Little Excitement Around Airgain, Inc.'s (NASDAQ:AIRG) Revenues As Shares Take 25% Pounding

Little Excitement Around Airgain, Inc.'s (NASDAQ:AIRG) Revenues As Shares Take 25% Pounding

Unfortunately for some shareholders, the Airgain, Inc. (NASDAQ:AIRG) share price has dived 25% in the last thirty days, prolonging recent pain. For any long-term shareholders, the last month ends a year to forget by locking in a 53% share price decline.

不幸的是,對於一些股東來說,Airain,Inc.納斯達克(Sequoia Capital:airG)股價在過去30天裡暴跌25%,延續了最近的痛苦。對於任何長期股東來說,最後一個月以鎖定股價下跌53%的方式結束了一年的忘記。

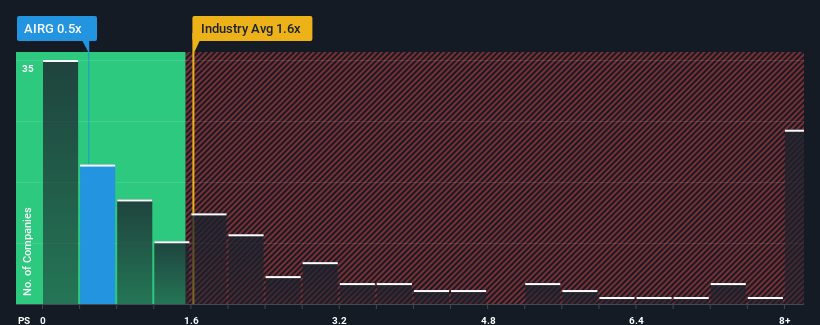

After such a large drop in price, Airgain's price-to-sales (or "P/S") ratio of 0.5x might make it look like a buy right now compared to the Electronic industry in the United States, where around half of the companies have P/S ratios above 1.6x and even P/S above 4x are quite common. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

在經歷瞭如此大的價格下跌後,AirGain的0.5倍的市售比(P/S)可能會讓它現在看起來像是買入,而在美國,大約一半的公司的P/S比超過1.6倍,甚至P/S高於4倍的情況也很常見。然而,P/S可能是有原因的,需要進一步調查才能確定是否合理。

View our latest analysis for Airgain

查看我們對AirGain的最新分析

How Airgain Has Been Performing

AirGain的表現如何

Airgain certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

AirGain最近肯定做得很好,因為它的收入增長速度超過了大多數其他公司。或許市場預期未來營收表現將跳水,這令本益比/S受到壓制。如果該公司設法堅持到底,那麼投資者應該得到與其收入數位相匹配的股價回報。

How Is Airgain's Revenue Growth Trending?

AirGain的收入增長趨勢如何?

The only time you'd be truly comfortable seeing a P/S as low as Airgain's is when the company's growth is on track to lag the industry.

只有當該公司的增長速度落後於行業時,你才會真正放心地看到像AirGain這樣低的本益比。

If we review the last year of revenue growth, the company posted a worthy increase of 7.5%. This was backed up an excellent period prior to see revenue up by 46% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

如果我們回顧去年的收入增長,該公司公佈了7.5%的合理增長。這是在過去三年總收入增長46%之前的一段很好的時期內得到支持的。因此,公平地說,最近的收入增長對公司來說是一流的。

Shifting to the future, estimates from the four analysts covering the company suggest revenue growth is heading into negative territory, declining 7.6% over the next year. With the industry predicted to deliver 7.4% growth, that's a disappointing outcome.

展望未來,追蹤該公司的四位分析師的估計顯示,該公司營收增長將進入負值區間,明年將下降7.6%。鑑於該行業預計將實現7.4%的增長,這是一個令人失望的結果。

With this information, we are not surprised that Airgain is trading at a P/S lower than the industry. Nonetheless, there's no guarantee the P/S has reached a floor yet with revenue going in reverse. There's potential for the P/S to fall to even lower levels if the company doesn't improve its top-line growth.

有了這些資訊,我們對AirGain的本益比低於行業並不感到驚訝。儘管如此,不能保證P/S已經觸底,營收出現了逆轉。如果該公司不改善其營收增長,本益比S有可能跌至更低的水準。

The Bottom Line On Airgain's P/S

艾瑞得P/S的底線

Airgain's P/S has taken a dip along with its share price. While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

AirGain的P/S隨著其股價一起下跌。雖然市銷率不應該成為你是否買入一隻股票的決定性因素,但它是一個很好的收入預期晴雨錶。

It's clear to see that Airgain maintains its low P/S on the weakness of its forecast for sliding revenue, as expected. As other companies in the industry are forecasting revenue growth, Airgain's poor outlook justifies its low P/S ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

很明顯,正如預期的那樣,AirGain維持了較低的本益比S,原因是其對收入下滑的預測疲軟。在業內其他公司預測營收增長之際,AirGain糟糕的前景證明其較低的本益比是合理的。除非這些條件得到改善,否則它們將繼續對股價在這些水準附近形成障礙。

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Airgain that you should be aware of.

別忘了,可能還有其他風險。例如,我們已經確定航空收益的3個警告信號這一點你應該知道.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

當然了,利潤豐厚、盈利增長迅速的公司通常是更安全的押注那就是。所以你可能想看看這個免費其他本益比合理、盈利增長強勁的公司的集合。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對這篇文章有什麼反饋嗎?擔心內容嗎? 保持聯繫直接與我們聯繫.或者,也可以給編輯組發電子郵件,地址是暗示Wallst.com。

本文由Simply Wall St.撰寫,具有概括性.我們僅使用不偏不倚的方法提供基於歷史數據和分析師預測的評論,我們的文章並不打算作為財務建議.它不構成買賣任何股票的建議,也沒有考慮你的目標或你的財務狀況.我們的目標是為您帶來由基本面數據驅動的長期重點分析.請注意,我們的分析可能不會將最新的對價格敏感的公司公告或定性材料考慮在內.Simply Wall St.對上述任何一隻股票都沒有持倉.

Airgain certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.

Airgain certainly has been doing a good job lately as it's been growing revenue more than most other companies. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. If the company manages to stay the course, then investors should be rewarded with a share price that matches its revenue figures.