There seems to be a consensus that the Chinese tram storm has swept through Europe, and that the Chinese car companies that paid homage to “volume” first are also “occupying” the European market step by step. However, when UBS removed the BYD Seal and explained Chinese car companies in detail, starting with parts, it still had to marvel at their complete supply chain,Over 75% of self-developed parts and the “cost power” that can disrupt global car companies.

On September 5, UBS analysts including Patrick Hummel released a research report saying that through disassemblyThe latest model from BYDSeal, they had an in-depth understanding of BYD's supply chain, costs, structure, technology, and after-sales service, and came to the conclusion:

- BYD has about 25% lower production costs in Europe than existing Western car companies, and has the potential to disrupt global original equipment manufacturers (OEMs). Chinese OEMs can meet two-thirds of the global automotive market demand.

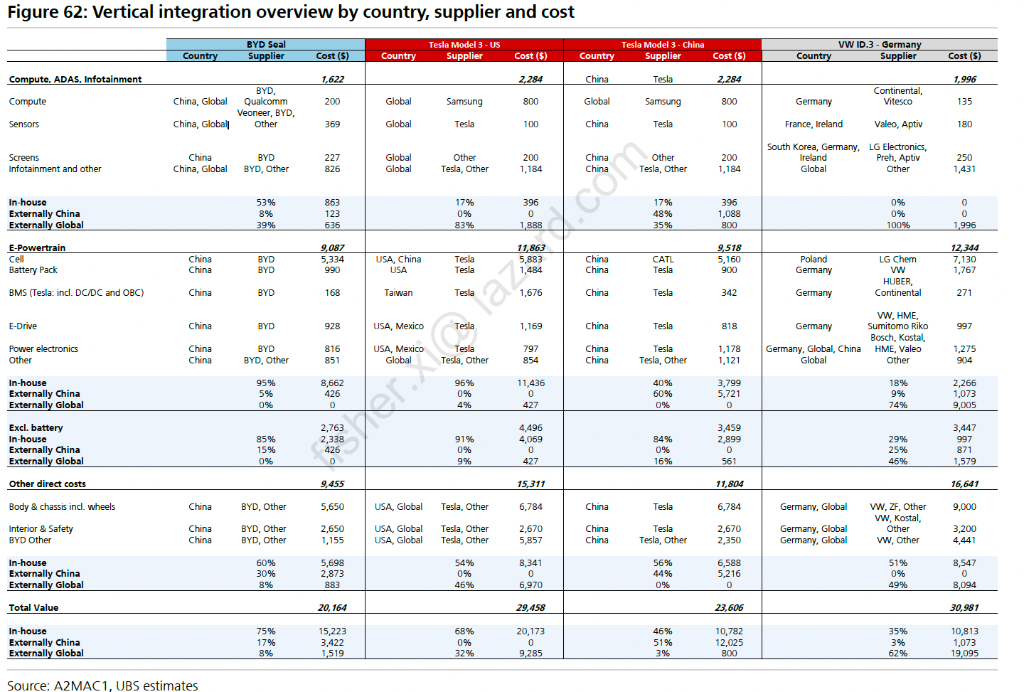

- Through vertical integration and scaling, BYD has a cost advantage,BYD Seal RatioTeslaModel 3 has 15% lower production costs,A BYD Seal is about $3,400 cheaper than the Model 3. Seal has a gross margin of 16% and a profit margin of 5%.

- BYD Seal is cost competitive. Not only is it the factor cost of Chinese production, but it also has advantages in terms of technology content, technology content, and degree of integration and vertical integration.

About 75% of Seal's components are produced by BYD itself. The space left for traditional suppliers around the world is relatively small, and it relies heavily on China's local supply chain. Other than Qualcomm's chips, not many parts are supplied overseas. The manufacturing ratio of Seal auto parts is higher than that of whether Tesla is produced in the US, China, or Volkswagen in Germany.

