[hot spot focus]

002654.SZ: there is still uncertainty about the future market sales of a number of storage products released by the company.

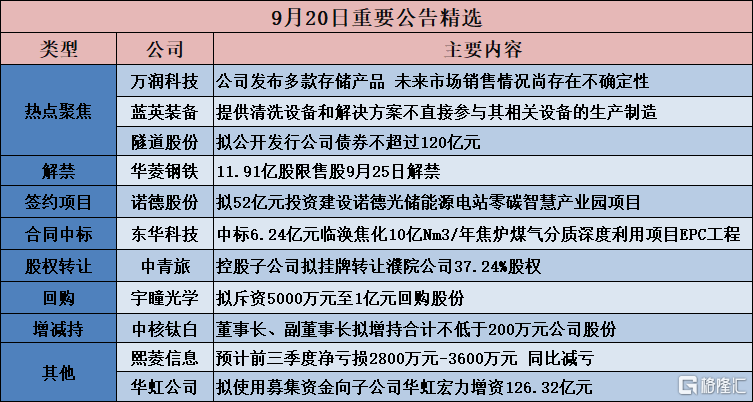

Wanrun Technology (002654.SZ) announced abnormal fluctuations in stock trading. On September 18, 2023, the company released a number of storage products at the Lighting and Storage Semiconductor Innovation Development Forum of the Yangtze River Industrial Science and Technology Innovation week sponsored by Yangtze River Industrial Investment Group Co., Ltd. The actual sales of these products depend on a variety of factors such as industry recovery, customer acceptance and market development. There is still uncertainty about the future market sales.

Blue British equipment (300293.SZ): the company provides cleaning equipment and solutions that are not directly involved in the production and manufacture of its related equipment.

Blue British equipment (300293.SZ) replied to the Shenzhen Stock Exchange's letter of concern that the products that the company can use in lithography-related industries are mainly based on special equipment and solutions applicable to cleaning principles / technologies. The company provides corresponding cleaning equipment and solutions according to the cleanliness and precision requirements of relevant users for their equipment-related parts. However, in the whole project of the relevant users, the company is not directly involved in the production and manufacture of its related equipment. In the whole value chain of related customer equipment manufacturing, compared with the value of relevant customer equipment products, the company's related equipment accounts for a relatively small proportion in terms of amount.

Tunnel shares (600820.SH): the proposed public offering of corporate bonds does not exceed 12 billion yuan.

Tunnel shares (600820.SH) announced that the corporate bonds issued this time have a face value of 100 yuan and will be issued at par value. The total size of the bonds will not exceed RMB 12 billion, of which the public issuance of general corporate bonds shall not exceed 6 billion yuan, and the public issuance of renewable corporate bonds shall not exceed 6 billion yuan. The specific issuance scale and types of bonds for each issue shall be submitted to the shareholders' meeting to authorize the board of directors or the authorized person of the board of directors to determine within the above scope according to the company's capital needs and market conditions at the time of issuance. After deducting the issuance expenses, the funds raised in this bond are intended to be used to repay interest-bearing liabilities, project construction and operation, equity investment, supplementary working capital and other purposes permitted by applicable laws and regulations.

[contract project]

Jingke Technology (601778.SH): about US $315 million will be invested in the 400MW photovoltaic project in Saudi Arabia.

601778.SH announced that in order to further promote the global strategic layout, the company agreed to promote the investment, construction and operation of the Saudi 400MW project, and agreed to Jingke Hong Kong to sign a complete set of project agreement documents, including the purchase and sale agreement. The actual construction scale of the project is about 450MWp, and the total investment of the project is about 315 million US dollars (equivalent to 2.3 billion yuan).

