Mingchuang Premium's 8.9 yuan eyebrow pencil has gone viral under the backdrop of the “Domestic Price Assassin.” Aromatherapy, which costs around 30 yuan, and an 8.9 eyebrow pencil have become the latest standard for young people.

Thanks to young people's pursuit of a refined lifestyle and at the same time their demand for maximum savings, Mingchuang Premium has grown rapidly in the global economic downturn cycle with its low price strategy. This year, it achieved the best performance in the company's history. Revenue for the third fiscal quarter increased 26% year-on-year, reaching 2.95 billion yuan.

However,Mingchuang Premium is not satisfied with its low price position; they are also worried about the sustainability brought about by low price traffic.Founder Ye Guofu believes that in a complex business world, only super platform companies, super technology companies, and super brand companies can thrive.

In order to move from a “low price brand” to a “super brand,” Mingchuang Premium has taken a series of brand upgrades and expansion initiatives. They are actively collaborating with well-known IPs, opening super stores, and accelerating their expansion overseas.

In order to move from a “low price brand” to a “super brand,” Mingchuang Premium has taken a series of brand upgrades and expansion initiatives. They are actively collaborating with well-known IPs, opening super stores, and accelerating their expansion overseas.

Everything is aimed at getting rid of the “strong retail” gene of the past. It is not simply used as a channel, but a brand that actually has pricing power.

When Mingchuang Premium is no longer cheap, will consumers continue to pay for it?

Mingchuang Premium's “Super Brand Dream”

In the past ten years, the reason why Mingchuang Premium has been able to achieve such low prices is mainly due to the advantages of the supply chain.

According to the prospectus, there are thousands of people in the upper reaches of the supply chain responsible for product selection and thousands of people in the downstream of the supply chain who are also responsible for store expansion. This makes sales feedback on products very fast and effective.

The best-selling products were quickly fed back to the headquarters. After research and analysis, orders were increased, and the huge purchase volume also received strong support from upstream manufacturers.

The strong supply chain has given Mingchuang Premium a cost lead, and its sales have also formed a rapid positive feedback loop, and the scale is getting bigger and bigger.

In 2023, Mingchuang Premium achieved the best performance in the company's history, and both revenue and profit sides exceeded market expectations. Moreover, the consumption boom continues. In July-August, sales of Mingchuang Premium continued to grow strongly, and many stores set new single-store sales highs.

Specifically, in July, nearly one-third of stores set a record sales record, and in January-July, domestic single-store GMV remained at the same level as before the 2019 epidemic and the same period in 2021.

In August, offline sales in China exceeded 1.3 billion yuan, an increase of 47.8% over the previous year. Out of more than 3,000 stores, 792 reached a record high.

However, this is not the ultimate goal of Mingchuang Premium. In its 10th year since its establishment, Mingchuang Premium finally called out its “superbrand dream.”

However, it is not easy for famous premium products, which have always had “extreme supply chain and strong retail attributes” as their core genes, to transform into a super brand.

Although strong brand power means stronger bargaining power and brand premiums, it also places higher demands on brand building ability.

The so-called brand power comes from the accumulation of products in all aspects, from design, selection, sales, and after-sales to advertising and promotion. Consumers give a positive or negative impression based on their experience in every step, and only then determine the brand's brand power level. Deficiency in any aspect may affect brand building.

“Open super stores, crazy co-branded IPs, and accelerate overseas expansion”. In this way, Mingchuang Premium is getting rid of the “low price brand” label in the past and building a “super brand.”

“Super stores” open the ceiling of single-store performance

Opening a superstore is one of the initiatives to upgrade the Mingchuang Premium brand.

According to Mingchuang Premium, only mega-stores can establish a strong brand impression in the minds of consumers and raise the performance ceiling of a single store.

However, oversized stores often represent a better shopping environment, a richer selection of SKUs, and a higher unit price per customer. When premium, affordable, and creative products take the high-end route, will consumers still approve?

Will high rents increase costs and affect the single-store profit model?

Regarding concerns in the market, Mingchuang Premium said that although the investment of large stores is about twice that of ordinary stores, the superstore has performed well after opening. The Guangzhou store can reach 5 million in monthly sales, and the US can reach 130-1.5 million US dollars.

Superstores have higher customer unit prices and high traffic, but single-store sales are better. Inventory transfers are faster, and the payback period is shorter, about one and a half to two years.

According to intellectual research, Mingchuang Premium is starting to change the original low price position, increase unit prices, and expand categories. The operation of the superstore model has verified the effectiveness of this strategy to a certain extent.

What is clear is that Mingchuang Premium will not directly increase prices in all categories; it will still guarantee a reasonable ratio of low-margin drainage products.

However, it goes without saying that they will start with categories with a lot of premium room and break through in the direction of high-end, which will not only increase gross profit, but also enhance brand style.

According to its disclosure at the performance conference, 70% of products will still stick to cost performance in the future, while IP and interest categories with higher gross margins will expand to about 30% of sales, which will be the key to increasing gross profit.

A typical example is the incense that originally sold for 39.9 yuan. The “Master Incense Room” is priced at 79.9-89.9 yuan. Although the customer unit price has doubled, the price of the Master Series aromatherapy still has an advantage compared horizontally to similar competitors.

Sales also exceeded the expectations of Mingchuang Premium, with cumulative revenue of nearly 30 million since it went live at the end of last year.

(Source: Tmall official flagship stores of various brands, Caitong Securities Research Institute)

From co-branding Sanrio to becoming Sanrio

IP co-branding is also an effective way to attract young people. Time-honored classic IPs such as Sanrio, Hello Kitty, Mickey Mouse, and Donald Duck provide brands with continuous traffic and sales.

