公司的P/S對股東意味著什麼?

The revenue growth achieved at Shenzhen LiantronicsLtd over the last year would be more than acceptable for most companies. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. Those who are bullish on Shenzhen LiantronicsLtd will be hoping that this isn't the case, so that they can pick up the stock at a lower valuation.

深圳聯創股份有限公司去年實現的收入增長對大多數公司來說都是可以接受的。或許市場預期這一可接受的營收表現將大幅跳水,這令本益比/S受到壓制。那些看好深圳聯創股份有限公司的人會希望情況並非如此,這樣他們就可以以較低的估值買入該股。

Is There Any Revenue Growth Forecasted For Shenzhen LiantronicsLtd?

深圳聯創有沒有收入增長的預測?

In order to justify its P/S ratio, Shenzhen LiantronicsLtd would need to produce anemic growth that's substantially trailing the industry.

為了證明其本益比與S的比率是合理的,深圳聯創股份有限公司需要實現遠遠落後於行業的增長乏力。

If we review the last year of revenue growth, the company posted a terrific increase of 22%. Despite this strong recent growth, it's still struggling to catch up as its three-year revenue frustratingly shrank by 35% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

如果我們回顧去年的收入增長,該公司公佈了22%的驚人增長。儘管最近增長強勁,但它仍在努力追趕,因為它三年的收入總體上令人沮喪地縮水了35%。因此,公平地說,最近的收入增長對公司來說是不可取的。

Comparing that to the industry, which is predicted to deliver 59% growth in the next 12 months, the company's downward momentum based on recent medium-term revenue results is a sobering picture.

相比之下,該行業預計將在未來12個月實現59%的增長,根據最近的中期營收結果,該公司的下滑勢頭令人警醒。

With this in mind, we understand why Shenzhen LiantronicsLtd's P/S is lower than most of its industry peers. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. Even just maintaining these prices could be difficult to achieve as recent revenue trends are already weighing down the shares.

考慮到這一點,我們理解為什麼深圳聯創股份有限公司的本益比低於大多數行業同行。然而,我們認為,營收縮水不太可能帶來長期穩定的本益比/S,這可能會讓股東們對未來的失望感到失望。即使只是維持這些價格也可能很難實現,因為最近的收入趨勢已經在拖累股價。

The Final Word

最後的結論

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

有人認為,在某些行業中,市銷率是衡量價值的次要指標,但它可能是一個強大的商業信心指標。

Our examination of Shenzhen LiantronicsLtd confirms that the company's shrinking revenue over the past medium-term is a key factor in its low price-to-sales ratio, given the industry is projected to grow. At this stage investors feel the potential for an improvement in revenue isn't great enough to justify a higher P/S ratio. Unless the recent medium-term conditions improve, they will continue to form a barrier for the share price around these levels.

我們對深圳聯創股份有限公司的調查證實,鑑於該行業預計將會增長,該公司在過去中期的收入縮水是其低性價比的一個關鍵因素。在這個階段,投資者認為營收改善的潛力還不夠大,不足以證明提高本益比和S比率是合理的。除非近期的中期狀況有所改善,否則將繼續在這些水準附近形成股價障礙。

You should always think about risks. Case in point, we've spotted 2 warning signs for Shenzhen LiantronicsLtd you should be aware of, and 1 of them doesn't sit too well with us.

你應該時刻考慮風險。舉個例子,我們發現深圳聯創股份有限公司的2個警告標誌你應該知道,他們中的一個和我們坐在一起不太好。

If these risks are making you reconsider your opinion on Shenzhen LiantronicsLtd, explore our interactive list of high quality stocks to get an idea of what else is out there.

如果這些風險讓你重新考慮對深圳聯創的看法,探索我們的高質量股票互動列表,以瞭解還有什麼。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.

In order to justify its P/S ratio, Shenzhen LiantronicsLtd would need to produce anemic growth that's substantially trailing the industry.

In order to justify its P/S ratio, Shenzhen LiantronicsLtd would need to produce anemic growth that's substantially trailing the industry.