Zhengye Technology (300410.SZ): plan to build a roof distributed photovoltaic project in Jingdezhen High-tech Zone

Zhengye Technology (300410.SZ) announced that the company held the 14th meeting of the Fifth Board of Directors on September 20, 2023 to deliberate and pass the "Bill on Investment in the Construction of Roof distributed Photovoltaic Project in Jingdezhen High-tech Zone". The company intends to invest in the construction of roof distributed photovoltaic project in Jingdezhen High-tech Zone through Jingdezhen Guangyunda New Energy Co., Ltd. (referred to as "Guangyunda"). The total installed capacity of photovoltaic power generation in this project is 19445.35kWp, and the total investment of the project is about 101 million yuan.The total construction period of the project is one year, the installed power generation capacity of the project is 19445.35kWp, the rated life of the power station is 25 years, and the average annual generating capacity is 19.6352 million kWh. About 80% of the project's generating capacity is self-used, and the remaining 20% is used for surfing the Internet.

Node Co., Ltd. (600110.SH): to invest 2.5 billion yuan in the construction of Nord compound fluid Collector Industrial Park

Nord shares (600110.SH) announced that Hubei Norde Lithium material Co., Ltd. and the Tieshan District people's Government of Huangshi Economic and technological Development Zone, Huangshi City, Hubei Province, intend to sign a "Project Investment contract" to invest in the construction of Norde compound fluid Collector Industrial Park project, with a total planned investment of RMB 2.5 billion. Of this total, 2 billion yuan was invested in fixed assets. The production line of the production equipment is flexible equipment, which is compatible with the production of composite aluminum foil and composite copper foil. After the completion of the project, it is expected to produce 420 million square meters of composite aluminum foil and composite copper foil every year, with an annual output value of about 4 billion yuan. The production line of production equipment is flexible equipment, which is compatible with the production of composite aluminum foil and composite copper foil.

600110.SH: plans to invest 5.2 billion yuan in the construction of zero-carbon intelligent industrial park for Nord light storage energy plant.

Nord shares (600110.SH) announced that the company's holding subsidiary, Nord Shengshi New Energy Co., Ltd. (referred to as "Nord Shengshi") and the Tieshan District people's Government of Huangshi Economic and technological Development Zone, Huangshi City, Hubei Province, intend to sign a "Project Investment contract" to invest in the construction of a zero-carbon intelligent industrial park for Nord light storage energy plant, with a total investment of 5.2 billion yuan in fixed assets.

[contract won the bid]

Nenghui Technology (301046.SZ): to win the bid for 100MW household photovoltaic project in Guigang, Guangxi, the procurement of power generation system and operation and maintenance services.

Nenghui Science and Technology (301046.SZ) announced that on September 20, 2023, China Power equipment Information Network released the "announcement of successful candidates for bidding for Jiangxi Regional Household Photovoltaic Project and Guangxi Guigang Household Photovoltaic Project". Shanghai Nenghui Science and Technology Co., Ltd. is the preferred candidate for "procurement of power generation system and operation and maintenance services for 100MW household photovoltaic project in Guigang City, Guangxi". The tenderer Guangxi Guigang Ganhui New Energy Co., Ltd. (referred to as "Ganhui Xinneng") is an affiliated legal person of the company and constitutes a related party transaction. Tender quotation: 3.50 yuan / Wp (including tax) for supply, 0.04 yuan / Wp/ (including tax) for operation and maintenance.

Nenghui Technology (301046.SZ): won the bid for Guangzhou Development Yangshan Taiping Photovoltaic Composite Phase II expansion Project EPC General contract (the second)

Nenghui Technology (301046.SZ) announced that the company recently received the "bid winning notice" from the EPC general contract (the second time) of the Guangzhou Development Yangshan Taiping Photovoltaic Composite Phase II expansion project. The winning price is 99.82056162 million yuan.

Donghua Science and Technology (002140.SZ): won the bid 624 million yuan Linyi Coking 1 billion Nm3/ Coke oven Gas quality and Deep Utilization Project EPC Project

Donghua Technology (002140.SZ) announced that on September 19, 2023, Donghua Engineering Technology Co., Ltd. received a "bid winning notice" issued by Anhui Antian Lixin Engineering Management Co., Ltd., and the company was identified as the winning bidder (serial number: 23AT50043803342) of the 1 billion Nm3/ coke oven gas deep utilization project EPC project of Linyi Coking Co., Ltd.The owner of the project is Linyi Coking Co., Ltd. (referred to as "Linyi Coking Co., Ltd."), the bidding agency is Anhui Antian Lixin Engineering Management Co., Ltd., and the winning bid for EPC project is 624 million yuan.