Moreover, IP products often have higher added value, which helps get rid of the heavily homogenized low price product label.

Back then, in order to fight for Marvel's IP, the famous creator of Premium for half a year, Mr. Ye personally went to the Disney headquarters in the US to talk about the PPT proposal. Later, he even gave a death order. If he didn't get a Marvel IP, he couldn't return home.

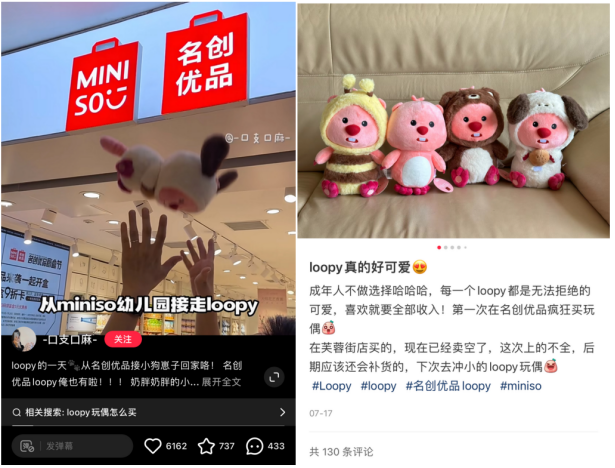

In July of this year, only 5 days after Barbie was co-branded, nearly half of the categories were sold out online. Little Beaver Loopy and Snoop also continued to increase their brand popularity on social media.

Obviously, Mingchuang Premium is shifting from focusing on cost to focusing on product quality and differentiation.

In the first half of the year, Mingchuang Premium IP product sales accounted for about 25%, up 1 percentage point from last year and 10 percentage points from 2019. With cooperation with well-known IPs such as Barbie, Loopy, and Snoopy, IP product sales exceeded 30% in August.

Co-branded mature IPs have a stable customer base and return rate, but excessive reliance on external IPs also has the risk of being viewed as an “OEM brand.” It is worth noting that Mingchuang Premium currently only has two own IP series, DUNDUN Chicken and PENPEN Penguin.

In response to this, Mingchuang Premium answered opinion research. Private IP is still in the initial incubation stage, and the supply of its own IP will increase in the future.

However, it's not like Disney doing heavy content, but rather similar to Sanrio. From an early gift retail store, it became a long-standing IP with strong vitality by constantly introducing new images.

From co-branding Sanrio to becoming Sanrio, this is what Mingchuang Premium wants to do.

Living overseas is better than imagined

Some analysts also believe that “Pinduoduo” and “Mingchuang Premium” do not represent “consumption downgrading,” but rather the externalization of China's supply chain advantages. Mingchuang Premium also used actual data to prove that it is doing better overseas than people think.

Four months ago, Mingchuang Premium opened its first Chinese brand store in Times Square in the US, which is an inch of land and money. Single day sales reached 550,000 yuan, setting a single-day sales record for global stores.

This is just a glimpse of Mingchuang Premium going overseas.

Overseas GMV grew rapidly this year, contributing more than 40% (25% in the previous quarter) of operating profit, making it the most impressive performance. Of these, 40% are from Asia, including Southeast Asia and India. 30% is in North America. Europe and the Middle East account for about 10% to 15%.

If you want to be an evergreen brand, you definitely can't bypass going overseas. Overseas profit margins are even larger. As soon as the currency unit for the same product is exchanged, the profit is completely different.Mingchuang Premium's overseas gross margin is 5%-10% higher than that of China.The target is 5,000 stores in China and 4,000 overseas stores by 2027.

(The number of stores has risen steadily, and the share has remained stable. Source: company prospectus, company announcement, Caitong Securities Research)

Unlike what the market imagines, Mingchuang Premium's success in overseas markets does not depend on subsidies, but rather on its supply chain advantages and domestic management dividends.

Take the US as an example. As long as basic actions such as loading and handling goods are done well, it can drive about ten percent of sales. At the end of last year, the average sales volume of a single store in the US exceeded one million US dollars, making it the number one overseas country contributing to revenue.

(Revenue Contribution of Mingchuang Premium by Country & GMV Contribution Ranking, Source: Mingchuang Premium Performance Demonstration Material)

Mingchuang Premium said bluntly to Informed Research,The gross margin of the North American direct-run market is as high as 60%-70%, which is the biggest development focus in the future.Currently, there are only 70 stores in the US, and the penetration rate is low. The target is to open 1000-1,500 stores. Store openings peak in the second half of the year, and 350-450 new stores can be added throughout the year.

Another important significance of the US market is to become a model market for demonstration and radiation to other overseas markets.If Mingchuang Premium can replicate China's business model and management experience to the US, it can undoubtedly spread to Europe and other places, increasing its popularity and reputation in the global market.

summed

The “consumption replacement” boom has brought rapid growth to Mingchuang Premium, but the company knows very well that the brand Evergreen cannot rely solely on low prices. As a result, in the 10th year since its establishment, Mingchuang Premium called out its “superbrand dream.”

New growth space was opened up during the transformation process by opening super stores to expand categories, increase customer unit prices, increase the added value of products, and boost overseas markets with higher gross margins. “Super brands” that actually have the power to price products will get higher profit margins.

Mingchuang Premium is working hard in this direction.

为了从“低价品牌”跨越到“超级品牌”,名创优品采取了一系列品牌升级和扩张的举措,他们积极与知名IP联名,开设超级大店,在海外加速扩张。

为了从“低价品牌”跨越到“超级品牌”,名创优品采取了一系列品牌升级和扩张的举措,他们积极与知名IP联名,开设超级大店,在海外加速扩张。