Recently, Shulan Medical Management Co., Ltd. (“Shulan Medical”) submitted an IPO application to the Hong Kong Stock Exchange.

During the reporting period, Shulan Medical's business was divided into three segments: self-operated hospitals, hospital management, and platform services.

Among them, self-operated hospitals are the main source of revenue. Revenue from 2020 to 2022 was 1,218 billion yuan, 1,111 billion yuan, and 1,296 billion yuan respectively, accounting for more than 70% of total revenue.

Although revenue from the main business is already substantial, Shulan Medical is still in a state of loss. Losses for the first quarter of 2022 and 2023 were 111 million yuan and 32 million yuan respectively.

The core reason is that Shulan Medical is expanding rapidly.

In addition to a core self-operated hospital in Hangzhou, Shulan Medical has also successively built hospitals in Anji and Quzhou. The latter two have eroded its profits to a certain extent.

“Net losses have been generated in 2021 and 2022 and for the three months ended March 31, 2022, and March 31, 2023, mainly due to the construction and establishment of Shulan (Anji) Hospital and Shulan (Quzhou) Hospital as we expand our hospital network.” Shulan Medical said.

But Shulan Healthcare doesn't seem to have given up on expansion. Currently, preparations are under way to build the Shulan Liangzhu International Medical Center and Shulan (Boao) Hospital with a proposed capacity of up to 2,000 beds.

All of this poses more challenges to Shulan Medical's short-term profits.

Wool comes from sheep

Unlike specialty private hospitals such as Aier Ophthalmology (300015.SZ) and Huaxia Ophthalmology (301267.SZ), which can increase revenue by expanding the scale, comprehensive private hospitals can generally only increase revenue by expanding the influence of individual hospitals.

Shulan Healthcare, which also has its main business in self-operated general hospitals, is carrying the banner of revenue through individual hospitals.

As of the end of March this year, Hangzhou Shulan Hospital, the core hospital of Shulan Medical, has opened 1,000 beds and 46 clinical specialties.

It is worth mentioning that although Hangzhou Shulan Hospital has only been in operation since 2015, in just a few years, its revenue in a single year has exceeded 1 billion yuan.

As the main source of revenue for Shulan Medical, the revenue of Hangzhou Shulan Hospital from 2020 to 2022 was 1,197 billion yuan, 1,057 billion yuan, and 1,061 billion yuan respectively, accounting for 74%, 68.3% and 59.7% of total revenue, respectively.

Compared with specialist hospitals, the gross margin of Hangzhou Shulan Hospital is not very high. It was only 11.90% in 2022, lower than the 35.94 percentage points and 20.29 percentage points of Huaxia Ophthalmology, which focuses on ophthalmology and Haijia Medical (6078.HK), which focuses on cancer diagnosis and treatment.

Due to the large number of departments opened, Hangzhou Shulan Hospital introduced doctors from many public hospitals as subject leaders. This is probably the reason why its gross margin is limited.

According to the official website, in addition to founders Li Lanjuan and Academician Zheng Haisen sitting in town, physicians at Hangzhou Shulan Hospital also include Ye Zaiyuan, former director of Zhejiang Provincial People's Hospital, and Li Qiyong, former deputy director of hepatobiliary and pancreatic surgery at the First Affiliated Hospital of Zhejiang University.

Wool comes from sheep, and the fees at Hangzhou Shulan Hospital are not low.

In the first quarter of 2023, the number of outpatients at Hangzhou Shulan Hospital and the average cost of outpatient visits were 140,800 and 458 yuan respectively. The average cost of outpatient visits was 14.82% higher than the average for level-3 public hospitals during the same period.

Also bridging the gap is the cost of hospitalization.

In the first quarter of 2023, the number of hospitalizations and the average cost of hospitalization at Hangzhou Shulan Hospital was 0.95 million and 241,000 yuan, respectively. The average cost of hospitalization was 74.64% higher than the average for level-3 public hospitals during the same period.

Although the fees are not low, Shulan Medical still failed to achieve profits. Losses for the first quarter of 2022 and 2023 were 111 million yuan and 32 million yuan, respectively.

The main reason is the capital expenditure initiated by Shulan Medical to expand its business scale.

In addition to Hangzhou Shulan Hospital, Shulan Medical also opened 2 comprehensive medical institutions in Anji and Quzhou in 2021 and 2022, respectively.

“Net losses have been generated in 2021 and 2022 and for the three months ended March 31, 2022, and March 31, 2023, mainly due to the construction and establishment of Shulan (Anji) Hospital and Shulan (Quzhou) Hospital as we expand our hospital network.” Shulan Medical said.

In 2021 and 2022, the revenue of Anji Shulan Hospital located in the tourist resort area was 30 million yuan and 104 million yuan respectively; in 2022, the revenue of Quzhou Shulan Hospital, which is positioned as a regional general hospital, was 104 million yuan.

