Revenues Tell The Story For Huasu Holdings Co.,Ltd (SZSE:000509)

Revenues Tell The Story For Huasu Holdings Co.,Ltd (SZSE:000509)

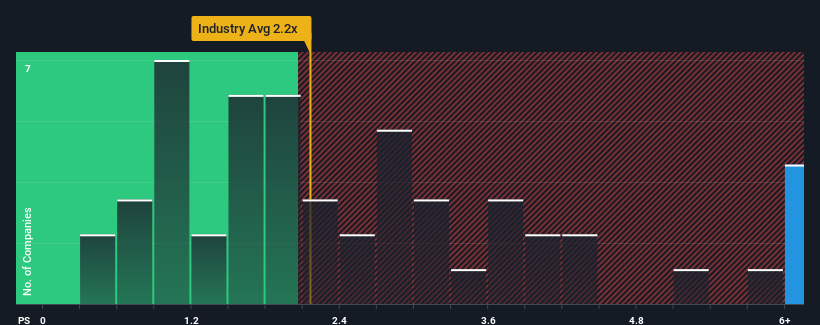

When you see that almost half of the companies in the Building industry in China have price-to-sales ratios (or "P/S") below 2.2x, Huasu Holdings Co.,Ltd (SZSE:000509) looks to be giving off strong sell signals with its 6.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

当你看到中国建筑业几乎一半的公司的市销率(P/S)低于2.2倍时,华数控股有限公司深圳证券交易所(SZSE:000509)的市盈率为6.4倍,S的市盈率为6.4倍,似乎正在发出强烈的卖出信号。尽管如此,仅仅从表面上看待P/S是不明智的,因为可能会有一个解释为什么它如此之高。

Check out our latest analysis for Huasu HoldingsLtd

查看我们对华数控股有限公司的最新分析

How Has Huasu HoldingsLtd Performed Recently?

华数控股最近表现如何?

For example, consider that Huasu HoldingsLtd's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

例如,考虑到华数控股有限公司最近的财务表现一直很差,因为它的收入一直在下降。或许,市场认为该公司在不久的将来可以做得足够好,跑赢业内其他公司,这使得市盈率和S的市盈率保持在较高水平。你真的希望如此,否则你会无缘无故地付出相当大的代价。

Is There Enough Revenue Growth Forecasted For Huasu HoldingsLtd?

华数控股有限公司的收入增长预测是否足够?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Huasu HoldingsLtd's to be considered reasonable.

有一个固有的假设,即一家公司的市盈率应该远远超过行业,就像华数控股有限公司的市盈率应该被认为是合理的。

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 18%. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

首先回顾一下,该公司去年的收入增长并不令人兴奋,因为它公布了令人失望的18%的下降。最近三年的营收出现了令人难以置信的整体增长,这与过去12个月形成了鲜明对比。因此,尽管该公司过去做得很好,但看到收入增长如此严重地下滑,有些令人担忧。

When compared to the industry's one-year growth forecast of 24%, the most recent medium-term revenue trajectory is noticeably more alluring

与该行业24%的一年增长预测相比,最近的中期收入轨迹明显更具诱惑力

In light of this, it's understandable that Huasu HoldingsLtd's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

有鉴于此,华数控股有限公司的P/S坐在其他大多数公司的前面也是可以理解的。据推测,股东们并不热衷于出售他们认为将继续胜过整个行业的股票。

The Bottom Line On Huasu HoldingsLtd's P/S

华数控股有限公司P/S的底线

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

虽然市销率不应该成为你是否买入一只股票的决定性因素,但它是一个很好的收入预期晴雨表。

We've established that Huasu HoldingsLtd maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

我们已经确定,华数控股有限公司维持其高市盈率是因为其最近三年的增长高于更广泛的行业预期,正如预期的那样。眼下,股东们对P/S很满意,因为他们非常有信心收入不会受到威胁。除非近期中期情况有所改变,否则将继续为股价提供有力支撑。

Before you take the next step, you should know about the 2 warning signs for Huasu HoldingsLtd that we have uncovered.

在您采取下一步之前,您应该了解华数控股有限公司的2个警告标志我们已经发现了。

If you're unsure about the strength of Huasu HoldingsLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

如果你.不确定华数控股有限公司的业务实力,为什么不探索我们的互动列表,为其他一些你可能没有达到预期的公司提供坚实的商业基本面。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

对这篇文章有什么反馈吗?担心内容吗? 保持联系直接与我们联系。或者,也可以给编辑组发电子邮件,地址是implywallst.com。

本文由Simply Wall St.撰写,具有概括性。我们仅使用不偏不倚的方法提供基于历史数据和分析师预测的评论,我们的文章并不打算作为财务建议。它不构成买卖任何股票的建议,也没有考虑你的目标或你的财务状况。我们的目标是为您带来由基本面数据驱动的长期重点分析。请注意,我们的分析可能不会将最新的对价格敏感的公司公告或定性材料考虑在内。Simply Wall St.对上述任何一只股票都没有持仓。

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Huasu HoldingsLtd's to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Huasu HoldingsLtd's to be considered reasonable.