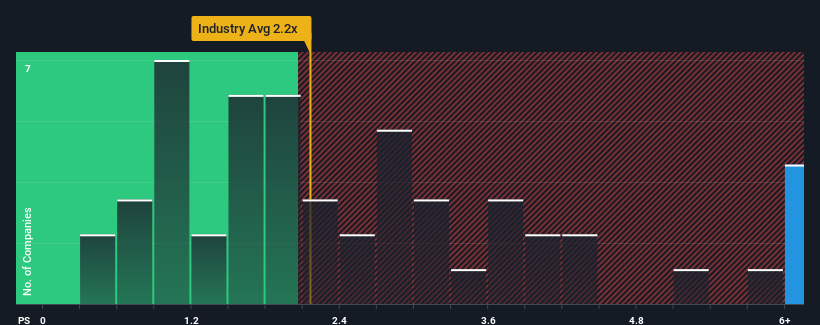

When you see that almost half of the companies in the Building industry in China have price-to-sales ratios (or "P/S") below 2.2x, Huasu Holdings Co.,Ltd (SZSE:000509) looks to be giving off strong sell signals with its 6.4x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Huasu HoldingsLtd

How Has Huasu HoldingsLtd Performed Recently?

For example, consider that Huasu HoldingsLtd's financial performance has been poor lately as its revenue has been in decline. Perhaps the market believes the company can do enough to outperform the rest of the industry in the near future, which is keeping the P/S ratio high. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Huasu HoldingsLtd's earnings, revenue and cash flow.Is There Enough Revenue Growth Forecasted For Huasu HoldingsLtd?

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Huasu HoldingsLtd's to be considered reasonable.

There's an inherent assumption that a company should far outperform the industry for P/S ratios like Huasu HoldingsLtd's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 18%. The latest three year period has seen an incredible overall rise in revenue, a stark contrast to the last 12 months. So while the company has done a great job in the past, it's somewhat concerning to see revenue growth decline so harshly.

When compared to the industry's one-year growth forecast of 24%, the most recent medium-term revenue trajectory is noticeably more alluring

In light of this, it's understandable that Huasu HoldingsLtd's P/S sits above the majority of other companies. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the wider industry.

The Bottom Line On Huasu HoldingsLtd's P/S

While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

We've established that Huasu HoldingsLtd maintains its high P/S on the strength of its recent three-year growth being higher than the wider industry forecast, as expected. Right now shareholders are comfortable with the P/S as they are quite confident revenue aren't under threat. Unless the recent medium-term conditions change, they will continue to provide strong support to the share price.

Before you take the next step, you should know about the 2 warning signs for Huasu HoldingsLtd that we have uncovered.

If you're unsure about the strength of Huasu HoldingsLtd's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.