Under the market environment of warm wind blowing frequently in the real estate policy, I Le Home (603326.SH), which does custom home, has also become the darling of the secondary market.

As of the close of trading on September 6, I Lejia rose eight times in a row, but in such a market, the major shareholders could not sit still first, and carried out a clearance-style reduction of their holdings.

On the evening of the 6th, we Lejia issued an announcement saying that major shareholders in Fan Yi and his concerted actors reduced their holdings in the company by 22.44 million shares, or 7.1%, and bought 4200 shares.

As the major shareholders reduced their holdings by more than 5% and did not make an announcement in advance, the SSE then issued a regulatory work letter.

At noon on September 7, I Lejia issued another announcement that the company's shareholders, Fan Yi and his concerted actor Liu Fujuan, received a notice from the Securities Regulatory Commission that the CSRC decided to file a case against the aforementioned shareholders on suspicion of over-proportional reduction.

On the evening of the 7th, we released the simplified equity change report of Fan Yi and his actors. From September 5 to 6, we sold 2.91 million and 19.53 million shares respectively, which were calculated at the closing price of 14.66 yuan per share and 16.13 yuan per share on the day. About 358 million yuan was cashed out to Fan Yi and other shareholders.

In the third quarter of last year, Fan Yi and his concerted actors increased their holdings in our Le Home. If the highest price in that quarter is 8.09 yuan per share, the position held by shareholders such as Fan Yi will increase by at least 97%.

But this operation of reducing holdings is all for nothing after all.

On the evening of the 7th, in reply to the regulatory work letter of the Shanghai Stock Exchange, I Lejia said that Fan Yi and his actors promised to buy back this illegal over-reduction shares as soon as possible within the limits of laws and regulations. If this part of the share repurchase involves income, it will all be owned by the listed company.

From the perspective of performance fundamentals, our main business is not as imaginative as the stock price trend of the continuous board.

As the custom home industry is related to the real estate industry, houses are difficult to sell and furniture is the same. And the industry pattern is scattered, the entry threshold is low, and the competition is fierce. As early as 2021, I Lejia successively fell into a situation of single-digit or even negative revenue growth.

After midday on September 7, I Lejia changed from rising to falling, and the stock price plummeted and finally closed at 14.52 yuan per share.

"commit a crime" against the wind

At a time when the CSRC has successively sent signals to enliven the capital market and boost investor confidence, the major shareholders of Le Home can be regarded as committing crimes against the wind.

During the period from August 28 to September 6, Lejiaju issued six announcements of serious abnormal fluctuations in stock trading, and the controlling shareholders and actual controllers also wrote back one after another denying that there was no trading.

Until the evening of September 6, a "regulatory work letter on the reduction of shares held by shareholders of Nanjing Le Home Co., Ltd." on the Shanghai Stock Exchange revealed that the major shareholder of Lejia was in Fan Yi and its concerted actors, Liu Fujuan, Yantai Ewei Management Co., Ltd. (hereinafter referred to as "Ewei Management"), Tibet Ewei Venture Capital Co., Ltd. (hereinafter referred to as "Ewei Venture Capital"), Yantai Ewei Trading Co., Ltd., and other illegal reduction actions.

During the period from June 30 to September 6 this year, Fan Yi and his actors reduced their holdings in the company by 22.44 million shares, or 7.11%, through centralized bidding, and bought 4200 shares.

According to Wind data, natural person investors bought a total of 333 million yuan from August 28 to September 6, accounting for 72.05% of the total, followed by net sales of institutional seats.

According to the supervision letter of the Shanghai Stock Exchange, according to the relevant provisions of the measures for the Administration of acquisition of listed companies in the Securities Law, the above-mentioned shareholders, as shareholders with a total shareholding of more than 5%, shall make a report and announcement when the change in their shareholding ratio reaches 5%. No more stocks shall be bought or sold from the date of occurrence of this fact to 3 days after the announcement. Yu Fanyi and other shareholders have been suspected of violating the above regulations.

On September 7, the CSRC issued a case notice that, on suspicion of over-proportional reduction, the CSRC decided to file a case against the aforementioned shareholders in accordance with laws and regulations such as the Securities Law of the people's Republic of China and the Administrative punishment Law of the people's Republic of China.

In fact, this is not Fan Yi's first violation.

As early as January 27, 2021, Evec and Eve Venture Capital, the concerted actors of Fanyi, increased their holdings of our music home shares through centralized bidding transactions, resulting in the total shareholding of the above shareholders increasing from 4.89% to 5.42%. When the shareholding ratio reached 5%, it did not stop increasing its holdings in time, nor did it disclose the equity change report, such as withdrawing from the undisclosed reduction transaction.

From January 28 to February 1, 2021, Evian Management and Evey Venture Capital continued to increase their holdings by 472000 shares and 1.071 million shares respectively, accounting for 0.15% and 0.34% of the company's total share capital, respectively. It was not until February 4 that Fan Yi and his concerted action disclosed the report on changes in rights and interests.

At that time, the Shanghai Stock Exchange paid regulatory attention to the Evian industry and Evey Venture Capital, and in September of that year, Fan Yi and his concerted actors received a warning letter issued by the Jiangsu Securities Regulatory Bureau.

As far as the illegal clearance-style reduction operation of Fan Yi and his concerted actors is concerned, it is an obvious "crime" against the wind.