- Currently, China's tram industry is in the stage of vertical integration triggered by a local price war. Whoever grasps the advantages of integration will be the winner,The winners, on the other hand, will actively pursue a global expansion strategy. This means that the “price war” for electric cars is likely to spread to Europe, and BYD will become the industry leader.

- The prices of Chinese car companies in the European market are clearly higher than in mainland China. The only explanation is that Chinese car manufacturers have not really made an effort in terms of prices; until now they are in the “testing the waters” stage. As time goes on, the prices of Chinese car companies in Europe will become more competitive. Price cuts of 10%-15% for local European brands are a necessary condition for maintaining market share.

- It is estimated that by 2030, the global market share of local Chinese brands will double from 17% today to 33%. European brands have lost the most market share, which is likely to drop from 81% to 58%.The fuel vehicle sector has been hit harder. Volkswagen, Renault, Volvo, and Honda have been the most negatively affected.

The advantages of BYD Seals - bringing consumers the greatest value for money

UBS stated in its report that in just a few years,China overtook Japan as the world's largest automobile exporter at an alarming rate. Chinese trams are extremely attractive to consumers because: (1)Advantages of scale and cost result in a very high price/performance ratio; (2)Industry-leading battery technology and power technology and supply chain; (3)First-class digital user experience (intelligent equipment such as intelligent cockpits and driving assistance systems).

UBS said that BYD can be said to be a witness to China's electric vehicle strength and has become the latest benchmark in the global electric vehicle market.In order to better understand the competitive advantages and supply chain of leading Chinese tram manufacturers, UBS disassembled BYD's latest Seal, conducted a detailed analysis of BYD's power system, including lithium iron phosphate (LFP) batteries, E/E electrical and electronic system architecture, and ADAS intelligent driving assistance systems, and compared them with the previously disassembled Volkswagen ID.3 and Tesla Model 3.

UBS put it bluntly. Overall,BYD's latest Seal is cheaper, larger in space, and has a more luxurious interior than the VW ID.3. Compared with the VW ID.3 and ID.4, BYD's degree of digitalization fully meets consumer expectations, and the interior is more beautiful (larger screen, higher quality materials):

