Investors Still Aren't Entirely Convinced By Adagene Inc.'s (NASDAQ:ADAG) Revenues Despite 30% Price Jump

Investors Still Aren't Entirely Convinced By Adagene Inc.'s (NASDAQ:ADAG) Revenues Despite 30% Price Jump

Adagene Inc. (NASDAQ:ADAG) shares have had a really impressive month, gaining 30% after a shaky period beforehand. Looking further back, the 20% rise over the last twelve months isn't too bad notwithstanding the strength over the last 30 days.

Adagene Inc. 纳斯达克股票代码:ADAG)的股价表现非常令人印象深刻,在之前的动荡时期之后上涨了30%。再往前看,尽管过去30天表现强劲,但过去十二个月的20%涨幅还不错。

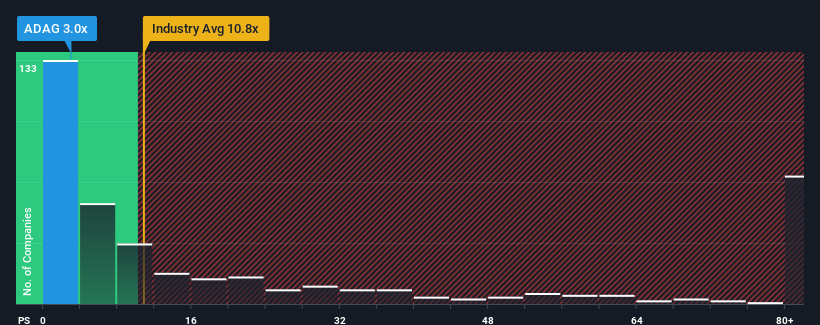

Although its price has surged higher, Adagene's price-to-sales (or "P/S") ratio of 3x might still make it look like a strong buy right now compared to the wider Biotechs industry in the United States, where around half of the companies have P/S ratios above 10.8x and even P/S above 46x are quite common. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

尽管其价格飙升,但与美国更广泛的生物技术行业相比,Adagene的3倍市盈率(或 “市盈率”)仍可能使其看起来像是强劲的买盘,在美国,大约一半的公司的市盈率高于10.8倍,甚至市盈率高于46倍也很常见。但是,仅按面值计算市盈率是不明智的,因为可能可以解释为什么市盈率如此有限。

See our latest analysis for Adagene

查看我们对Adagene的最新分析

How Has Adagene Performed Recently?

Adagene 最近的表现如何?

With revenue growth that's superior to most other companies of late, Adagene has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

由于最近的收入增长优于大多数其他公司,Adagene的表现相对较好。也许市场预计未来的收入表现将下滑,这使市盈率受到抑制。如果你喜欢这家公司,你会希望情况并非如此,这样你就有可能在股票失宠的时候买入一些股票。

What Are Revenue Growth Metrics Telling Us About The Low P/S?

关于低市盈率,收入增长指标告诉我们什么?

In order to justify its P/S ratio, Adagene would need to produce anemic growth that's substantially trailing the industry.

为了证明其市盈率是合理的,Adagene需要实现大幅落后于该行业的疲软增长。

If we review the last year of revenue growth, the company posted a terrific increase of 78%. The latest three year period has also seen an incredible overall rise in revenue, aided by its incredible short-term performance. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

如果我们回顾一下去年的收入增长,该公司公布了78%的惊人增长。在最近三年中,由于其令人难以置信的短期表现,收入也出现了令人难以置信的总体增长。因此,我们可以首先确认该公司在这段时间内在增加收入方面做得非常出色。

Shifting to the future, estimates from the three analysts covering the company suggest revenue should grow by 129% each year over the next three years. That's shaping up to be materially higher than the 110% per year growth forecast for the broader industry.

展望未来,报道该公司的三位分析师的估计表明,未来三年收入将每年增长129%。这将大大高于整个行业110%的年增长预期。

With this in consideration, we find it intriguing that Adagene's P/S sits behind most of its industry peers. Apparently some shareholders are doubtful of the forecasts and have been accepting significantly lower selling prices.

考虑到这一点,我们发现Adagene的市盈率落后于大多数行业同行,这很有趣。显然,一些股东对这一预测持怀疑态度,并已接受大幅降低的销售价格。

The Key Takeaway

关键要点

Shares in Adagene have risen appreciably however, its P/S is still subdued. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

但是,Adagene的股价已大幅上涨,其市盈率仍然低迷。有人认为,在某些行业中,价格与销售比率是衡量价值的次要指标,但它可能是一个有力的商业情绪指标。

A look at Adagene's revenues reveals that, despite glowing future growth forecasts, its P/S is much lower than we'd expect. There could be some major risk factors that are placing downward pressure on the P/S ratio. While the possibility of the share price plunging seems unlikely due to the high growth forecasted for the company, the market does appear to have some hesitation.

看看Adagene的收入就会发现,尽管未来的增长预测好转,但其市盈率仍远低于我们的预期。可能有一些主要的风险因素给市盈率带来了下行压力。尽管由于预计该公司将实现高增长,股价暴跌的可能性似乎不大,但市场似乎确实有些犹豫。

It is also worth noting that we have found 5 warning signs for Adagene (2 are a bit concerning!) that you need to take into consideration.

还值得注意的是,我们已经发现 Adagene 的 5 个警告标志 (2 有点令人担忧!)这是你需要考虑的。

If these risks are making you reconsider your opinion on Adagene, explore our interactive list of high quality stocks to get an idea of what else is out there.

如果这些 风险让你重新考虑自己对Adagene的看法,浏览我们的高品质股票互动清单,了解还有什么。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有反馈吗?担心内容吗? 取得联系 直接和我们在一起。 或者,给编辑团队 (at) simplywallst.com 发送电子邮件。

Simply Wall St 的这篇文章本质上是笼统的。 我们仅使用公正的方法根据历史数据和分析师的预测提供评论,我们的文章无意作为财务建议。 它不构成买入或卖出任何股票的建议,也没有考虑您的目标或财务状况。我们的目标是为您提供由基本面数据驱动的长期重点分析。请注意,我们的分析可能不考虑最新的价格敏感公司公告或定性材料。简而言之,华尔街在上述任何股票中都没有头寸。

With revenue growth that's superior to most other companies of late, Adagene has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

With revenue growth that's superior to most other companies of late, Adagene has been doing relatively well. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.