NeoGenomics (NASDAQ:NEO) Delivers Shareholders Decent 70% Return Over 1 Year, Surging 9.2% in the Last Week Alone

NeoGenomics (NASDAQ:NEO) Delivers Shareholders Decent 70% Return Over 1 Year, Surging 9.2% in the Last Week Alone

It hasn't been the best quarter for NeoGenomics, Inc. (NASDAQ:NEO) shareholders, since the share price has fallen 25% in that time. But looking back over the last year, the returns have actually been rather pleasing! To wit, it had solidly beat the market, up 70%.

這不是今年以來最好的一個季度新基因組學公司(納斯達克股票代碼:NEO)股東,因為在此期間股價已經下跌了25%。但回顧過去一年,回報其實相當不錯!也就是說,它的表現強於大盤,上漲了70%。

On the back of a solid 7-day performance, let's check what role the company's fundamentals have played in driving long term shareholder returns.

在連續7天表現穩健的基礎上,讓我們來看看該公司的基本面在推動長期股東回報方面發揮了什麼作用。

View our latest analysis for NeoGenomics

查看我們對新基因組學的最新分析

NeoGenomics wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

新基因公司在過去的12個月裡沒有盈利,我們不太可能看到它的股價和每股收益(EPS)之間有很強的相關性。可以說,收入是我們的下一個最佳選擇。一般來說,沒有利潤的公司預計每年都會有收入增長,而且增長速度很快。這是因為,如果一家公司的收入增長微不足道,而且永遠不會盈利,那麼很難相信它會持續下去。

NeoGenomics grew its revenue by 13% last year. That's not a very high growth rate considering it doesn't make profits. The modest growth is probably largely reflected in the share price, which is up 70%. That's not a standout result, but it is solid - much like the level of revenue growth. Given the market doesn't seem too excited about the stock, a closer look at the financial data could pay off, if you can find indications of a stronger growth trend in the future.

新基因公司去年的營收增長了13%。考慮到它沒有盈利,這並不是一個很高的增長率。這種溫和的增長可能在很大程度上反映在股價上,該公司股價上漲了70%。這不是一個突出的結果,但它是堅實的-很像收入增長的水準。鑑於市場似乎對該股不太感興趣,如果你能找到未來更強勁增長趨勢的跡象,仔細看看財務數據可能會有回報。

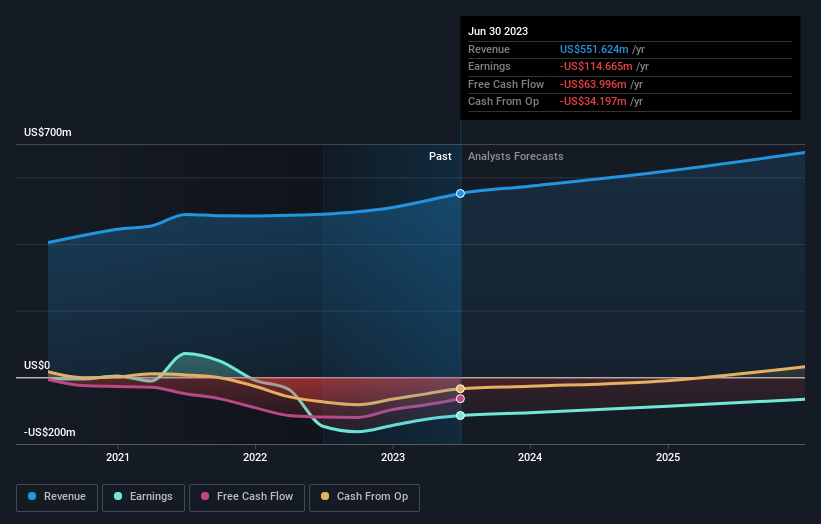

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

該公司的收入和收益(隨著時間的推移)如下圖所示(點擊查看具體數位)。

NeoGenomics is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think NeoGenomics will earn in the future (free analyst consensus estimates)

新基因組學是一隻知名的股票,有大量的分析師報道,這表明對未來的增長有一定的可見性。因此,看看分析師認為新基因組公司未來會賺多少錢是很有意義的(免費分析師共識估計)。

A Different Perspective

不同的視角

It's good to see that NeoGenomics has rewarded shareholders with a total shareholder return of 70% in the last twelve months. There's no doubt those recent returns are much better than the TSR loss of 1.8% per year over five years. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for NeoGenomics you should know about.

很高興看到,在過去的12個月裡,新基因組公司為股東帶來了70%的總回報。毫無疑問,最近的回報率遠遠好於TSR在過去五年中每年1.8%的損失。長期的虧損讓我們保持謹慎,但短期的TSR收益肯定暗示著更光明的未來。雖然值得考慮市場狀況對股價可能產生的不同影響,但還有其他更重要的因素。例如,考慮一下風險。每家公司都有它們,我們已經發現新基因組學的一個警告信號你應該知道。

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

如果你更願意看看另一家公司--一家財務狀況可能更好的公司--那麼不要錯過這一點免費已證明自己能夠實現盈利增長的公司名單。

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

請注意,本文引用的市場回報反映了目前在美國交易所交易的股票的市場加權平均回報.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.

NeoGenomics wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

NeoGenomics wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.