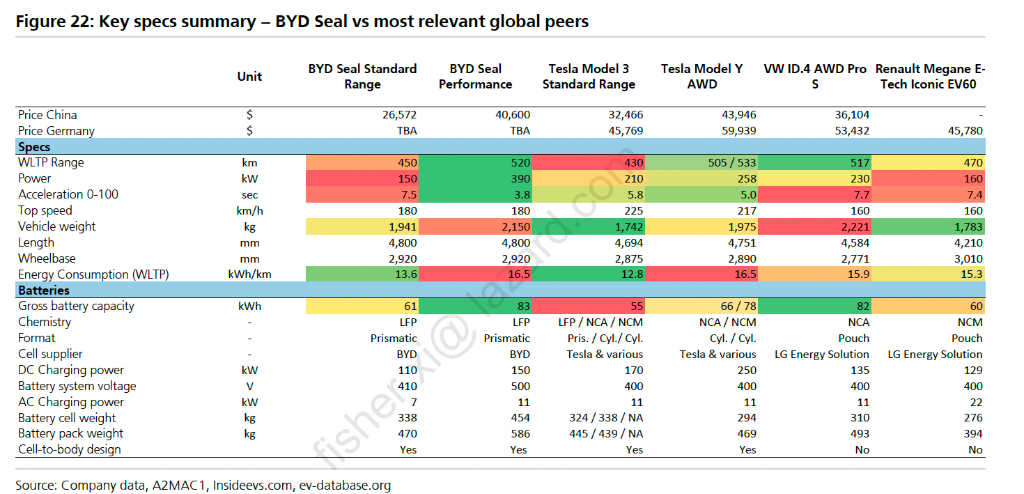

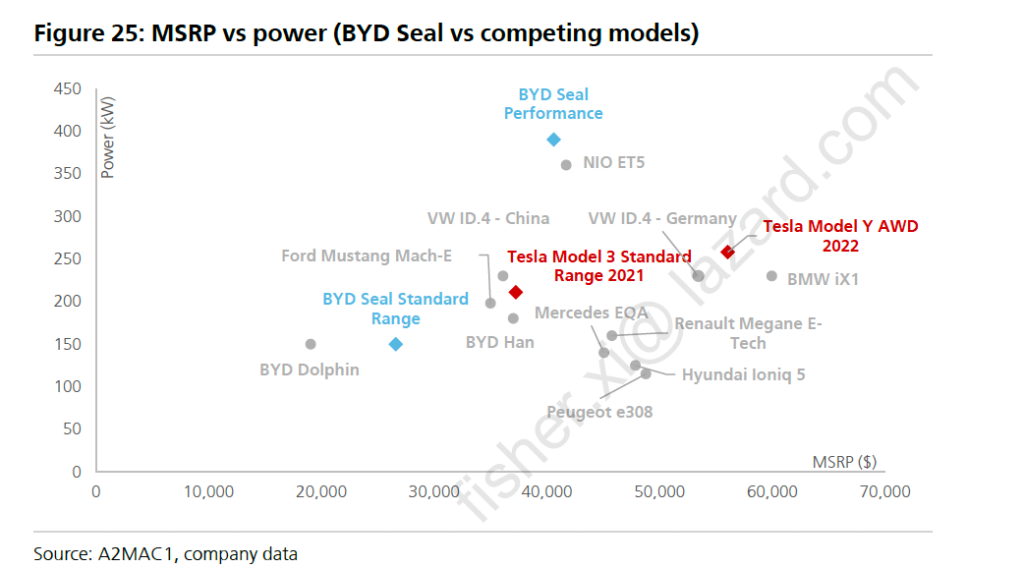

The models that directly compete with BYD include the Sri Lankan Model 3 and Y as well as the VW ID.3 and ID.4.

Seal is the closest car to the Tesla Model 3 under the BYD genealogy. They are all mid-size cars. They are all rear-drive cars, and are the closest in price, size, and shape. They can be compared very well with the disassembly of the previous Tesla Model 3.

The Seal has more interior space than the Tesla Model 3, yet it's much cheaper. Unlike Tesla, the design goal of the BYD Seal is not to achieve full autonomous driving over time, but it meets all the expectations of the economy market for ADAS with a reliable Class 2 system, and has a higher quality interior.

Unlike the VW ID.3 and ID.4, its level of digitalization is exactly what consumers expect, and in our opinion, it also has a more beautiful interior (larger screen, better materials).

As shown in the detailed teardown analysis, BYD has used its price advantage through a high degree of vertical integration, bringing excellent engineering solutions and cost leadership. The BYD Seal is currently sold in China and some Asian markets, but has announced plans to introduce it to Europe in the second half of 2023, at which time it will compete directly with existing European automakers.