Bacon Energy (002828.SZ): Bacon Chengdu signed about 1.453 billion yuan drilling project construction contract

Bacon Energy (002828.SZ) announced that Bacon Energy (Chengdu) Co., Ltd. ("subsidiary" or "Bacon Chengdu"), a wholly owned subsidiary of the company, and the Development Department of Southwest Oil and Gas Field Branch of Petrochina Natural Gas Co., Ltd. ("transaction counterparty") signed the "Development Division 2023-2024 Deep Shale Gas drilling Engineering (Daily fee) contract (Bacon)" on September 19, 2023. The total amount of the contract is tentatively estimated to be about 1.453 billion yuan, including 9% VAT.

Gan Consulting (000779.SZ): hydropower Design Institute won 13.65 million yuan survey and design of cold and drought efficient agricultural water source project of Modern Silk Road in Pingchuan District, Baiyin City, Gansu Province.

Gan Consulting (000779.SZ) announced that Gansu Water Conservancy and Hydropower Survey and Design Institute Co., Ltd. (referred to as "Hydropower Design Institute"), a wholly-owned subsidiary of the company, recently received the bid-winning notice of "Survey and Design of Modern Silk Road Cold and drought High efficiency Agricultural Water Source Project in Pingchuan District, Baiyin City, Gansu Province". The winning price is 13.65 million yuan.

600335.SH: the subsidiary signed the EPC general contract with SAIC for the project of Zhengzhou Battery PACK Plant.

600335.SH announced that China Automotive Industry Engineering Co., Ltd., a wholly owned subsidiary, signed the "EPC General contract for Zhengzhou Battery PACK Factory Project" with Shanghai Automotive Group Co., Ltd. on September 20, 2023, with a contract price of 181.9529 million yuan. Construction of 240000 new energy vehicle battery packs with an annual production capacity of about 41000 square meters, including but not limited to scheme design, construction, equipment and material procurement, installation and commissioning, testing, inspection, third-party inspection, acceptance and warranty.

[Equity acquisition]

China Youth Travel Service (600138.SH): the holding subsidiary intends to transfer 37.24% of the shares of Puyuan Company.

China Youth Travel Service (600138.SH) announced that Wuzhen Tourism Co., Ltd., a holding subsidiary, plans to transfer its 37.24% stake in Tongxiang Puyuan Tourism Co., Ltd. (referred to as Puyuan Company) through the Shanghai United property Exchange at a listing price of no less than 254.2747 million yuan.

Bacon Energy (002828.SZ): plans to transfer 51% stake in Baoji Bacon to Baoji Huayou

Bacon Energy (002828.SZ) announced that the company and Baoji Huayou Oil drilling and production equipment Co., Ltd. (referred to as "Baoji Huayou") signed an "equity transfer agreement" on September 18, 2023, the company will hold a 51% stake in Baoji Bacon Energy equipment Design Co., Ltd. (referred to as "Baoji Bacon", "target company") (corresponding to subscribed registered capital of 30.6 million yuan) The actual contribution of 6.12 million yuan) will be transferred to Baoji Huayou at the price of 8.70818 million yuan. After the completion of this transaction, Baoji Bacon will no longer be included in the scope of the company's consolidated statements.

[lifting the ban]

Valin Iron and Steel (000932.SZ): 1.191 billion restricted shares lifted on September 25th

Valin Iron and Steel (000932.SZ) announced that the unrestricted shares are new shares issued by Valin Iron and Steel in 2019. Four shareholders, the company's controlling shareholders and their concerted actors, have lifted the restrictions. The total number of shares lifted is 1.191 billion shares, accounting for 17.23% of the total share capital of Valin Iron and Steel. The unrestricted shares will be circulated on Monday, September 25, 2023.

Tianchen Medical (688013.SH): 41.868 million restricted shares will be listed and circulated on September 28th.

