The Returns On Capital At Henan Zhongyuan Expressway (SHSE:600020) Don't Inspire Confidence

The Returns On Capital At Henan Zhongyuan Expressway (SHSE:600020) Don't Inspire Confidence

If we're looking to avoid a business that is in decline, what are the trends that can warn us ahead of time? When we see a declining return on capital employed (ROCE) in conjunction with a declining base of capital employed, that's often how a mature business shows signs of aging. This reveals that the company isn't compounding shareholder wealth because returns are falling and its net asset base is shrinking. And from a first read, things don't look too good at Henan Zhongyuan Expressway (SHSE:600020), so let's see why.

如果我們希望避免一項正在衰落的業務,哪些趨勢可以提前警告我們?當我們看到經濟衰退時退貨在資本使用(ROCE)下降的情況下基地對於已動用的資本,這往往是成熟企業顯示出老化跡象的原因。這表明,該公司沒有增加股東財富,因為回報率在下降,淨資產基礎在縮水。從第一眼看,事情看起來並不太好河南中原高速公路(上海證券交易所:600020),讓我們來看看為什麼。

Understanding Return On Capital Employed (ROCE)

瞭解資本回報率(ROCE)

Just to clarify if you're unsure, ROCE is a metric for evaluating how much pre-tax income (in percentage terms) a company earns on the capital invested in its business. To calculate this metric for Henan Zhongyuan Expressway, this is the formula:

如果您不確定,只需澄清一下,ROCE是一種評估公司投資於其業務的資本獲得多少稅前收入(按百分比計算)的指標。要計算河南中原高速公路的這一指標,公式如下:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

已動用資本回報率=息稅前收益(EBIT)?(總資產-流動負債)

0.039 = CN¥1.6b ÷ (CN¥51b - CN¥8.8b) (Based on the trailing twelve months to June 2023).

0.039=CN元16億?(CN元510億-CN元88億)(根據截至2023年6月的往績12個月計算)。

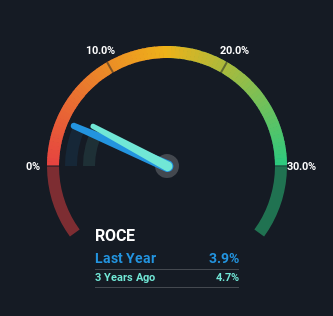

So, Henan Zhongyuan Expressway has an ROCE of 3.9%. In absolute terms, that's a low return but it's around the Infrastructure industry average of 4.7%.

所以,河南中原高速公路ROCE為3.9%。按絕對值計算,這是一個較低的回報率,但約為基礎設施行業4.7%的平均水準。

Check out our latest analysis for Henan Zhongyuan Expressway

查看我們對河南中原高速公路的最新分析

Historical performance is a great place to start when researching a stock so above you can see the gauge for Henan Zhongyuan Expressway's ROCE against it's prior returns. If you're interested in investigating Henan Zhongyuan Expressway's past further, check out this free graph of past earnings, revenue and cash flow.

在研究一隻股票時,歷史表現是一個很好的起點,因為在歷史表現上方,你可以看到河南中原高速公路ROCE相對於其先前回報的衡量標準。如果你有興趣進一步調查河南中原高速公路的過去,請查看以下內容免費過去收益、收入和現金流的圖表。

What Does the ROCE Trend For Henan Zhongyuan Expressway Tell Us?

河南中原高速公路ROCE走勢告訴我們什麼?

There is reason to be cautious about Henan Zhongyuan Expressway, given the returns are trending downwards. To be more specific, the ROCE was 6.6% five years ago, but since then it has dropped noticeably. On top of that, it's worth noting that the amount of capital employed within the business has remained relatively steady. This combination can be indicative of a mature business that still has areas to deploy capital, but the returns received aren't as high due potentially to new competition or smaller margins. If these trends continue, we wouldn't expect Henan Zhongyuan Expressway to turn into a multi-bagger.

鑑於回報呈下降趨勢,對河南中原高速公路持謹慎態度是有理由的。具體地說,五年前的ROCE是6.6%,但此後明顯下降。最重要的是,值得注意的是,企業內部使用的資金量保持了相對穩定。這一組合可能表明,一家成熟的企業仍有需要配置資本的領域,但由於潛在的新競爭或利潤率較低,獲得的回報並不那麼高。如果這種趨勢繼續下去,我們預計河南中原高速公路不會變成一個多袋子。

In Conclusion...

總之..。

In summary, it's unfortunate that Henan Zhongyuan Expressway is generating lower returns from the same amount of capital. Investors must expect better things on the horizon though because the stock has risen 17% in the last five years. Regardless, we don't like the trends as they are and if they persist, we think you might find better investments elsewhere.

總而言之,不幸的是,河南中原高速公路用同樣數量的資本產生的回報較低。不過,投資者肯定期待著更好的前景,因為該股在過去五年裡上漲了17%。無論如何,我們不喜歡這種趨勢,如果它們持續下去,我們認為你可能會在其他地方找到更好的投資。

If you want to know some of the risks facing Henan Zhongyuan Expressway we've found 3 warning signs (2 can't be ignored!) that you should be aware of before investing here.

如果你想知道河南中原高速公路面臨的一些風險,我們已經找到了3個警示標誌(2不可忽視!)在這裡投資之前你應該意識到這一點。

While Henan Zhongyuan Expressway isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

雖然河南中原高速公路並沒有獲得最高的回報,但看看這個免費資產負債表穩健、股本回報率高的公司名單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.

0.039 = CN¥1.6b ÷ (CN¥51b - CN¥8.8b) (Based on the trailing twelve months to June 2023).

0.039 = CN¥1.6b ÷ (CN¥51b - CN¥8.8b) (Based on the trailing twelve months to June 2023).