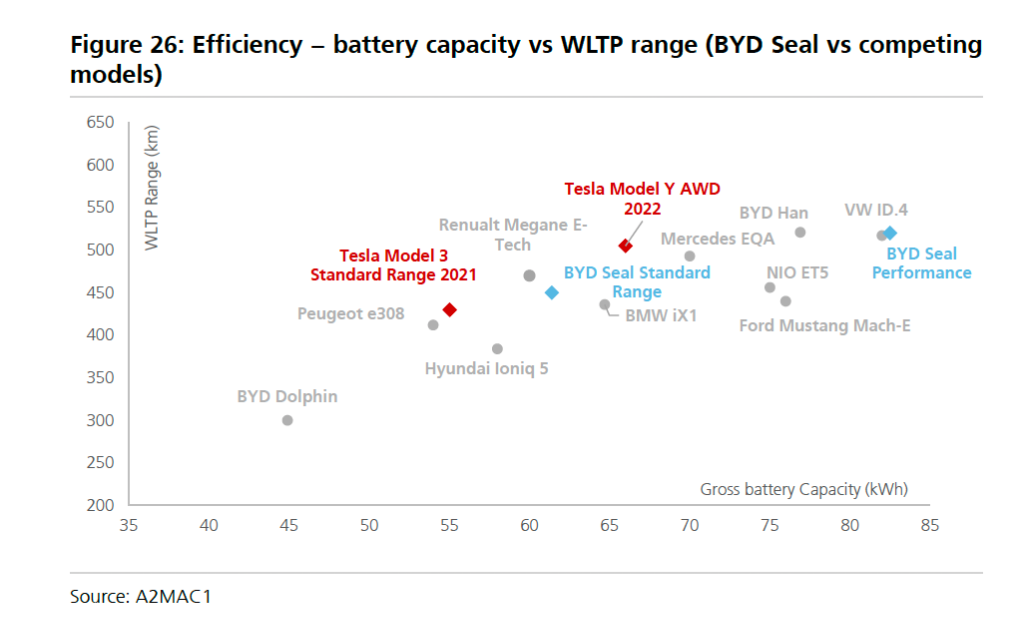

UBS emphasized,WLTP pure electric range is an important indicator of whether consumers are willing to spend money to buy economical electric vehicles. In this indicator, BYD products have their own advantages:

The ratio between BYD's recommended retail price and range has been lost in car companies' competition.

In terms of efficiency (the ratio of WLTP range to battery capacity), the BYD Seal is on average among models in its class. Tesla continues to lead with first-class aerodynamic design and efficient power systems.

Looking at the details, Seal's performance in areas including the battery, powertrain, driver assistance systems, and E/E architecture is not outstanding; most key performance indicators are at least medium.But the key point is that from a cost perspective, seals score very high on every metric,Moreover, in terms of battery cells and electronic devices, it is the cheapest of its kind:

UBS says, in other words, the position of seals is very accurate, can bring maximum cost performance to ordinary consumers.

BYD's cost advantage

UBS pointed out that BYD has shown a high vertical integration advantage. About 75% of the parts in Seal are produced by BYD itself, and the space left for traditional suppliers around the world is relatively small. It relies heavily on China's local supply chain. The manufacturing ratio of Seal Auto parts is higher than that of Tesla's production in the US, China, or Volkswagen's production in Germany:

The most prominent of these are batteries, powertrains, and electronic components, including printed circuit boards (PCBs). Other than Qualcomm's chips, not many parts are supplied overseas.

In China, Tesla's degree of vertical integration in terms of batteries is lower than that of BYD because it relies on suppliers outside of China, but Tesla's supply chain is more integrated in terms of ADAS and software.

In terms of taking advantage of China's cost advantages, BYD and Tesla can use their production capacity in China as a global production center, while traditional OEMs are only joint venture partners (usually only 50% or less), so using China's production capacity to serve the global market is a financial choice.

UBS pointed out that in terms of gross profit, Seal's gross margin reached 16%, or 3,700 US dollars/vehicle. Generally speaking, the higher version with a higher battery capacity and a full-time four-wheel drive system should have a higher profit margin, since the price difference is greater than the incremental cost.Compared with the Model 3 standard series made in China, it is estimated that the production cost of the BYD Seal is 15% lower:

The battery costs for the two cars are similar (BYD's battery cost is slightly higher), but BYD chose a powertrain and ADAS with a lower overall cost (slightly lower performance), while Tesla's assembly labor costs should be slightly lower than BYD's due to the use of first-class manufacturing processes and a higher degree of factory automation.

Overall, the BYD Seal is about 3,400 US dollars cheaper than the Model 3 in terms of direct cost. However, with the introduction of the new Model 3, this gap is likely to close.

Will BYD set off a storm in Europe?

According to data released by the General Administration of Customs, the amount of Chinese cars imported by the EU in 2022 was 13.3 billion US dollars, an increase of 100% over the previous year. According to S&P global data, by the end of this year, 1/5 of the cars imported from Europe may come from China, compared to less than 1% five years ago.