Tianchen Medical (688013.SH) announced that the restricted shares in circulation are some of the restricted shares in the initial public offering, involving two shareholders, namely Chen Wangyu and Chen Wangdong, and the corresponding number of restricted shares is 41.868 million shares, accounting for 51.59% of the company's current total share capital. The restriction period for the above-mentioned restricted shares is 36 months from the date on which the company's first issued shares are listed on the Shanghai Stock Exchange by Science and Technology Innovation Board. The current sales restriction period is about to expire and will be listed and circulated from September 28th, 2023.

Shangwei New Materials (688585.SH): 320 million restricted shares have been in circulation since September 28th.

688585.SH announced that the restricted shares circulated in the company's initial public offering are some restricted shares in the company's initial public offering, with two shareholders and 320 million shares corresponding to the number of restricted shares, accounting for 79.23% of the company's total share capital as of the date of this announcement. The restricted period is 36 months from the date of the company's listing, and this part of the restricted shares will be listed and circulated from September 28th, 2023.

[buyback]

Pupil Optics (300790.SZ): plan to spend 50 million to 100 million yuan to buy back shares

Pupil Optics (300790.SZ) announced that it intends to use its own funds to buy back some of the company's outstanding A-share common shares through centralized bidding. The total amount of funds used for the repurchase of shares shall not be less than 50 million yuan (inclusive) and shall not exceed 100 million yuan (inclusive); the price of the repurchased shares shall not exceed 21.00 yuan per share (inclusive).

Shen Hao Technology (300853.SZ): plans to spend 40 million-80 million yuan to buy back the company's shares

300853.SZ announced that the company plans to use its own funds to buy back A shares of the company's RMB common shares in a centralized bidding transaction for the implementation of employee stock ownership plans or equity incentives. The total amount of funds to be used for the repurchase is not less than 40 million yuan (including capital) and no more than 80 million yuan (including capital). The specific total amount of repurchase funds shall prevail on the total amount of funds actually used. The proposed repurchase price range shall not exceed RMB 38.29 per share (including capital, which shall not exceed 150% of the average trading price of the company's shares in the 30 trading days prior to the adoption of this repurchase resolution by the board of directors).

Nan Shan Zhishang (300918.SZ): plans to spend 30 million-60 million yuan to buy back the company's shares

300918.SZ announced that the company intends to use its own funds to buy back some of the company's shares (RMB common shares (A shares) in a centralized bidding transaction for the implementation of employee stock ownership plans or equity incentives. The total amount of funds for repurchasing shares shall not be less than RMB 30 million yuan (inclusive) and shall not exceed RMB 60 million yuan (inclusive). The price of the repurchased shares shall not exceed RMB 17.42 per share (including capital).

East Micro Semiconductor (688261.SH): plans to buy back 25 million yuan-50 million yuan of company shares

East Micro Semiconductor Director (688261.SH) announced that the total amount of the proposed repurchase capital is not less than RMB 25 million yuan and not more than RMB 50 million yuan, and the price of the repurchase shares does not exceed RMB 140. it is intended to be used for equity incentives and / or employee stock ownership plans at an appropriate time in the future, and transferred within three years after the announcement of the implementation results of the share repurchase and share changes.

300428.SZ Group: plan to spend 30 million-50 million yuan to buy back the company's shares

300428.SZ announced that it plans to use its own funds to buy back some of the company's RMB common A shares through centralized bidding, and the repurchased shares will be used to implement employee stock ownership plans or equity incentive plans. The total amount of repurchase funds shall not be less than RMB 30 million yuan (inclusive) and shall not exceed RMB 50 million yuan (inclusive). The source of funds shall be self-owned funds; the repurchase price shall not exceed RMB 34.00 yuan per share.

Jilin Aodong (000623.SZ): plans to spend 100 million-150 million yuan to buy back the company's shares

Jilin Aodong (000623.SZ) announced an announcement on the plan to buy back some of the public shares with a repurchase price of no more than RMB20.00 per share. The total amount of funds to be used for repurchase is not less than 100 million yuan (inclusive) and not more than 150 million yuan (inclusive).