On August 18 this year, in response to a reporter's question, the relevant responsible person of the CSRC made it clear that the Securities Law, the Company Law and the relevant regulatory rules have clear provisions on the shareholding period and the number of shares sold by major shareholders and Dong Jiangao. Major shareholders and Dong Jiangao shall strictly abide by them and shall not evade the restrictions on the reduction of holdings in any way. And the person in charge said at the meeting, "the Securities Regulatory Commission will continue to do a good job in the supervision of holdings reduction and resolutely crack down on illegal holdings reduction."

In response to the regulatory work letter of the Shanghai Stock Exchange on the evening of September 7, I Lejia said that Fan Yi and his concerted actors expressed sincere apologies for this illegal reduction, and the aforementioned shareholders promised to buy back the illegal excess reduction shares as soon as possible within the limits permitted by laws and regulations. if this part of the share repurchase involves income, it will be owned by the listed company.

The above rectification measures are similar to the illegal reduction of holdings by another listed company.

On September 6th, 603377.SH 's controlling shareholders reduced their holdings of 3.4 million Dongfang Fashion shares through bulk trading in the case of the company's stock price break, violating "some regulations on the reduction of shares held by shareholders of listed companies and Dong Jian Gao". Under the penalty decision of the Shanghai Stock Exchange to give it a regulatory warning, the controlling shareholder of Dongfang Fashion promised to buy the shares previously reduced by the meeting, and the proceeds will go to the listed company.

Waiting for the real estate to pick up.

If combined with the fundamentals of my home furnishings, the recent eight-board market is more like a market mood hype.

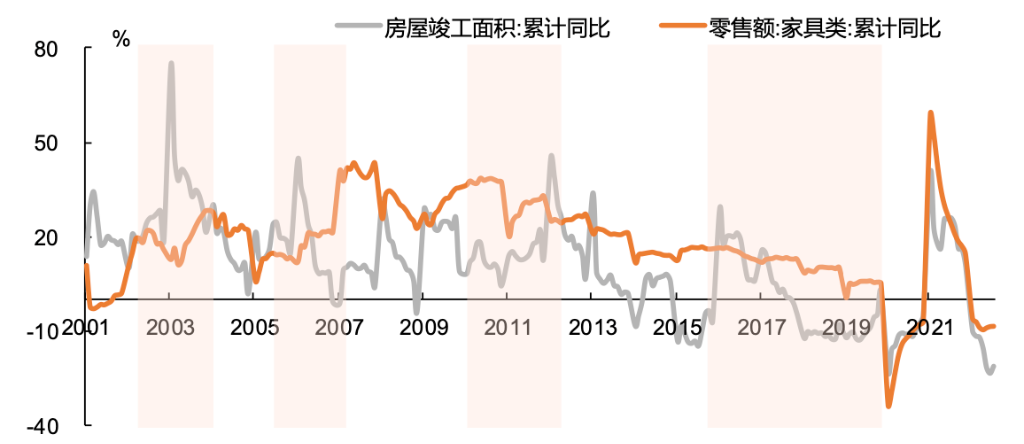

As a related industry of the real estate industry, the retail sales of furniture is positively related to the completed area of the house. According to the National Bureau of Statistics, the total revenue of furniture manufacturing enterprises above scale reached 289.82 billion yuan in the first half of this year, down 9.9% from the same period last year; the total profit was about 13.2 billion yuan, down 1.9% from the same period last year.

Specific to the custom home industry where we live, the competition pattern is scattered and the regional characteristics are obvious. Nearly 60% of our revenue contributes to East China.

According to a report by Yang Kan of Ping an Securities and others, the CR9 of the custom home industry is only 11.6% in 2022, while the market share of 603833.SH, which has the largest share, is about 4.8%, while that of China Le Home is only 0.4%.

When consumers spend at home, they have the characteristics of large one-time investment, long decision-making chain, great correlation between different products and so on. As a result, I Le Home, which started as a custom cabinet, has been looking for increments from the custom assembly business since 2016.

In 2022, the overall cabinet revenue decreased by 27.92% compared with the same period last year, which dragged down the overall revenue of our Le Home by 3.43% to 1.666 billion yuan. Among them, the revenue of the whole house customization business contributed 1.124 billion yuan, an increase of 15.51% over the same period last year, accounting for 67.45% of the revenue.

But the revenue growth of the whole-house customization business is not driven by sales, but more likely by price increases. During the reporting period, the sales of our house-wide customized products increased by only 0.19% compared with the same period last year.

The trend of selling less and more expensive is also reflected in the performance of their peers. Take 002572.SZ 's wardrobe and its accessories, which account for more than 80 per cent of revenue, whose sales fell 1.6 per cent in 2022 from a year earlier, but contributed 10.98 per cent year-on-year growth in revenue.

At the same time, in order to "squeeze" out more profits, the three fees of our home furnishings have declined. In the first half of this year, the rate of sales expenses and management expenses decreased by 2.02% and 1.18% respectively compared with the same period last year.

However, the marginal effect of price increase and fee control will eventually come to an end, especially in the home market where the competition is scattered and fierce, it is more dependent on advertising, promotion and other sales expenses. The sales expense rate of our Le Home is more than 20% all the year round. European Home and Sophia, which rank in the top two in market share, are controlled within 10%.

At present, compared with the hot stock price speculation, we Le Home, which has been "standing still" since 2021, may prefer a substantial reversal of the plight of the industry.