While it may not be enough for some shareholders, we think it is good to see the Shenzhen Kangtai Biological Products Co., Ltd. (SZSE:300601) share price up 12% in a single quarter. But that is meagre solace in the face of the shocking decline over three years. The share price has sunk like a leaky ship, down 74% in that time. Arguably, the recent bounce is to be expected after such a bad drop. The thing to think about is whether the business has really turned around.

So let's have a look and see if the longer term performance of the company has been in line with the underlying business' progress.

Check out our latest analysis for Shenzhen Kangtai Biological Products

We don't think that Shenzhen Kangtai Biological Products' modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

We don't think that Shenzhen Kangtai Biological Products' modest trailing twelve month profit has the market's full attention at the moment. We think revenue is probably a better guide. Generally speaking, we'd consider a stock like this alongside loss-making companies, simply because the quantum of the profit is so low. For shareholders to have confidence a company will grow profits significantly, it must grow revenue.

Over three years, Shenzhen Kangtai Biological Products grew revenue at 18% per year. That's a fairly respectable growth rate. So it seems unlikely the 20% share price drop (each year) is entirely about the revenue. It could be that the losses were much larger than expected. If you buy into companies that lose money then you always risk losing money yourself. Just don't lose the lesson.

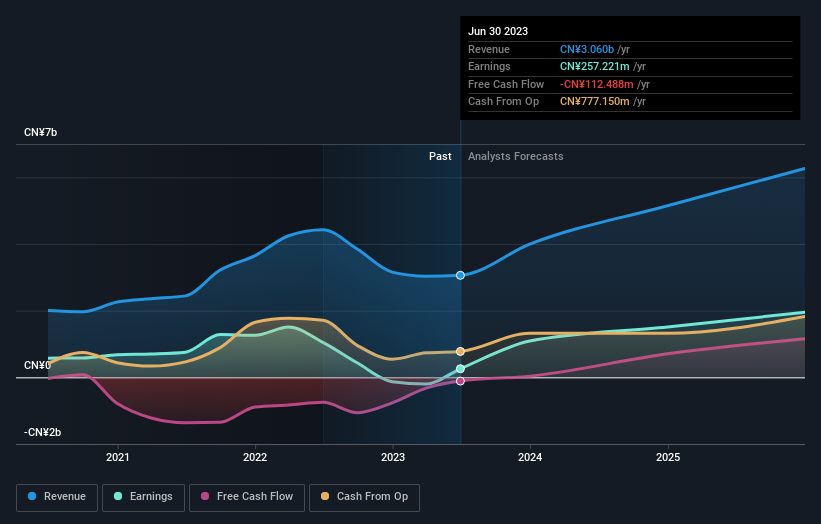

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Shenzhen Kangtai Biological Products is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. If you are thinking of buying or selling Shenzhen Kangtai Biological Products stock, you should check out this free report showing analyst consensus estimates for future profits.

A Different Perspective

It's good to see that Shenzhen Kangtai Biological Products has rewarded shareholders with a total shareholder return of 5.7% in the last twelve months. That's including the dividend. However, the TSR over five years, coming in at 6% per year, is even more impressive. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Shenzhen Kangtai Biological Products that you should be aware of before investing here.

Of course Shenzhen Kangtai Biological Products may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.