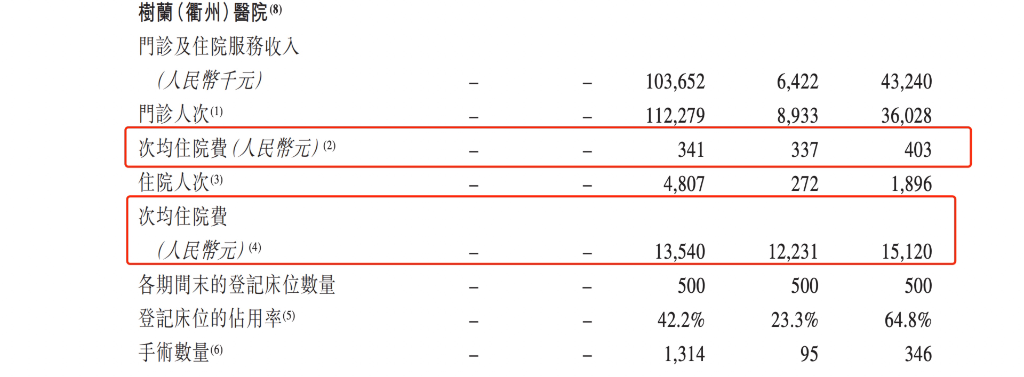

An investigation by Xinfeng (ID: TradeWind01) found that Shulan Medical's prospectus appeared to have made an error in disclosing the “average outpatient fee” of Quzhou Shulan Hospital.

On page 240 of the prospectus, Shulan Medical erroneously recorded the “average outpatient fee” of Quzhou Shulan Hospital as the “average inpatient fee”. As a result, two lines of the same “average hospitalization fee” for this hospital appeared in the income table, but the data shown in the two were quite different.

According to the prospectus, in 2022, the first quarter of 2022, and the first quarter of 2023, the amount of “average hospitalization fee” in line 4 of the Quzhou Shulan Hospital form was 341 yuan, 337 yuan, and 403 yuan, respectively; the amount of “average hospitalization fee” in line 6 of the hospital form for the same period was 13,500 yuan, 12,200 yuan, and 151,000 yuan, respectively.

However, if the “average inpatient fee” in line 4 of the Quzhou Shulan Hospital form is changed to “average outpatient fee”, the amount shown will return to reasonable.

In addition, Shulan Medical is also preparing to build the Shulan Liangzhu International Medical Center and Shulan (Boao) Hospital with a proposed capacity of up to 2,000 beds.

The doctor is the core

Shulan Medical has also expanded its business into hospital management services.

“We provide management-related services to other hospitals for a service period of 1 to 10 years. Hospitals receive services when we perform our contracts and enjoy the benefits of our performance. Revenue from the provision of hospital management services is recognized during the period of provision of the relevant services.” Shulan Medical said.

As of the end of March this year, Shulan Medical has signed management service agreements with 14 hospitals.

From 2020 to 2022, Shulan Medical's hospital management service revenue was 114 million yuan, 112 million yuan, and 117 million yuan respectively.

Compared to self-operated hospitals, the hospital's “escrow” business is obviously more profitable. From 2020 to 2022, gross margins reached 65.20%, 66.60%, and 70.80%, respectively.

“We help partner hospitals improve service quality, management efficiency and research capabilities by deploying doctors and nurses, providing training opportunities, and assisting partner hospitals to carry out medical research projects. In return, we receive service revenue from partner hospitals.” Shulan Medical said.

However, it seems that the core of Shulan Medical's management services for partner hospitals is not the optimization of the management system, but rather the sharing of high-quality doctors' resources.

According to public reports, in June 2023, Shulan Medical and Partner Hospital Jinjiang Hospital and the Jinnan Branch of Jinjiang Hospital jointly hosted a free consultation event. During this period, physicians such as Shulan Medical Academic Committee member Ye Zaiyuan, Shulan Distinguished Expert, and Xu Ji, chief physician of gastrointestinal surgery at Zhejiang People's Hospital, provided medical services to patients.

Looking at it this way, doctors' resources are still Shulan Medical's core competitiveness, and whether it can continue to retain high-quality doctors is also testing Shulan Medical's management ability in various aspects such as the remuneration system.

The business of operating and managing hospitals no longer seems to be able to satisfy Shulan Medical's ambitions; it also wants to become a vaccine innovator.

Currently, Shulan Medical's ongoing research pipeline also includes 5 COVID-19 mRNA vaccine clinical trials and 1 novel coronavirus inactivated vaccine clinical trial.

However, along with the decline of the epidemic, the commercialization value of Shulan Medical's COVID-19 mRNA vaccine declined sharply.

When will Shulan Healthcare, which is “both necessary and necessary,” make a profit may be a difficult issue at hand.