Dafeng Industrial (603081.SH): to spend 10 million to 20 million yuan to buy back shares

603081.SH announced that the company intends to use its own funds to buy back some of the company's shares through centralized bidding, and the repurchased shares will be used to convert convertible corporate bonds issued by listed companies, with a total amount of not less than 10 million yuan (inclusive) and no more than 20 million yuan (inclusive). The proposed repurchase price shall not exceed RMB 22.50 per share (inclusive).

[increase or decrease holdings]

Medium Nuclear Titanium dioxide (002145.SZ): the chairman and vice chairman of the board of directors plan to increase the total shareholding of the company by not less than 2 million yuan

China Nuclear Titanium dioxide (002145.SZ) announced that the chairman and vice chairman of the company plan to increase their holdings of the company's shares with their own funds or self-raised funds through centralized bidding transactions, with a total increase of not less than 2 million yuan. The implementation period of the plan is one month from September 21, 2023.

Xiangshan shares (002870.SZ): Qunsheng Electronics bulk Trading increases its stake by 1.97%

Xiangshan shares (002870.SZ) announced that the company recently received a notice from its shareholder Ningbo Junsheng Electronics Co., Ltd. (referred to as "Junsheng Electronics") that it had increased its stake in the company by means of bulk transactions, accounting for 1.966 per cent of the company's total share capital.

Zanyu Technology (002637.SZ): director and General Manager Zou Huanjin accumulated 255000 shares during the increase period.

Zanyu Technology (002637.SZ) announced that, as of the date of disclosure of the announcement, the plan for this increase had passed halfway. Zou Huanjin, the company's director and general manager, accumulated 255000 shares of the company's shares through the Shenzhen Stock Exchange's stock trading system, with a cumulative increase of 2.545 million yuan (excluding transaction fees).

[other]

Xiling Information (300588.SZ): it is estimated that the net loss in the first three quarters is 28 million yuan to 36 million yuan compared with the same period last year.

Xiling Information (300588.SZ) announced that it is expected to make a net loss of 28 million yuan to 36 million yuan in the first three quarters, reducing losses over the same period last year, deducting non-net losses of 33.8 million yuan to 41.8 million yuan, and operating income of 107 million yuan to 125 million yuan.The company's overall loss narrowed during the reporting period, on the one hand, the gross profit is expected to increase compared with the same period last year due to the gradual recovery of business; on the other hand, the company's credit impairment loss and asset impairment loss are expected to turn back in the reporting period, which is expected to have a positive impact on the total profit. In the same period last year, the amount of credit impairment loss and asset impairment loss is-8.4299 million yuan.

Huahong Company (688347.SH): plans to use the raised funds to increase the capital of its subsidiary Huahong Hongli by 12.632 billion yuan

Huahong Company (688347.SH) announced that it plans to use the raised funds to increase its capital to Huahong Hongli, a wholly-owned subsidiary, by 12.63235 billion yuan. This capital increase is based on the needs of the implementation of the company's fund-raising plan, and the capital source of this capital increase is the company's funds raised by the company. the company is currently in good financial condition and is not expected to adversely affect the normal production and operation of the company. There is no harm to the interests of the company and its shareholders.

Jinjia Co., Ltd. (002191.SZ): Jinjia Xinyuan plans to carry out strategic cooperation with Houlang Laboratory on high-power magnetron sputtering equipment for polymer / metal composite products.

002191.SZ announced that in order to promote the development of Shenzhen Jinjia Group Co., Ltd. in the electronic materials industry, the company has yet to establish a wholly-owned subsidiary of Shenzhen Jinjia Xinyuan Technology Group Co., Ltd. (provisional name, subject to industrial and commercial registration With "Jinjia Xinyuan"), it is planned to sign the "Strategic Cooperation Agreement between Shenzhen Jingjia Xinyuan Technology Group Co., Ltd. And Shenzhen Houlang Laboratory Technology Co., Ltd." with Shenzhen Houlang Laboratory Technology Co., Ltd. (referred to as "Houlang Lab"). Jinjia Xinyuan will carry out strategic cooperation with Houlang Lab on high-power magnetron sputtering equipment for polymer / metal composite products.