Business performance at home and abroad was outstanding, and Mingchuang Premium's 2023 fiscal year “came to an end” smoothly.

After the Hong Kong stock market on September 15, Mingchuang Premium Group released its report for the 2023 fiscal year ending June 30, 2023.

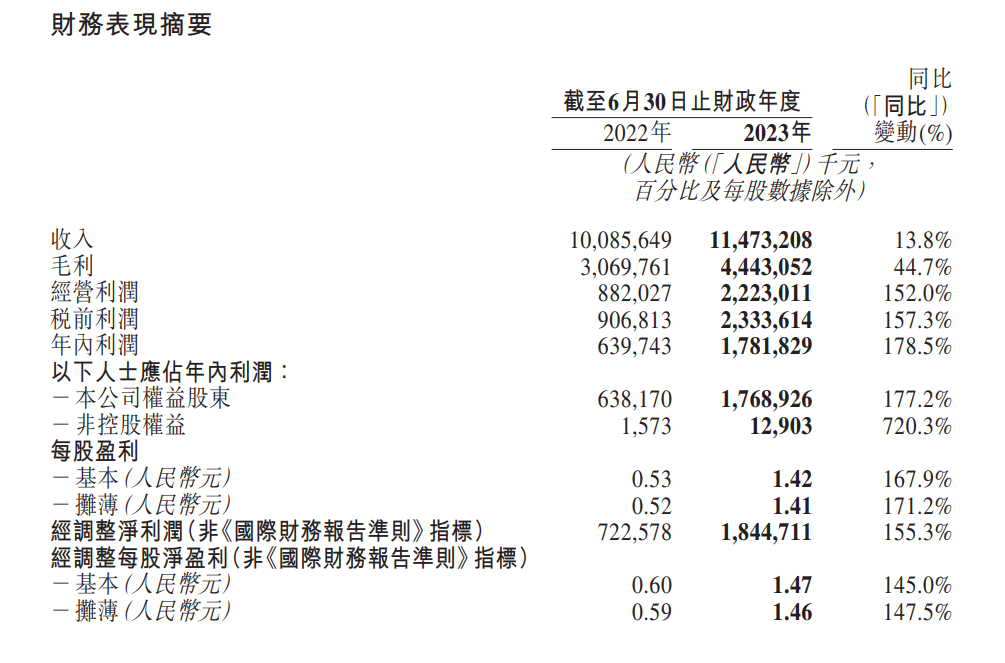

The report shows that in fiscal year 2023, Mingchuang Premium achieved sales revenue of RMB 11.473 billion, an increase of 13.8% over the previous year, reaching a new high. Among them, overseas market sales revenue was 3,822 billion yuan, accounting for 44.7%. Net profit for the mother was 1,769 million yuan, a sharp increase of 177.2% over the previous year. The adjusted net profit was 1,845 million yuan, an increase of 155.3% over the previous year. The basic EPS was 1.47 yuan, an increase of 145% over the previous year.

While sales revenue has increased, the gross profit level of Mingchuang Premium has also improved.Gross profit for fiscal year 2023 was 4,443 billion yuan, up 44.7% year on year, and gross margin was 38.7%, up 2.5 percentage points from the previous year.

While sales revenue has increased, the gross profit level of Mingchuang Premium has also improved.Gross profit for fiscal year 2023 was 4,443 billion yuan, up 44.7% year on year, and gross margin was 38.7%, up 2.5 percentage points from the previous year.

Mingchuang Premium said that the increase in gross margin was mainly due to the company's brand upgrade strategy, cost reduction measures, and initiatives such as shifting the product portfolio to more profitable products.

Furthermore, Mingchuang Premium said it will pay $0.412 per ADS share or $0.103 per common share on September 19, 2023, totaling about $1.29 in cash dividends, accounting for 50% of the company's adjusted net profit. The ex-dividend date is September 6.

Specifically, Mingchuang Premium's overseas and Chinese markets performed well in FY2023.