UBS emphasized that there is no doubt that in a market like Europe,Only electric cars can get export share, and only a few Chinese companies can master the path of global expansion,This is also enough to disrupt the global automobile market:

The situation over the past few months also shows that the global rise of local Chinese car brands is not a straight line. We believe that a tram price war in China will inevitably lead to a reshuffle in the industry. This will force some electric vehicle manufacturers to enter a state of maintaining cash flow and not be forced to postpone their global expansion plans. For some automakers, this situation will be permanent.

It is highly likely that only a few Chinese automakers will successfully take the initiative to expand, which is enough to disrupt the global car market.

UBS pointed out that China's tram industry is currently in a stage of vertical integration triggered by a local price war. Whoever has the advantage of integration will be the winner, and the winner will actively pursue a global expansion strategy. This means that tram prices are likely to spread to Europe.And BYD will be the industry leader:

Tesla has already begun exporting to Europe, and BYD will also export seals to Europe to compete with traditional OEM products made in Europe.

Companies like BYD can use the low-cost Chinese supply chain to assemble cars locally in target markets.

We believe that Chinese OEMs can enter two-thirds of the global automobile market. Given the size of the European market and clear plans for the promotion of electric vehicles, Europe is the most attractive region in the world.

According to our analysis, after deducting EU automobile import tariffs, the cost for BYD to produce seals in Europe will be about 10% higher than exporting from China. Even if this were the case, BYD Seal would still be about 25% cheaper (about 10,000 US dollars) than electric models of the same quality made by European OEMs.

UBS pointed out that Europe is now the biggest opportunity for local Chinese tram companies.The reasons are as follows:

● The tram market is growing rapidly. Due to the ban on fuel vehicles (the proportion of trams will reach 69% in 2030), the proportion of trams will reach 100% by 2035;

● There are no local disruptive companies in Europe; only traditional OEMs are transitioning to the era of electric vehicles at a slow pace;

● There is a high degree of overlap with China's market segments, that is, the same car category (small and compact crossovers and SUVs are the most popular market segments in both places);

● The cost advantage of Chinese OEMs is difficult (if not impossible) for European OEMs to replicate.

UBS said that according to the survey, for European consumers (and consumers in other regions),The purchase price is the most important decision-making factor, and China's economical electric cars are likely to seize most of the European market's share from the transformation of traditional fuel-fueled vehicles:

It should also be noted that in a survey of European tram purchasers, UBS found that although it is still low compared to existing European brands, BYD also has the highest market share among local Chinese brands. Economical electric vehicle brands (BYD, SAIC Motor Group) have shown a more positive trend than high-end electric vehicle brands (such as NIO).

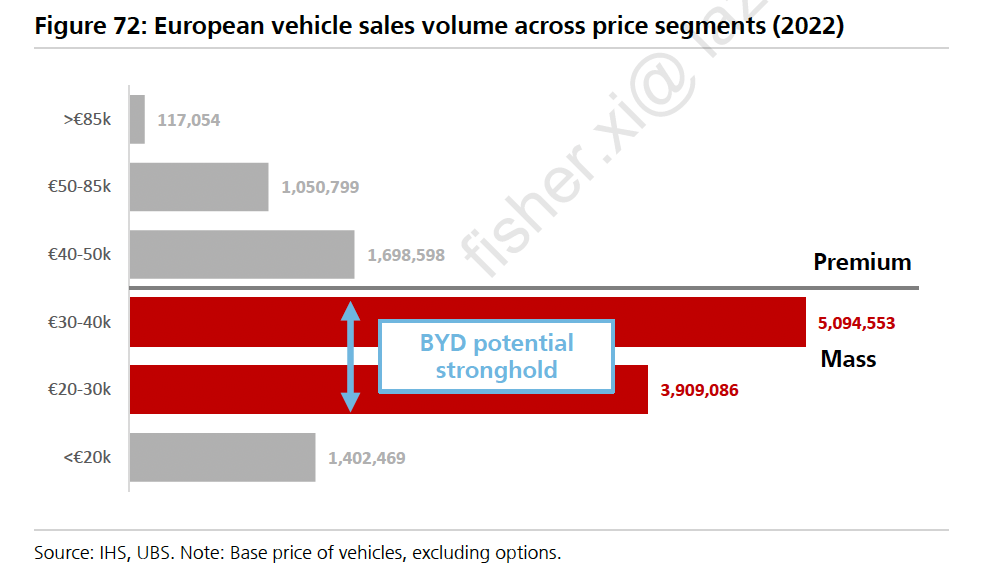

UBS pointed out that when asked why it is considering purchasing a pure electric vehicle in China,50% of consumers emphasized “good quality and low price” as the primary reason. In view of this,UBS judges that the European economy car market is more likely to be impacted by Chinese tram brands than the high-end and luxury markets:

Currently, European automakers only have electric vehicle products starting at 40,000 euros, which is why the penetration rate of electric cars in the economy market is relatively low. Chinese tram makers and Tesla are best placed to fill this gap, thereby promoting the spread of electric vehicles in the European economy market.

According to UBS, budget cars from Volkswagen, Stellantis, and economy cars such as Renault are the most threatened,At the same time, BYD's gradual occupation of the European market will also have an impact on Japanese and South Korean automakers:

Overall, similar models from European OEMs cost $1.5-25 million more than the Seal.

However, as shown in the chart below, the retail price of electric cars of BYD and other local Chinese brands in Europe has so far been significantly higher than in China. Our only explanation for this is that China's local automakers have so far been in the “testing waters” stage, rather than “pressing it step by step”. We think Chinese OEMs will become more aggressive in pricing in Europe over time.

Is the European market “forced” to start a “price war”?

UBS analyzed in the report that assuming that BYD's profit when selling in Europe is the same as its profit in mainland China, it can be found that it is at least 15% cheaper than local European cars. This situation is unsustainable.It is expected that Volkswagen will need to cut prices drastically to avoid loss of market share:

According to our conservative estimates, with profit margins unchanged, the price of BYD Seals in Europe could be about 9,000 US dollars higher than the price in China (including: 10% import tariffs, shipping costs per vehicle, additional distribution profits, and the difference between German VAT and Chinese VAT).

And this also means that there is a big price gap between BYD and European competitor models,We can find that these models are at least 15% more expensive, and it should be emphasized that these “naked cars” have far fewer interiors than the BYD Seal, and are also much smaller in size (such as the Volkswagen ID.3 or Peugeot e208).

The price of similar models in the ID.4 class is more than 30% higher. In our opinion, this situation is unsustainable, and we expect the public will need to drastically reduce pricing to avoid loss of market share.

UBS said that if European automakers do not cut prices, they will be squeezed out of the market. Compared with similar products, a price reduction of 10%-15% is a necessary condition to win customers:

Without such an incentive mechanism, we think only a very small number of consumers with extremely high brand loyalty would not give up on local brands. Gradually, however, consumers will realize that China's electric vehicles are superior to existing products in many ways, particularly with high-end standard features in infotainment and † ADAS.

For large sedans and SUVs, the price gap with traditional competitors is even greater than in the small/compact market.

However, this is the base for high-end and luxury brands, and due to the brand image of established companies, price is no longer a selling point.However, products need to meet the high expectations of high-end brand customersAs far as battery life, connectivity, and ADAS are concerned, Chinese trams are on par with them, or even better.

Additionally, interiors often have high-end appeal. But the higher the price, the more difficult it is for Chinese brands to subvert established European companies. Furthermore, in the high-end market, high-performance fuel vehicles have a stable consumer base, and we don't think these cars will soon be replaced by electric vehicles.

UBS pointed out that data shows that new energy vehicles currently account for 35% of the automobile market, and BYD has a dominant position in the electric vehicle sector, with a market share of about 30%. Judging from the passenger car market performance in Q1 2023, BYD ushered in a historic moment, surpassing Volkswagen for the first time.Become the best-selling passenger car brand in China:

Despite utilizing the Global Electrification Kit (MEB) platform, Volkswagen's share of the NEV market in China is still very small. In our opinion, Volkswagen is not competitive compared to local Chinese brands, especially in terms of software and ADAS intelligent driving assistance systems.