Optimistic Investors Push Dezhan Healthcare Company Limited (SZSE:000813) Shares Up 29% But Growth Is Lacking

Optimistic Investors Push Dezhan Healthcare Company Limited (SZSE:000813) Shares Up 29% But Growth Is Lacking

Dezhan Healthcare Company Limited (SZSE:000813) shareholders have had their patience rewarded with a 29% share price jump in the last month. Looking back a bit further, it's encouraging to see the stock is up 29% in the last year.

德展醫療股份有限公司 (SZSE: 000813) 股東們的耐心在上個月股價上漲了29%。再往前看,令人鼓舞的是,該股在去年上漲了29%。

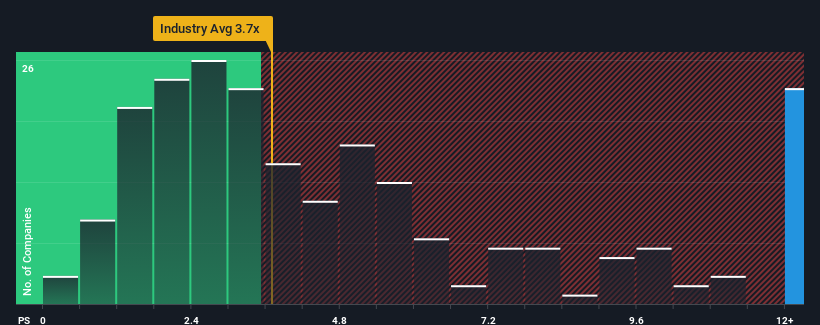

Since its price has surged higher, given around half the companies in China's Pharmaceuticals industry have price-to-sales ratios (or "P/S") below 3.7x, you may consider Dezhan Healthcare as a stock to avoid entirely with its 17.2x P/S ratio. However, the P/S might be quite high for a reason and it requires further investigation to determine if it's justified.

由於其價格飆升,鑑於中國製藥行業中約有一半的公司的市售比(或 “市盈率”)低於3.7倍,因此您可以將德展醫療視爲市盈率爲17.2倍的完全避開的股票。但是,市盈率可能很高是有原因的,需要進一步調查才能確定是否合理。

Check out our latest analysis for Dezhan Healthcare

查看我們對德展醫療的最新分析

What Does Dezhan Healthcare's P/S Mean For Shareholders?

德展醫療的市盈率對股東意味着什麼?

As an illustration, revenue has deteriorated at Dezhan Healthcare over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

舉例來說,德展醫療的收入在過去一年中有所惡化,這根本不理想。許多人可能預計,在未來一段時間內,該公司的表現仍將超過大多數其他公司,這使市盈率免於崩潰。但是,如果不是這樣,投資者可能會因爲爲股票支付過多費用而陷入困境。

How Is Dezhan Healthcare's Revenue Growth Trending?

德展醫療的收入增長趨勢如何?

The only time you'd be truly comfortable seeing a P/S as steep as Dezhan Healthcare's is when the company's growth is on track to outshine the industry decidedly.

你唯一能真正放心地看到像Dezhan Healthcare這樣高漲的市盈率的時候,是該公司的增長有望絕對超越整個行業。

Retrospectively, the last year delivered a frustrating 25% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 69% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

回顧過去,該公司的收入下降了25%,令人沮喪。過去三年看起來也不太好,因爲該公司的總收入減少了69%。因此,不幸的是,我們必須承認,在這段時間裏,該公司在增加收入方面做得不好。

In contrast to the company, the rest of the industry is expected to grow by 190% over the next year, which really puts the company's recent medium-term revenue decline into perspective.

與該公司形成鮮明對比的是,該行業的其他部門預計將在明年增長190%,這確實可以看出該公司最近的中期收入下降。

With this in mind, we find it worrying that Dezhan Healthcare's P/S exceeds that of its industry peers. Apparently many investors in the company are way more bullish than recent times would indicate and aren't willing to let go of their stock at any price. There's a very good chance existing shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the recent negative growth rates.

考慮到這一點,我們感到擔憂的是,Dezhan Healthcare的市盈率超過了業內同行。顯然,該公司的許多投資者比最近所顯示的要看漲得多,他們不願意不惜任何代價放棄股票。如果市盈率降至更符合最近的負增長率的水平,那麼現有股東很有可能爲未來的失望做好準備。

The Key Takeaway

關鍵要點

Shares in Dezhan Healthcare have seen a strong upwards swing lately, which has really helped boost its P/S figure. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Dezhan Healthcare的股價最近出現了強勁的上漲,這確實有助於提振其市盈率。通常,我們傾向於將價格與銷售比的使用限制在確定市場對公司整體健康狀況的看法上。

We've established that Dezhan Healthcare currently trades on a much higher than expected P/S since its recent revenues have been in decline over the medium-term. Right now we aren't comfortable with the high P/S as this revenue performance is highly unlikely to support such positive sentiment for long. Unless the recent medium-term conditions improve markedly, investors will have a hard time accepting the share price as fair value.

我們已經確定,Dezhan Healthcare目前的市盈率遠高於預期,因爲其最近的收入在中期內有所下降。目前,我們對高市盈率並不滿意,因爲這種收入表現極不可能長期支持這種積極的情緒。除非最近的中期狀況顯著改善,否則投資者將很難接受股價作爲公允價值。

There are also other vital risk factors to consider and we've discovered 2 warning signs for Dezhan Healthcare (1 makes us a bit uncomfortable!) that you should be aware of before investing here.

還有其他重要的風險因素需要考慮,我們已經發現 德展醫療有 2 個警告信號 (1 讓我們有點不舒服!)在這裏投資之前,你應該注意這一點。

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

如果實力雄厚的公司讓你大開眼界,那麼你一定要看看這個 免費的 以低市盈率交易(但已證明可以增加收益)的有趣公司名單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有反饋嗎?擔心內容嗎? 取得聯繫 直接和我們在一起。 或者,給編輯團隊 (at) simplywallst.com 發送電子郵件。

Simply Wall St 的這篇文章本質上是籠統的。 我們僅使用公正的方法根據歷史數據和分析師的預測提供評論,我們的文章無意作爲財務建議。 它不構成買入或賣出任何股票的建議,也沒有考慮您的目標或財務狀況。我們的目標是爲您提供由基本面數據驅動的長期重點分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。簡而言之,華爾街在上述任何股票中都沒有頭寸。

As an illustration, revenue has deteriorated at Dezhan Healthcare over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.

As an illustration, revenue has deteriorated at Dezhan Healthcare over the last year, which is not ideal at all. It might be that many expect the company to still outplay most other companies over the coming period, which has kept the P/S from collapsing. However, if this isn't the case, investors might get caught out paying too much for the stock.