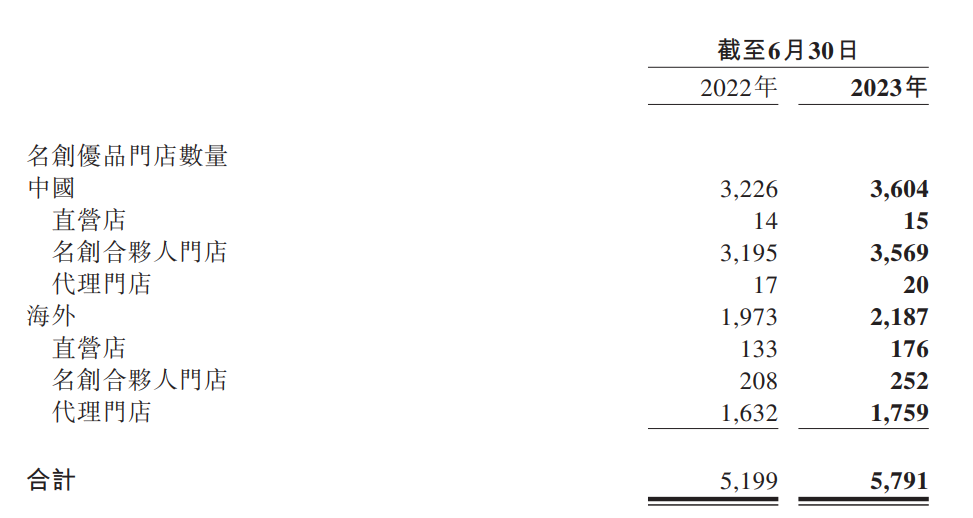

During the reporting period, the Group's total number of Mingchuang Premium stores in China and overseas markets increased from 5199 in the previous year to 5,791, a net increase of 592. The total GMV generated was approximately RMB 21.4 billion.

Among them, as of June 30, 2023, there were 2,187 premium stores in the overseas market, an increase of 10.8% over the previous year, the number of directly-managed stores was 176, an increase of 33% over the previous year; the number of agency stores was 1,759, an increase of 7.8% over the previous year. The overall GMV of stores in overseas markets reached 9.072 billion yuan, an increase of 40% over the previous year.

During the reporting period, there were 3604 Mingchuang Premium stores in the Chinese market, an increase of 11.7% over the previous year, 15 direct-run stores, and 3,569 partner stores, an increase of 11.7% over the previous year. The total GMV of Mingchuang Premium stores in the Chinese market was 10.671 billion yuan, an increase of 2.6% over the previous year.

TOP TOY, another brand incubated by Mingchuang Premium, developed well. During the reporting period, the number of stores reached 118, an increase of 21.6% over the previous year, and a total GMV of 606 million yuan, an increase of 16.8% over the previous year.

In terms of products, as of June 30, 2023, Mingchuang Premium products cover 11 major categories, with an average of about 530 SKUs launched every month, and about 9,700 core SKUs, the vast majority of which belong to the “Mingchuang Premium” brand. The TOP TOY brand offers around 7,000 SKUs, covering 8 major categories, including blind boxes, building blocks, figures, building models, dolls, and other trendy toys.

Mingchuang Premium said it will continue to increase trendy IP licenses and enrich product categories to meet the needs of young consumers for innovative products. It has established joint brand relationships with 80 IP licensees during the reporting period.

Looking ahead to fiscal year 2024, facing the uncertainty brought about by the macro environment, Mingchuang Premium said it will focus on the Group's long-term strategic goals, firmly promote globalization, strengthen product strength, and further optimize the store network.

In the future, we hope to further grow our business through the following strategies.

We will participate in global competition from the two dimensions of cost leadership and product differentiation. While always adhering to the fundamentals of cost performance, we will continue to produce high-quality IP works, featuring IP design, and make lifestyle products more fashionable and trendy.

At the same time, we will also actively experiment with the “super store” strategy, establish a strong brand image in the minds of consumers through “super stores”, lock in “big beauty,” “big toys,” and “big IP” to create super categories, and further explore the space for average single-store sales growth.

In China, we will further penetrate the major cities we already cover by seizing the opportunities of low-tier cities, attracting more new creative partners, and expanding and upgrading our store network.

As far as overseas markets are concerned, we will adapt to local conditions, adopt different operating models in each market, further expand our store network, and continue to deepen our strategic markets in North America, Asia and Europe.

Additionally, Mingchuang Premium made the following disclosures regarding recent business conditions outside of the reporting period:

July 2023: The average GMV per store of Mingchuang Premium stores increased by about 14%, driving the GMV of Mingchuang Premium's offline stores in China to increase by more than 25% year-on-year. The GMV of Mingchuang Premium's overseas business increased by about 50% year-on-year.

August 2023: The GMV of Mingchuang Premium's offline stores in China increased by about 45% year-on-year, due to the fact that the average GMV of Mingchuang Premium stores per store increased by about 25% and the average number of stores increased by about 15%. The GMV of Mingchuang Premium's overseas business increased by more than 45% year-on-year

Mingchuang Premium's US stock opened and dived and is now down 2.5%.

销售收入增长的同时,名创优品的毛利水平也有所改善。2023财年毛利为44.43亿元,同比增长44.7%,毛利率为38.7%,较上年提升2.5个百分点。

销售收入增长的同时,名创优品的毛利水平也有所改善。2023财年毛利为44.43亿元,同比增长44.7%,毛利率为38.7%,较上年提升2.5个百分点。