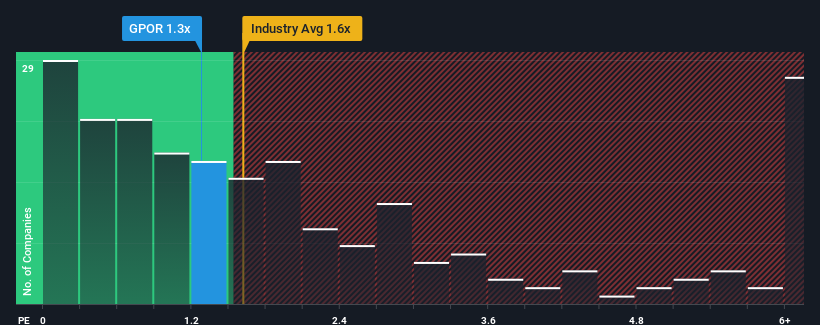

It's not a stretch to say that Gulfport Energy Corporation's (NYSE:GPOR) price-to-sales (or "P/S") ratio of 1.3x right now seems quite "middle-of-the-road" for companies in the Oil and Gas industry in the United States, where the median P/S ratio is around 1.6x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Gulfport Energy

How Has Gulfport Energy Performed Recently?

Gulfport Energy could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. It might be that many expect the dour revenue performance to strengthen positively, which has kept the P/S from falling. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Gulfport Energy's future stacks up against the industry? In that case, our free report is a great place to start.How Is Gulfport Energy's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Gulfport Energy's is when the company's growth is tracking the industry closely.

The only time you'd be comfortable seeing a P/S like Gulfport Energy's is when the company's growth is tracking the industry closely.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 14%. Still, the latest three year period has seen an excellent 75% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the five analysts covering the company are not great, suggesting revenue should decline by 4.8% per annum over the next three years. Meanwhile, the industry is forecast to moderate by 3.1% per year, which suggests the company won't escape the wider industry forces.

With this information, it's not too hard to see why Gulfport Energy is trading at a fairly similar P/S in comparison. However, we think shrinking revenues are unlikely to lead to a stable P/S over the longer term, which could set up shareholders for future disappointment. There is still potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth.

What Does Gulfport Energy's P/S Mean For Investors?

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

As expected, we see that Gulfport Energy maintains its moderate P/S thanks to a revenue outlook that's pretty much level with the wider industry. Right now shareholders are comfortable with the P/S as they are confident future revenue won't throw up any further unpleasant surprises. However, we're slightly cautious about the company's ability to resist further pain to its business from the broader industry turmoil. In the meantime, unless the company's prospects change they will continue to support the share price at these levels.

Before you settle on your opinion, we've discovered 4 warning signs for Gulfport Energy (2 are significant!) that you should be aware of.

If these risks are making you reconsider your opinion on Gulfport Energy, explore our interactive list of high quality stocks to get an idea of what else is out there.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.